PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871136

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871136

Direct on Line Motor Starter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

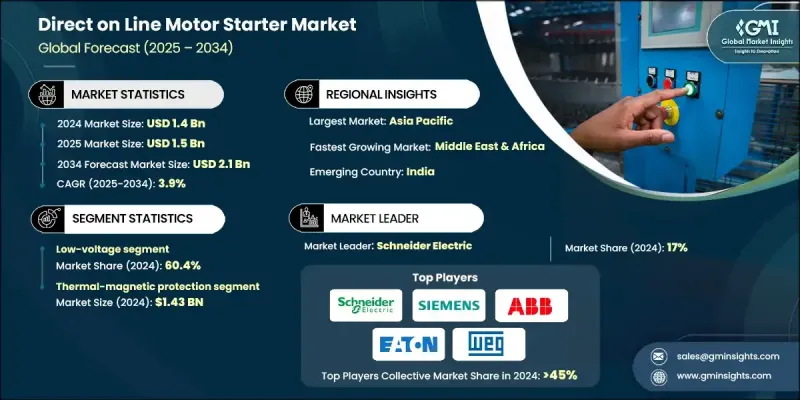

The Global Direct on Line Motor Starter Market was valued at USD 1.4 Billion in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 2.1 Billion by 2034.

Increasing global electricity demand and the accelerated pace of industrial electrification are fueling the adoption of DOL motor starters, especially in small to medium motor segments. These starters continue to be favored for their cost efficiency and operational simplicity. Investments in water infrastructure modernization and wastewater facilities are supporting steady demand for DOL starters across pumps, blowers, and auxiliary motor loads. Manufacturing growth in Asia, driven by revived capital expenditure and a strong push toward high-tech plant upgrades, is further boosting deployment in essential systems like conveyors and utility equipment. In regions across sub-Saharan Africa and parts of Asia, increasing access is creating new use cases for basic motor control systems. The IEA's latest updates highlight substantial growth in power availability, which is translating into heightened demand for compressors, fans, and pumps, key applications for DOL starter systems. Emerging markets are adopting these solutions for their low life-cycle cost and easy maintenance, aligning with the needs of expanding infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 3.9% |

Thermal-magnetic protection remains widely adopted in DOL starters due to its affordability, reliability, and functional efficiency. These combined mechanisms ensure effective protection against overload and short-circuit events, making them suitable for sectors such as HVAC, manufacturing, and water management. As industries continue prioritizing safety and simplicity under budget constraints, thermal-magnetic units offer an ideal balance between performance and practicality.

The low-voltage DOL starters segment held 60.4% share in 2024, owing to their prevalent use in small and medium-sized electric motors. This category continues to lead due to ease of installation, compatibility with standard motor configurations, and cost-effectiveness in high-volume applications. Expansion in infrastructure development and rising utility investments across global markets are also contributing to the increasing preference for low-voltage DOL starters, especially in water treatment and industrial facilities.

United States Direct on Line Motor Starter Market generated USD 162.7 million in 2024. U.S. continues to witness strong demand due to investments in modernizing water and wastewater infrastructure. Federal funding aimed at improving pump efficiency and motor control technologies is driving the replacement of legacy systems. Energy efficiency standards promoted by the Department of Energy (DOE) are also supporting the transition toward updated low-voltage starter technologies across both public and industrial sectors.

Key companies competing in the Global Direct on Line Motor Starter Market include Schneider Electric, WEG, Kalp Controls, LOVATO ELECTRIC, BCH Electric Limited, Jaydeep Controls, Rockwell Automation, ABB, CHINT Group, Lauritz Knudsen Electrical & Automation, C&S Electric, Siemens, LS ELECTRIC, CMI Switchgear, CG Power & Industrial Solutions, Omron Corporation, Danfoss, NOARK Electric, c3controls, and Eaton. To strengthen their position in the Direct on Line Motor Starter Market, companies are prioritizing strategies such as expanding product portfolios with compact, modular designs tailored for emerging infrastructure projects. They are also enhancing compatibility with energy-efficient motors and smart industrial systems. Strategic collaborations with government-led utility and water projects are being leveraged to increase public sector penetration. In parallel, global players are targeting high-growth regions by setting up local manufacturing facilities and service centers, aiming to reduce lead times and enhance support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Protection system trends

- 2.1.3 Control system trends

- 2.1.4 Voltage trends

- 2.1.5 Current trends

- 2.1.6 Application trends

- 2.1.7 End use trends

- 2.1.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.7 Cost structure analysis of Direct on Line (DoL) motor starters

- 3.8 Price trend analysis, (USD/Unit)

- 3.8.1 By region

- 3.9 Emerging opportunities & trends

- 3.10 Investment analysis & future outlook for the DoL motor starter

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Strategic dashboard

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Protection System, 2021 - 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Electronic overload relays

- 5.3 Solid-state overload protection

- 5.4 Thermal-magnetic protection

Chapter 6 Market Size and Forecast, By Control System, 2021 - 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 PLC

- 6.3 Fieldbus

Chapter 7 Market Size and Forecast, By Voltage, 2021 - 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Size and Forecast, By Current, 2021 - 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 > 9 A - 27 A

- 8.3 > 27 A - 90 A

- 8.4 > 90 A - 270 A

- 8.5 > 270 A - 810 A

- 8.6 > 810 A

Chapter 9 Market Size and Forecast, By Application, 2021 - 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 Distributed architecture

- 9.3 Control cabinet

- 9.4 Hybrid configuration

Chapter 10 Market Size and Forecast, By End Use, 2021 - 2034 (Units & USD Million)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

- 10.4 Industrial

Chapter 11 Market Size and Forecast, By Region, 2021 - 2034 (Units & USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 France

- 11.3.3 Russia

- 11.3.4 UK

- 11.3.5 Italy

- 11.3.6 Spain

- 11.3.7 Netherlands

- 11.3.8 Austria

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 South Korea

- 11.4.4 India

- 11.4.5 Australia

- 11.4.6 New Zealand

- 11.4.7 Indonesia

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 UAE

- 11.5.3 Qatar

- 11.5.4 Egypt

- 11.5.5 South Africa

- 11.5.6 Nigeria

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Argentina

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 BCH Electric Limited

- 12.3 C&S Electric

- 12.4 CG Power & Industrial Solutions

- 12.5 CHINT Group

- 12.6 CMI Switchgear

- 12.7 c3controls

- 12.8 Danfoss

- 12.9 Eaton

- 12.10 Jaydeep Controls

- 12.11 Kalp Controls

- 12.12 Lauritz Knudsen Electrical & Automation

- 12.13 LOVATO ELECTRIC

- 12.14 LS ELECTRIC

- 12.15 NOARK Electric

- 12.16 Omron Corporation

- 12.17 Rockwell Automation

- 12.18 Schneider Electric

- 12.19 Siemens

- 12.20 WEG