PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871099

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871099

Europe Cloud Carbon Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

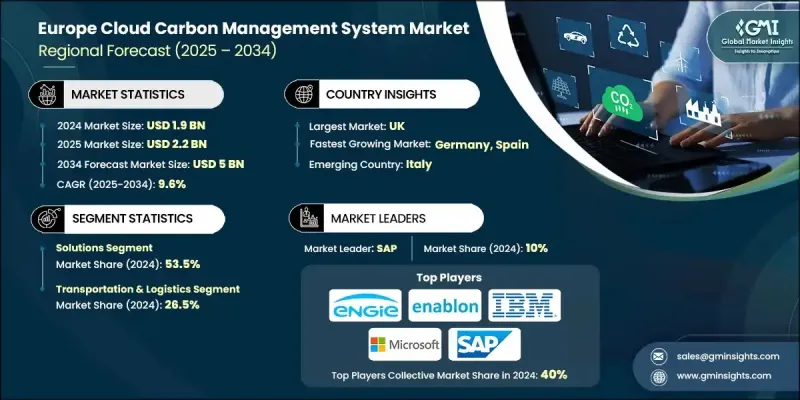

Europe Cloud Carbon Management System Market was valued at USD 1.9 Billion in 2024 and is estimated to grow at a CAGR of 9.6% to reach USD 5 Billion by 2034.

The acceleration of climate-focused regulations under the EU Green Deal and stringent climate laws has established a solid policy foundation driving rapid decarbonization across industries. These legally binding mandates are compelling organizations to embrace advanced digital platforms, particularly cloud-based carbon management systems, to track, measure, and minimize their carbon emissions. The Fit for 55 initiative, targeting at least a 55% reduction in greenhouse gas emissions by 2030, is intensifying the demand for transparent, data-driven carbon tracking solutions. Cloud platforms provide the flexibility and scalability required to adapt to dynamic regulatory landscapes while enabling companies to meet increasing expectations from investors and regulators. The growing implementation of carbon pricing mechanisms and incentive-based frameworks has become a critical driver for emissions reduction. The success of emissions trading systems has proven that assigning economic value to carbon output accelerates technological innovation and promotes low-carbon adoption. As carbon prices become more stable and significant, organizations are investing in cloud-based carbon management technologies to refine and optimize their decarbonization strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $5 Billion |

| CAGR | 9.6% |

The solutions category segment held 53.5% share in 2024 and is expected to grow at a CAGR of 9% through 2034. Integration of artificial intelligence (AI) and machine learning technologies into these platforms is transforming the market by enabling more precise emission forecasting and reduction modeling. These intelligent systems empower businesses to simulate future carbon outcomes by assessing operational adjustments, shifting regulatory landscapes, and supply chain dependencies. Predictive analytics has become essential for strategic planning, ensuring that enterprises remain compliant with evolving European climate mandates. The ability to forecast potential carbon exposure and strategically manage mitigation efforts is turning into a core differentiator for modern cloud platforms, particularly for businesses handling complex indirect (Scope 3) emissions.

The transportation and logistics segment held a 26.5% share in 2024 and is expected to register a CAGR of 9.7% by 2034. Increasing reliance on emissions monitoring tools and integration with mobility and telematics systems is transforming this industry's sustainability initiatives. Logistics firms are turning to cloud-based platforms to measure and optimize fleet emissions, improve operational efficiency, and support the transition toward lower-carbon mobility. These platforms not only assist in meeting European transportation regulations but also help minimize Scope 1 and Scope 3 emissions, enhancing environmental accountability across logistics operations.

United Kingdom Cloud Carbon Management System Market held a 24% share in 2024, generating USD 470 million. Market expansion in the country is primarily driven by its Net Zero Strategy and alignment with climate commitments supported by digital transformation. Businesses across the UK are leveraging cloud platforms to track emissions in real time and automate carbon reporting in line with national legislation. These systems help organizations adhere to carbon budgeting frameworks and remain compliant with the country's binding climate objectives. Increasing connectivity with IoT and smart grid networks is further enhancing the functionality and accuracy of emissions management in the region.

Key players active in the Europe Cloud Carbon Management System Market include Microsoft, Greenly, Emitwise, Plan A, SAP, Salesforce, ENGIE, IsoMetrix, Persefoni, Sphera, Carbmee, Watershed, Greenstone+, Simble Solutions, IBM, Enablon, Schneider Electric, Terrascope, Net0, and Sweep. Leading companies in the Europe Cloud Carbon Management System Market are emphasizing innovation, collaboration, and product diversification to strengthen their competitive edge. Many are investing heavily in AI-driven analytics and automation to deliver real-time carbon tracking and predictive insights. Strategic alliances, mergers, and partnerships with sustainability-focused organizations are helping expand service capabilities and regional presence. Several players are focusing on integrating their platforms with enterprise resource planning (ERP), IoT, and energy management systems to offer end-to-end decarbonization solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Component trends

- 2.1.3 Industry trends

- 2.1.4 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Solutions

- 5.3 Services

Chapter 6 Market Size and Forecast, By Industry, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Energy & utilities

- 6.3 Manufacturing

- 6.4 Residential & commercial building

- 6.5 Transportation & logistics

- 6.6 IT & telecom

- 6.7 Others

Chapter 7 Market Size and Forecast, By Country, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Germany

- 7.3 France

- 7.4 UK

- 7.5 Spain

- 7.6 Italy

Chapter 8 Company Profiles

- 8.1 Carbmee

- 8.2 Emitwise

- 8.3 Enablon

- 8.4 ENGIE

- 8.5 Greenly

- 8.6 Greenstone+

- 8.7 IBM

- 8.8 IsoMetrix

- 8.9 Microsoft

- 8.10 Net0

- 8.11 Persefoni

- 8.12 Plan A

- 8.13 Salesforce

- 8.14 SAP

- 8.15 Schneider Electric

- 8.16 Simble Solutions

- 8.17 Sphera

- 8.18 Sweep

- 8.19 Terrascope

- 8.20 Watershed