PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871105

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871105

Silicon Photonics for Vehicle Communication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

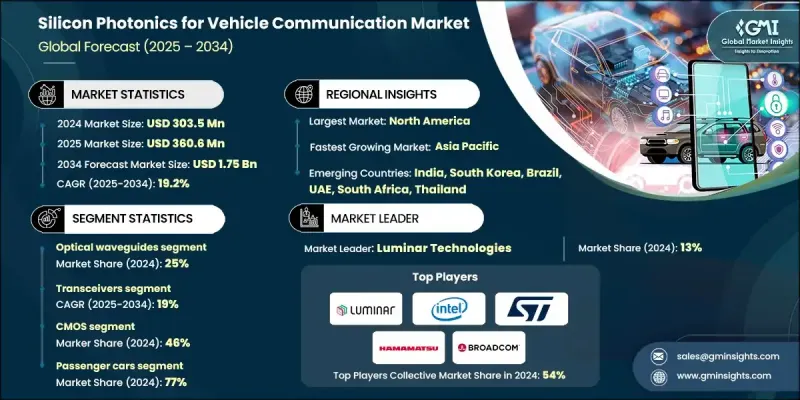

The Global Silicon Photonics for Vehicle Communication Market was valued at USD 303.5 million in 2024 and is estimated to grow at a CAGR of 19.2% to reach USD 1.75 Billion by 2034.

Market growth is propelled by the increasing deployment of silicon photonics in advanced automotive communication systems. Silicon photonics integrate light-based components such as lasers, detectors, and modulators onto silicon chips, enabling faster, more efficient, and energy-saving data transmission. In modern vehicles, these technologies play a central role in vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-everything (V2X) communication systems. They also support LiDAR and high-speed in-vehicle data networks, which are critical for advanced driver assistance systems (ADAS) and autonomous driving. The expanding use of semi-autonomous and fully autonomous vehicles is accelerating adoption as they require high-bandwidth, low-latency communication and sensing. Silicon photonics-based LiDAR systems are gaining traction due to their superior range accuracy and ability to measure velocity more effectively than traditional systems. Moreover, as automotive electronics evolve with a rise in HD cameras, smart sensors, and infotainment devices, manufacturers are shifting from copper-based wiring to photonic interconnects that offer greater data capacity, lighter weight, and improved signal integrity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $303.5 Million |

| Forecast Value | $1.75 Billion |

| CAGR | 19.2% |

The optical waveguides segment held a 25% share in 2024 and is expected to grow at a CAGR of 19.7% through 2034. Waveguides play a crucial role in directing and confining optical signals among chip components. In automotive applications, where compactness, performance, and reliability are critical, waveguides enable efficient, low-loss communication links. They are widely integrated into high-speed intra-vehicle communication systems and LiDAR-based sensing solutions, providing enhanced bandwidth and superior optical efficiency for real-time data transmission in connected vehicles.

The transceivers segment held a 40% share in 2024 and is estimated to register a CAGR of 19% from 2025 to 2034. Transceivers dominate the silicon photonics for vehicle communication market due to their role in enabling high-speed, interference-free data exchange. As vehicles become more connected and sensor-rich, they generate massive amounts of information that must be transmitted rapidly and reliably. Conventional copper-based systems face challenges such as bandwidth constraints, signal degradation, and electromagnetic interference, making photonics-based transceivers a superior alternative for next-generation vehicle architectures.

North America Silicon Photonics for Vehicle Communication Market held 34% share and generated USD 102.8 million in 2024. The region's leadership stems from its strong innovation ecosystem, advanced semiconductor infrastructure, and high adoption of emerging automotive technologies. Government initiatives, university research programs, and the presence of leading photonic and semiconductor manufacturers further strengthen North America's position. Continuous R&D investments, along with collaboration across automotive and tech sectors, are accelerating the commercialization of silicon photonics-based communication systems across the region.

Key companies operating in the Global Silicon Photonics for Vehicle Communication Market include Broadcom, Intel, Infineon Technologies, Nvidia, Cisco Systems, Marvell Technology, Qualcomm, STMicroelectronics, NXP Semiconductors, and GlobalFoundries. To reinforce their position in the Silicon Photonics for Vehicle Communication Market, major companies are adopting a mix of strategic initiatives focused on innovation, scalability, and collaboration. Leading players are heavily investing in R&D to develop next-generation photonic chips with higher bandwidth, lower latency, and better energy efficiency. Strategic partnerships with automotive OEMs and technology firms are being formed to accelerate system integration and bring photonic-enabled communication to production vehicles. Companies are also expanding their manufacturing capabilities and exploring hybrid integration of electronic and photonic components to optimize performance and cost efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Product

- 2.2.4 Technology

- 2.2.5 Vehicle

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing ADAS and autonomous systems need high-speed data transfer

- 3.2.1.2 V2X and in-vehicle networks require low-latency, high-reliability links

- 3.2.1.3 Power-efficient communication is critical for EVs and connected cars

- 3.2.1.4 Advancements in integration enable robust automotive-grade solutions

- 3.2.1.5 CASE (Connected, Autonomous, Shared, Electric) trends expand demand

- 3.2.1.6 Evolving safety and performance standards push tech adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs hinder scalability

- 3.2.2.2 Integration and reliability challenges in harsh vehicle environments

- 3.2.3 Market opportunities

- 3.2.3.1 LiDAR integration offers performance and cost improvements

- 3.2.3.2 Optical interconnects can simplify vehicle architecture

- 3.2.3.3 Co-packaged optics enable compact, energy-efficient designs

- 3.2.3.4 Regulatory and consumer push boosts demand

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology landscape

- 3.8.1 Current technological trends

- 3.8.1.1 Silicon photonics manufacturing maturity

- 3.8.1.2 Optical phased array performance benchmarks

- 3.8.1.3 High-speed modulator and detector capabilities

- 3.8.1.4 Packaging and integration solutions

- 3.8.2 Emerging technologies

- 3.8.2.1 Next-generation silicon photonics platforms

- 3.8.2.2 Quantum-enhanced optical communication

- 3.8.2.3 AI/ML-optimized photonic systems

- 3.8.1 Current technological trends

- 3.9 Regulatory landscape

- 3.9.1 AEC-Q100 reliability requirements and testing protocols

- 3.9.2 ISO 26262 functional safety compliance framework

- 3.9.3 V2X communication standards (IEEE 802.11p, 5G NR-V2X)

- 3.9.4 LiDAR safety standards (IEC 60825-1)

- 3.9.5 ISO/SAE 21434 automotive cybersecurity standards

- 3.9.6 GDPR and regional data privacy compliance

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product

- 3.11 Sustainability and environmental aspects

- 3.11.1 Environmental impact assessment

- 3.11.2 Silicon photonics lifecycle carbon footprint

- 3.11.3 Manufacturing process environmental impact

- 3.11.4 Environmental performance indicators

- 3.11.5 Social impact assessment and community benefits

- 3.11.6 Green manufacturing process implementation

- 3.12 Investment & funding trends analysis

- 3.13 Cost breakdown analysis

- 3.13.1 Silicon photonics cost structure decomposition

- 3.13.2 Manufacturing cost drivers and optimization

- 3.13.3 Cost reduction strategies and implementation

- 3.14 End use behavior analysis

- 3.14.1 Automotive OEM decision-making processes

- 3.14.2 Technology adoption behavior analysis

- 3.14.3 Purchase decision influencing factors

- 3.14.4 Market resistance and barrier analysis

- 3.15 Disruptive technology threats and opportunities

- 3.15.1 Alternative optical communication technologies

- 3.15.2 Competing sensing and LiDAR approaches

- 3.15.3 Breakthrough material science developments

- 3.15.4 System-level architecture innovations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Optical waveguides

- 5.3 Photodetectors

- 5.4 Modulators

- 5.5 Light sources/lasers

- 5.6 Filters

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Transceivers

- 6.3 Switches

- 6.4 Cables

- 6.5 Sensors

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 CMOS

- 7.3 Hybrid silicon photonics

- 7.4 Silicon-on-insulator (SOI) photonics

- 7.5 Silicon nitride photonics

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Broadcom

- 10.1.2 Cisco Systems

- 10.1.3 GlobalFoundries

- 10.1.4 Infineon Technologies

- 10.1.5 Intel

- 10.1.6 Marvell Technology

- 10.1.7 Nvidia

- 10.1.8 NXP Semiconductors

- 10.1.9 Qualcomm

- 10.1.10 STMicroelectronics

- 10.1.11 Synopsys

- 10.1.12 Texas Instruments

- 10.1.13 TSMC

- 10.2 Regional Players

- 10.2.1 Anello Photonics

- 10.2.2 Foxconn Technology

- 10.2.3 LIGENTEC

- 10.2.4 Lumentum

- 10.2.5 Silicon Austria Labs

- 10.2.6 Valeo

- 10.2.7 Xanadu Quantum Technologies

- 10.3 Emerging Players / Disruptors

- 10.3.1 Aeva Technologies

- 10.3.2 Ayar Labs

- 10.3.3 Baraja

- 10.3.4 Lightmatter

- 10.3.5 Rockley Photonics