PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871238

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871238

Self-healing Waterproofing Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

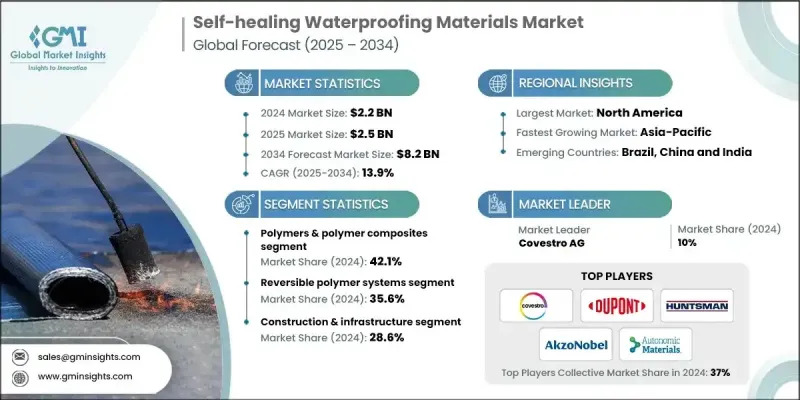

The Global Self-healing Waterproofing Materials Market was valued at USD 2.2 Billion in 2024 and is estimated to grow at a CAGR of 13.9% to reach USD 8.2 Billion by 2034.

The market is experiencing strong growth as industries increasingly focus on long-term durability and reduced maintenance costs. These advanced materials are gaining traction in construction, automotive, and electronics applications, where exposure to moisture and harsh environmental conditions often affects performance and lifespan. In the construction sector, self-healing coatings and concretes are being incorporated to improve structural resilience and minimize lifecycle expenses. The automotive industry is adopting corrosion-resistant and damage-repairing surfaces to enhance durability. Technological progress in microencapsulation, vascular systems, and shape-memory polymers is driving the evolution of more efficient self-repair mechanisms. In addition, the integration of sensor-based systems for real-time damage detection and autonomous healing activation is shaping the next generation of waterproofing solutions. Despite these advancements, the market faces challenges related to cost-effectiveness and scalability, especially in developing economies. However, growing regulatory support for sustainable materials and global efforts toward standardization are expected to foster commercialization. Rapid infrastructure development across the Asia-Pacific region further contributes to market expansion, driven by urbanization and the rising need for long-lasting construction materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 13.9% |

The polymers and polymer composites segment held a 42.1% share in 2024 and is projected to grow at a CAGR of 13.6% through 2034. Their dominance is attributed to high adaptability, mature manufacturing capabilities, and suitability for diverse applications across multiple industries. These materials can employ a range of self-healing mechanisms, making them ideal for construction, automotive, and electronic applications. Continuous advancements in sustainable and bio-based polymer technologies, combined with growing research investments, are reinforcing their demand in environmentally conscious markets worldwide.

The reversible polymer systems segment held 35.6% share in 2024 and is expected to grow at a CAGR of 13.7% during 2025-2034. These systems are favored for their ability to undergo multiple healing cycles without significant loss in mechanical performance. Based on dynamic covalent and non-covalent bonding, they can autonomously restore their structure when exposed to stress or damage. Their compatibility with existing manufacturing processes and commercial scalability make them highly suitable for large-scale applications in sectors such as construction, electronics, and transportation. The reliability and repeatability of their healing mechanisms contribute to their widespread industrial adoption.

North America Self-healing Waterproofing Materials Market held 38.2% share in 2024. The region benefits from strong government funding, world-class research facilities, and early commercialization of advanced materials. High-performance applications in aerospace, defense, and infrastructure are driving demand, supported by significant investments in innovation from both private and public institutions. Research collaborations and funding from agencies dedicated to material science continue to strengthen North America's leadership position. The presence of major universities, startups, and established chemical companies fuels continuous product development and technological advancement, ensuring a steady supply of innovative self-healing solutions across the region.

Key companies active in the Global Self-healing Waterproofing Materials Market include Autonomic Materials Inc., DuPont de Nemours Inc., PPG Industries Inc., Avecom N.V., Covestro AG, Critical Materials S.A., Tnemec Company Inc., Devan Chemicals NV, Akzo Nobel N.V., Huntsman Corporation, Applied Thin Films Inc., Acciona S.A., and Sensor Coating Systems Ltd. To strengthen their position, leading companies are focusing on technological innovation, product diversification, and sustainable development. Many are increasing R&D investments to improve the efficiency, responsiveness, and cost-effectiveness of self-healing systems. Strategic partnerships with research organizations and industrial players are being established to accelerate product testing and commercialization. Manufacturers are expanding production capacities and developing eco-friendly formulations to meet global sustainability standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Technology type

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing infrastructure maintenance costs & repair frequency reduction needs

- 3.2.1.2 Aerospace industry demands lightweight, self-repairing composites

- 3.2.1.3 Automotive industry push for scratch-resistant & self-healing coatings

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial material costs & manufacturing complexity

- 3.2.2.2 Limited standardized testing protocols & performance validation

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging applications in renewable energy systems

- 3.2.3.2 Medical device integration & biocompatible self-healing materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By material type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only )

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo tons)

- 5.1 Key trends

- 5.2 Polymers & polymer composites

- 5.3 Metals & metal alloys

- 5.4 Ceramics & glass materials

- 5.5 Concrete & cementitious materials

- 5.6 Composite materials

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo tons)

- 6.1 Key trends

- 6.2 Reversible polymer systems

- 6.3 Shape memory materials

- 6.4 Microencapsulation technologies

- 6.5 Vascular network systems

- 6.6 Biological material systems

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo tons)

- 7.1 Key trends

- 7.2 Construction & infrastructure

- 7.3 Automotive & transportation

- 7.4 Aerospace & defense

- 7.5 Healthcare & biomedical

- 7.6 Electronics & semiconductors

- 7.7 Energy & power systems

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Covestro AG

- 9.2 DuPont de Nemours Inc.

- 9.3 Huntsman Corporation

- 9.4 Akzo Nobel N.V.

- 9.5 Autonomic Materials Inc.

- 9.6 Acciona S.A.

- 9.7 PPG Industries Inc.

- 9.8 Applied Thin Films Inc.

- 9.9 Avecom N.V.

- 9.10 Critical Materials S.A.

- 9.11 Devan Chemicals NV

- 9.12 Sensor Coating Systems Ltd.

- 9.13 Tnemec Company, Inc.