PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871270

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871270

Europe Motor Starter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

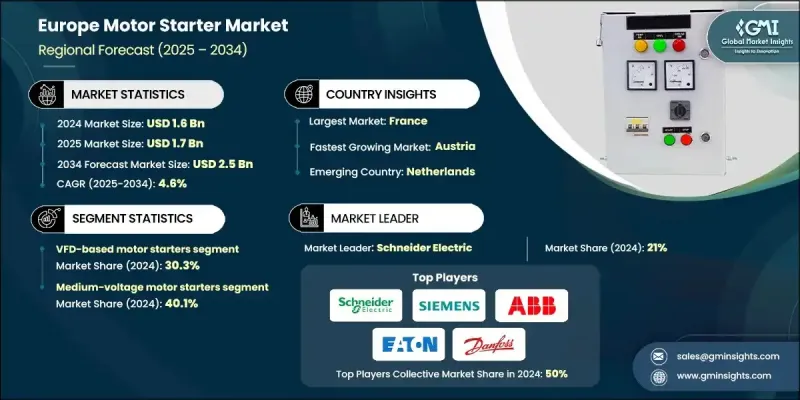

Europe Motor Starter Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 2.5 billion by 2034.

Growth in the region is driven by policy-backed industrial electrification, clean energy initiatives, and rising demand for smart automation technologies. Countries across Europe are prioritizing the shift from fossil fuels to electricity-powered operations, fueling the adoption of energy-efficient motor control systems. Motor starters play a crucial role in these transitions, supporting motor protection, energy conservation, and operational efficiency. As the industrial sector digitizes, there's a growing demand for intelligent starters that enable predictive maintenance, remote access, and data-driven process optimization. Nations like France, the Netherlands, and Germany are witnessing a surge in the deployment of IoT-integrated starters as part of broader Industry 4.0 strategies. Regulatory mandates such as the EU's Ecodesign Regulation (EU) 2019/1781, which enforces IE4 efficiency standards for motors from 75kW to 200kW, are further accelerating product replacements across manufacturing, mining, and infrastructure. This legislation impacts hundreds of millions of electric motors, increasing pressure on businesses to install compatible motor starters that align with energy efficiency targets while boosting control reliability across all sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 4.6% |

The VFD-based motor starters segment held a 30.3% share in 2024 and is forecasted to grow at a CAGR of 5.1% through 2034. Their widespread adoption stems from their ability to regulate motor speeds, enabling lower energy consumption in systems like ventilation, conveyor belts, and pumping solutions. By adjusting output based on demand, these starters extend motor life and improve overall plant efficiency, which is critical under today's tightening energy guidelines.

The medium-voltage motor starters segment held a 40.1% share in 2024. These products are preferred for high-demand industrial environments where reliability and safety are non-negotiable. Facilities in sectors such as cement production, water utilities, and minerals processing are adopting these starters to scale operations efficiently while managing energy costs. Their ease of integration into mid-sized automation systems makes them especially valuable in facilities looking to modernize without upgrading to high-voltage infrastructure.

France Motor Starter Market was valued at USD 265.3 million in 2024. Holding roughly 16.5% of Europe's total share in 2024, France is expected to see solid future growth. Government-led digital transformation initiatives are encouraging the adoption of advanced automation technologies across the country's industrial base. As energy-efficient solutions become a national focus, demand for intelligent motor starters is rising in sectors such as automotive, food processing, and building services.

Major companies active in the Europe Motor Starter Market include Mitsubishi Electric Corporation, Emerson Electric, Schneider Electric, ABB, WEG, Eaton, DENSO, CHINT Group, Kalp Controls, EMZ Elektromaschinenzentrale, L&T Electrical & Automation, Danfoss, GE Vernova, Rockwell Automation, Siemens, LOVATO ELECTRIC, MAHLE, C&S Electric Limited, Remy Automotive, and CG Power & Industrial Solutions. Leading companies in the Europe Motor Starter Market are strengthening their position by developing energy-efficient and digitally compatible starters that meet evolving regulatory and performance demands. Many are integrating IoT functionality to support remote monitoring, diagnostics, and predictive analytics, aligning with Industry 4.0 goals. To address region-specific efficiency mandates, firms are expanding portfolios with IE4-compliant solutions and modular designs for easier installation and maintenance. Strategic collaborations with industrial automation players and manufacturing facilities help streamline product adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Product trends

- 2.1.3 Protection system trends

- 2.1.4 Control system trends

- 2.1.5 Voltage trends

- 2.1.6 Current trends

- 2.1.7 Application trends

- 2.1.8 End use trends

- 2.1.9 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.7 Cost structure analysis of motor starters

- 3.8 Price trend analysis, (USD/Unit)

- 3.8.1 By country

- 3.8.2 By product

- 3.9 Emerging opportunities & trends

- 3.10 Investment analysis & future outlook for the motor starter

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.3 Strategic initiatives

- 4.4 Strategic dashboard

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Soft starters

- 5.3 Variable frequency drives (VFDs)

- 5.4 Across-the-line starters

- 5.5 Reversing starters

- 5.6 Hybrid motor starters

- 5.7 Others

Chapter 6 Market Size and Forecast, By Protection System, 2021 - 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Electronic overload relays

- 6.3 Solid-state overload protection

- 6.4 Thermal-magnetic protection

Chapter 7 Market Size and Forecast, By Control System, 2021 - 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 PLC

- 7.3 Fieldbus

Chapter 8 Market Size and Forecast, By Voltage, 2021 - 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Size and Forecast, By Current, 2021 - 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 > 9 A - 27 A

- 9.3 > 27 A - 90 A

- 9.4 > 90 A - 270 A

- 9.5 > 270 A - 810 A

- 9.6 > 810 A

Chapter 10 Market Size and Forecast, By Application, 2021 - 2034 (Units & USD Million)

- 10.1 Key trends

- 10.2 Distributed architecture

- 10.3 Control cabinet

- 10.4 Hybrid configuration

Chapter 11 Market Size and Forecast, By End Use, 2021 - 2034 (Units & USD Million)

- 11.1 Key trends

- 11.2 Residential

- 11.3 Commercial

- 11.4 Industrial

Chapter 12 Market Size and Forecast, By Country, 2021 - 2034 (Units & USD Million)

- 12.1 Key trends

- 12.2 Germany

- 12.3 France

- 12.4 Russia

- 12.5 UK

- 12.6 Italy

- 12.7 Spain

- 12.8 Netherlands

- 12.9 Austria

Chapter 13 Company Profiles

- 13.1 ABB

- 13.2 C&S Electric Limited

- 13.3 CHINT Group

- 13.4 CG Power & Industrial Solutions

- 13.5 Danfoss

- 13.6 DENSO

- 13.7 Eaton

- 13.8 Emerson Electric

- 13.9 EMZ Elektromaschinenzentrale

- 13.10 GE Vernova

- 13.11 Kalp Controls

- 13.12 L&T Electrical & Automation

- 13.13 LOVATO ELECTRIC

- 13.14 MAHLE

- 13.15 Mitsubishi Electric Corporation

- 13.16 Rockwell Automation

- 13.17 Remy Automotive

- 13.18 Schneider Electric

- 13.19 Siemens

- 13.20 WEG