PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871110

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871110

Self-healing Flooring Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

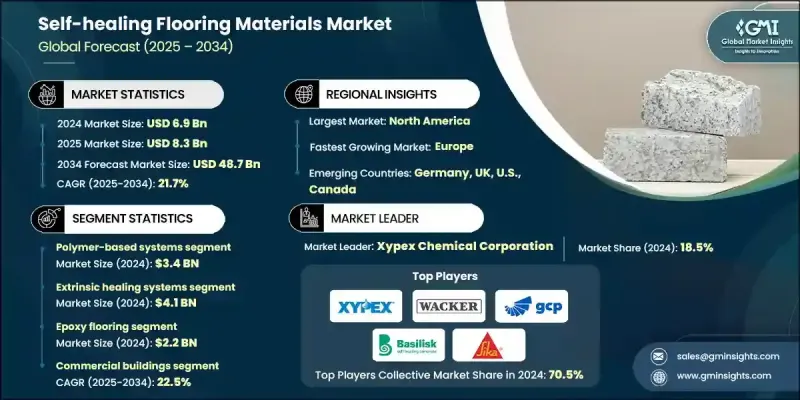

The Global Self-healing Flooring Materials Market was valued at USD 6.9 Billion in 2024 and is estimated to grow at a CAGR of 21.7% to reach USD 48.7 Billion by 2034.

The market expansion is driven by rising demand for durable, low-maintenance flooring across commercial, healthcare, and industrial sectors. Self-healing flooring is gaining traction as it reduces repair costs and minimizes downtime in high-traffic environments. Advanced materials technologies are becoming widely accepted in construction and industrial applications, contributing significantly to the market. Flooring types such as epoxy, polyurethane, concrete, vinyl, rubber composites, and smart modular tiles all play a role, influenced by adoption rates and price premiums. Research demonstrates that self-healing polymers can recover a substantial portion of their mechanical strength after damage, making them ideal for abrasive and impact-prone surfaces. In addition to sustainability benefits, these materials help reduce material waste and carbon emissions, enhancing environmental appeal. Recent innovations have integrated additional functionalities into flooring systems, such as antimicrobial properties and thermal stability. Vitrimers and supramolecular polymers are emerging as leading materials due to their ability to repeatedly self-heal under mild conditions while retaining strength. These advancements cater to demanding applications requiring both durability and hygienic surfaces, particularly in healthcare and food processing facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.9 Billion |

| Forecast Value | $48.7 Billion |

| CAGR | 21.7% |

The polymer-based systems segment held a 50% share in 2024 with a projected CAGR of 21.2% through 2034. These systems leverage materials like epoxy, polyurethane, and advanced polymer blends, incorporating self-healing mechanisms either through intrinsic molecular design or embedded microcapsules.

The extrinsic healing systems segment accounted for USD 4.1 Billion in 2024. These systems rely on microcapsule or vascular network technologies, storing healing agents in discrete reservoirs and releasing them automatically when damage occurs. Microcapsule-based extrinsic systems are commercially viable, with predictable and reliable performance characteristics.

North America Self-healing Flooring Materials Market captured 41.5% share in 2024, driven by demand for advanced construction standards, upgraded healthcare infrastructure, and industrial facility development. The United States is the largest single-country market due to strict building codes and performance requirements favoring advanced material adoption. Key factors supporting self-healing flooring in hospitals and clinical facilities include hygiene control, seamless surfaces, and lower maintenance needs.

Key players in the Self-healing Flooring Materials Market include Green-Basilisk BV, Pacific Northwest National Laboratory (PNNL), Sika Group, Sensicon Ventures Ltd, Saint Gobain, Xypex Chemical Corporation, Oscrete Construction Products, Corbion, Fescon Oy, HEGGEL GmbH, Wacker Chemie AG, Polycoat Products, SCHOMBURG GmbH, and Minicrete. Companies in the self-healing flooring market focus on developing advanced polymer blends, integrating multifunctional properties, and expanding microcapsule-based healing technologies. Partnerships with construction firms, healthcare providers, and industrial facility developers help enhance market penetration. Investment in R&D drives innovation in antimicrobial, thermal-resistant, and eco-friendly floor systems. Manufacturers emphasize cost-effective solutions and sustainability messaging to attract environmentally conscious buyers. Digital marketing, educational campaigns, and pilot installations highlight product advantages, boosting adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Self-Healing Mechanism

- 2.2.4 Flooring type

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure maintenance cost reduction

- 3.2.1.2 Healthcare infection control requirements

- 3.2.1.3 Industrial downtime minimization needs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment & catalyst costs

- 3.2.2.2 Installation complexity & contractor training

- 3.2.2.3 Temperature & environmental activation barriers

- 3.2.3 Market opportunities

- 3.2.3.1 Post-pandemic healthcare facility expansion

- 3.2.3.2 Government infrastructure modernization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Material Type

- 3.7.3 Self-Healing Mechanism

- 3.7.4 Flooring type

- 3.7.5 End Use

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polymer-based systems

- 5.2.1 Epoxy Resins

- 5.2.2 Polyurethane

- 5.2.3 Acrylic & methacrylate

- 5.2.4 Polyurea

- 5.2.5 Polydimethylsiloxane (PDMS)

- 5.3 Cementitious/concrete-based systems

- 5.3.1 Portland cement matrix

- 5.3.2 Geopolymer systems

- 5.3.3 Fiber-reinforced variants

- 5.4 Hybrid/composite systems

- 5.4.1 Polymer-concrete composites

- 5.4.2 Fiber-reinforced polymers (FRP)

- 5.4.3 Multi-layer systems

- 5.5 Bio-based/sustainable materials

- 5.5.1 Plant-based polymer systems

- 5.5.2 Recycled content integration

- 5.5.3 Biodegradable components

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Self-Healing Mechanism, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Extrinsic healing systems

- 6.2.1 Microcapsule-based healing agents

- 6.2.2 Vascular network-based systems

- 6.2.3 Encapsulated bacteria/enzyme system

- 6.2.4 Hollow fiber integration

- 6.2.5 External reservoir systems

- 6.3 Intrinsic healing systems

- 6.3.1 Dynamic covalent networks

- 6.3.2 Supramolecular interactions

- 6.3.3 Shape memory polymers

- 6.3.4 Metal-ligand coordination

- 6.3.5 Hydrogen bonding systems

- 6.3.6 Temperature-responsive systems

- 6.3.7 Self-assembly mechanisms

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Flooring Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Epoxy flooring

- 7.3 Polyurethane flooring

- 7.4 Vinyl flooring

- 7.4.1 Luxury vinyl tile

- 7.4.2 Vinyl composite tile

- 7.5 Concrete flooring

- 7.6 Rubber/composites flooring

- 7.7 Smart modular tiles

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential buildings

- 8.3 Commercial buildings

- 8.3.1 Office buildings

- 8.3.2 Retail facilities

- 8.3.3 Educational institutions

- 8.3.4 Hospitality & entertainment

- 8.3.5 Sports & recreation

- 8.3.6 Data centers

- 8.4 Healthcare & pharmaceuticals

- 8.4.1 Hospital operating rooms

- 8.4.2 Sterile processing areas

- 8.4.3 Laboratory facilities

- 8.4.4 Pharmaceutical manufacturing

- 8.5 Industrial buildings

- 8.5.1 Chemical processing plants

- 8.5.2 Automotive assembly

- 8.5.3 Electronics manufacturing

- 8.5.4 Aerospace facilities

- 8.6 Other

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Xypex Chemical Corporation

- 10.2 Green-Basilisk BV

- 10.3 Sika Group

- 10.4 Oscrete Construction Products

- 10.5 Fescon Oy

- 10.6 Wacker Chemie AG

- 10.7 Polycoat Products

- 10.8 Saint Gobain

- 10.9 Corbion

- 10.10 Giatec Scientific Inc.

- 10.11 HEGGEL GmbH

- 10.12 SCHOMBURG GmbH

- 10.13 Minicrete

- 10.14 Sensicon Ventures Ltd

- 10.15 Pacific Northwest National Laboratory (PNNL)