PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871153

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871153

Self-Healing Joint Compounds Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

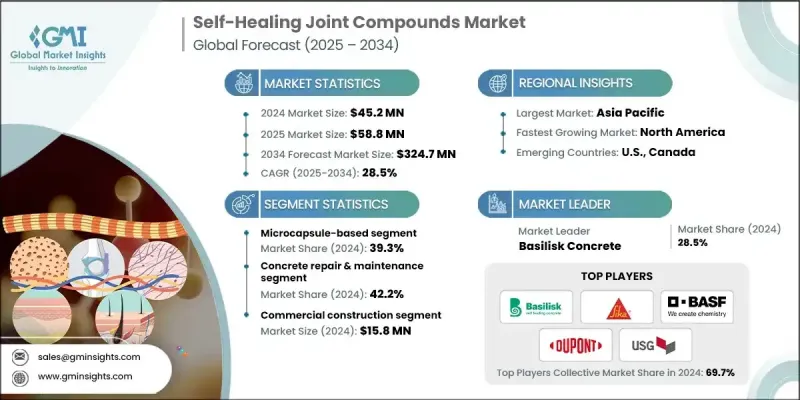

The Global Self-Healing Joint Compounds Market was valued at USD 45.2 million in 2024 and is estimated to grow at a CAGR of 28.5% to reach USD 324.7 million by 2034.

The market is gaining rapid traction as demand rises for smart construction materials that combine durability, sustainability, and reduced maintenance costs. Self-healing joint compounds are increasingly being adopted across both residential and commercial construction projects for their ability to automatically repair minor cracks and gaps in walls, ceilings, and structural joints. These compounds formulated using dynamic polymers, embedded microcapsules, or bio-based healing agents, help extend the lifespan of infrastructure and building interiors while reducing long-term repair expenses. Growing global awareness of sustainable building materials, alongside stricter government mandates on reducing waste and maintenance costs, is accelerating adoption. Developed economies are particularly focusing on revitalizing aging infrastructure, which is driving investments in materials that reduce future renovation cycles. Similarly, emerging economies in Asia Pacific are boosting spending on railways, transit, and urban infrastructure projects, fueling market expansion. With rising construction activity and heightened focus on performance efficiency, self-healing joint compounds are expected to become a standard in modern construction practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.2 Million |

| Forecast Value | $324.7 Million |

| CAGR | 28.5% |

The microcapsule-based systems segment held a 39.3% share in 2024. These systems are popular due to their compatibility with conventional joint compound formulations and cost-effective manufacturing processes. Their ability to blend seamlessly into standard drywall applications allows manufacturers to integrate self-healing properties without major adjustments to production lines. Meanwhile, intrinsic polymer systems are witnessing steady development, offering multiple self-healing cycles without embedded agents. This feature is especially valuable in high-movement structural joints and interior settings that demand both flexibility and longevity.

The protective coatings segment accounted for 24.1% share in 2024. Their rising use in demanding environments such as industrial and offshore installations highlights their effectiveness in providing moisture resistance, corrosion protection, and extended durability of architectural and equipment surfaces.

U.S. Self-Healing Joint Compounds Market was valued at USD 15.8 million in 2024. North America continues to lead the industry due to strong investment in infrastructure modernization and government-backed initiatives promoting durable, low-VOC materials. The region benefits from active demonstration programs, training workshops, and R&D collaborations between suppliers, universities, and material innovators. These efforts are enhancing product adoption across drywall finishing, sealants, and coatings applications, positioning the U.S. as a hub for advanced self-healing technologies.

Key players operating in the Global Self-Healing Joint Compounds Market include CertainTeed Gypsum, DuPont de Nemours Inc., Sika AG, United States Gypsum Company (USG), BASF SE, ITW Performance Polymers, Autonomic Materials Inc., Applied Nanotech Holdings Inc., National Gypsum Company, and Basilisk Concrete. Leading companies are focusing on technological innovation, sustainable formulations, and strategic collaborations to reinforce their market position. Many are investing in advanced polymer chemistry and nanotechnology to improve healing efficiency, product longevity, and environmental compliance. Partnerships between chemical firms and construction material manufacturers are accelerating commercialization and large-scale deployment of self-healing solutions. Companies are also expanding their regional presence by establishing production facilities close to key infrastructure markets, particularly in North America and Asia Pacific.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology Type

- 2.2.3 Application

- 2.2.4 End use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift toward sustainable, low-VOC building materials

- 3.2.1.2 Growth of smart & sustainable construction

- 3.2.1.3 Integration of smart sensors for structural health monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory complexity & compliance costs

- 3.2.2.2 Compatibility issues with existing materials

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in green building certifications

- 3.2.3.2 Integration with Smart Building Technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Microcapsule-based Systems

- 5.3 Bacterial/Biological Systems

- 5.4 Polymer-based Intrinsic Healing

- 5.5 Vascular Network Systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Drywall Joint Finishing

- 6.3 Concrete Repair & Maintenance

- 6.4 Protective Coatings Market Analysis

- 6.5 Structural Sealants

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential Construction

- 7.3 Commercial Construction

- 7.4 Infrastructure/Civil Engineering

- 7.5 Industrial Facilities

- 7.6 Marine/Offshore

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Applied Nanotech Holdings, Inc.

- 9.2 Autonomic Materials, Inc.

- 9.3 BASF SE

- 9.4 Basilisk Concrete

- 9.5 CertainTeed Gypsum

- 9.6 DuPont de Nemours, Inc.

- 9.7 ITW Performance Polymers

- 9.8 National Gypsum Company

- 9.9 Sika AG

- 9.10 United States Gypsum Company (USG)