PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871140

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871140

Spintronics Devices for Automotive Applications Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

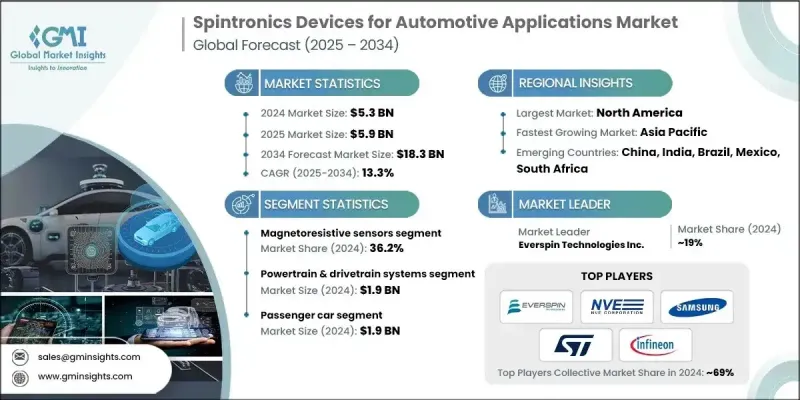

The Global Spintronics Devices for Automotive Applications Market was valued at USD 5.3 Billion in 2024 and is estimated to grow at a CAGR of 13.3% to reach USD 18.3 Billion by 2034.

The growth is primarily driven by the rising adoption of electric and autonomous vehicles, the demand for energy-efficient electronic components, and continuous advancements in magnetic sensor technologies for vehicle safety and control. Increasing focus on reducing power consumption, enhancing data storage, and improving the performance of infotainment and navigation systems is accelerating the use of spintronics technology in automotive applications. The rising integration of advanced electronics in vehicles, particularly electric and hybrid models, is boosting demand for spintronics devices. Spintronics-based sensors and memory solutions deliver faster data processing, lower energy consumption, and superior magnetic sensing capabilities. Automakers are leveraging these technologies to enhance efficiency, reliability, and performance across electric powertrains, ADAS, and battery management systems. The growing adoption of intelligent vehicle architecture is further driving the need for spintronic components to support next-generation automotive design and functionality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $18.3 Billion |

| CAGR | 13.3% |

In 2024, the magnetoresistive sensors held a 36.2% share. These sensors are highly valued for their efficiency in detecting magnetic fields, enabling precise control in automotive systems. Variants such as TMR and GMR are preferred due to their sensitivity, durability, and performance under diverse temperatures and operating conditions, making them essential for electric vehicles, ADAS, and autonomous driving systems.

The powertrain and drivetrain systems segment generated USD 1.9 Billion in 2024. Spintronics devices enhance motor control and energy distribution, improving performance across battery management, regenerative braking, and torque systems. The integration of MRAM technology, advanced sensors, and AI-based control modules has significantly increased the precision, reliability, and responsiveness of spintronic components in automotive applications.

U.S. Spintronics Devices for Automotive Applications Market was valued at USD 1.5 Billion in 2024. The country continues to dominate due to its strong automotive industry, advanced semiconductor ecosystem, substantial research funding, and supportive regulatory framework. Leading automakers, technology providers, and semiconductor companies in the U.S. benefit from a robust pipeline of innovative spintronic devices and state-of-the-art sensor and MRAM solutions.

Key players in the Global Spintronics Devices for Automotive Applications Market include Toshiba Corporation, Renesas Electronics Corporation, Canon Inc., Western Digital Technologies, Inc., STMicroelectronics N.V., Micron Technology, Inc., Ficosa International S.A., NVE Corporation, Everspin Technologies Inc., Spin Memory Inc., Hitachi Ltd., Qualcomm Technologies Inc., Intel Corporation, Samsung Electronics Co., Ltd., Fujitsu Ltd., TDK Corporation, Visteon Corporation, IBM Corporation, and Infineon Technologies AG. To strengthen Spintronics Devices for Automotive Applications Market presence, companies are investing in research and development to introduce next-generation spintronic sensors and MRAM devices optimized for automotive applications. Strategic collaborations and partnerships are being formed to expand global distribution and integration capabilities. Firms are also diversifying product portfolios to meet evolving automotive requirements, including electric and autonomous vehicle systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Vector trends

- 2.2.3 Delivery method trends

- 2.2.4 Gene type trends

- 2.2.5 Indication trends

- 2.2.6 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of electric and hybrid vehicles.

- 3.2.1.2 Increasing integration of advanced driver-assistance systems (ADAS).

- 3.2.1.3 Demand for energy-efficient and compact automotive electronics.

- 3.2.1.4 Technological advancements in MRAM and TMR/GMR sensors.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Complexity of spintronics devices for automotive applications delivery and potential side effects

- 3.2.3 Market opportunities

- 3.2.3.1 High manufacturing and development costs.

- 3.2.3.2 Limited large-scale production infrastructure.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Magnetoresistive Sensors

- 5.2.1 Anisotropic Magnetoresistance (AMR) Sensors

- 5.2.2 Giant Magnetoresistance (GMR) Sensors

- 5.2.3 Tunneling Magnetoresistance (TMR) Sensors

- 5.3 Magnetic Random Access Memory (MRAM)

- 5.3.1 Toggle MRAM

- 5.3.2 Spin-Transfer Torque MRAM (STT-MRAM)

- 5.3.3 Spin-Orbit Torque MRAM (SOT-MRAM)

- 5.4 Spin Logic Devices

- 5.4.1 Spin Field-Effect Transistors (Spin-FETs)

- 5.4.2 Magnetic Tunnel Junction Logic

- 5.4.3 All-Spin Logic Devices

- 5.5 Spin-Based RF & Oscillator Devices

- 5.5.1 Spin-Torque Oscillators

- 5.5.2 Spin-Wave Devices

Chapter 6 Market Estimates and Forecast, By Automotive Application, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Powertrain & drivetrain systems

- 6.3 Safety & ADAS systems

- 6.4 Body & comfort systems

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.3 Commercial vehicles

- 7.4 Off-Highway vehicles

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 NVE Corporation

- 9.2 Everspin Technologies Inc.

- 9.3 Crocus Technology Inc.

- 9.4 Spin Memory Inc.

- 9.5 IBM Corporation

- 9.6 Intel Corporation

- 9.7 Samsung Electronics Co., Ltd.

- 9.8 Toshiba Corporation

- 9.9 STMicroelectronics N.V.

- 9.10 Infineon Technologies AG

- 9.11 Qualcomm Technologies Inc.

- 9.12 Micron Technology, Inc.

- 9.13 Renesas Electronics Corporation

- 9.14 Hitachi Ltd.

- 9.15 Canon Inc.

- 9.16 Fujitsu Ltd.

- 9.17 Western Digital Technologies, Inc.

- 9.18 Visteon Corporation

- 9.19 Ficosa International S.A.

- 9.20 TDK Corporation