PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871155

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871155

Green Ammonia Production Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

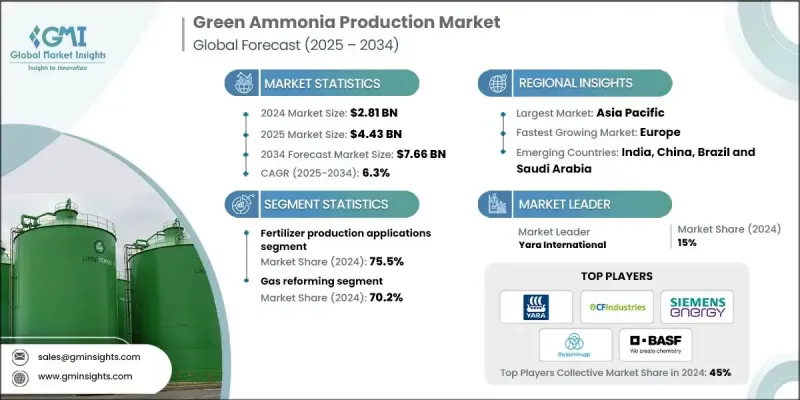

The Global Green Ammonia Production Market was valued at USD 2.81 Billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 7.66 Billion by 2034.

The market is gaining momentum due to green ammonia's role as a next-generation energy carrier that combines high efficiency, cost-effective production, and versatility. By using perovskite-structured compounds as light-absorbing layers, green ammonia technologies convert solar energy into electricity efficiently. Low-temperature solution-based fabrication methods, such as spin-coating, inkjet printing, and blade-coating, significantly reduce production costs. Green ammonia enables the storage and transport of renewable energy over long distances and is becoming a key component in renewable integration, power generation, and grid stabilization. Countries with abundant renewable resources are investing heavily in green ammonia export projects to supply regions with limited renewable capacity, transforming green ammonia into a globally traded, low-carbon commodity and fostering international clean energy collaboration and economic development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.81 Billion |

| Forecast Value | $7.66 Billion |

| CAGR | 6.3% |

The pharmaceuticals segment is anticipated to grow at a CAGR of 10.5% through 2034, driven by the industry's growing interest in sustainable chemical feedstocks and specialty chemical production. Industrial decarbonization efforts are prompting manufacturers to adopt greener alternatives, creating premium demand for certified green ammonia.

The gas reforming segment held a 70.2% share in 2024 and is expected to grow at a 5.5% CAGR through 2034. This process benefits from existing natural gas infrastructure, access to CO2 storage, and lower capital costs compared to fully renewable hydrogen systems. Gas reforming allows producers to cut emissions while leveraging established technology, making it ideal for regions with high or intermittent renewable electricity costs. Carbon pricing, policy incentives, and the emergence of ammonia as a low-carbon tradeable commodity further accelerate adoption.

U.S. Green Ammonia Production Market was valued at USD 458.4 million by 2024, supported by strong government funding and strategic research initiatives. The U.S. benefits from abundant wind and solar resources, enabling cost-effective green hydrogen production for ammonia synthesis. Growing emphasis on sustainable agricultural practices is further driving the adoption of green ammonia as a cleaner alternative to conventional fertilizers.

Key players in the Green Ammonia Production Market include Fertiberia, Enaex, Orsted, IFFCO, Nutrien, CF Industries Holdings Inc., AM Green Ammonia, Statkraft, Talus Renewables, ACME Group, PT Pupuk Sriwidjaja Palembang (Pusri), Scatec, BASF, ENGIE, CSBP Limited, Group DF, Envision Energy, Yara International, and LSB Industries. Companies in the Green Ammonia Production Market are focusing on technological innovation, strategic partnerships, and capacity expansion to strengthen their market presence. Firms are investing in low-cost, high-efficiency production methods and scalable renewable energy integration for ammonia synthesis. Collaborations with global energy and chemical companies are accelerating export capabilities and market penetration. Players are also prioritizing certification and sustainability standards to command premium pricing for green ammonia.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Process trends

- 2.4 End Use trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Green ammonia production plants

- 3.3.1 Operational

- 3.3.2 Planned

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of world

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Process, 2021 - 2034 (USD Million & Million Tonnes)

- 5.1 Key trends

- 5.2 Gas reforming

- 5.3 Water reforming

- 5.4 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & Million Tonnes)

- 6.1 Key trends

- 6.2 Fertilizer production

- 6.3 Energy storage

- 6.4 E-fuel

- 6.5 Pharmaceuticals

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Million Tonnes)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Italy

- 7.3.4 UK

- 7.3.5 Poland

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 ACME Group

- 8.2 AM Green Ammonia

- 8.3 BASF

- 8.4 CSBP Limited

- 8.5 CF Industries Holdings Inc.

- 8.6 Envision Energy

- 8.7 ENGIE

- 8.8 Enaex

- 8.9 First Ammonia

- 8.10 Fertiberia

- 8.11 Group DF

- 8.12 IFFCO

- 8.13 LSB Industries

- 8.14 Nutrien

- 8.15 Ørsted

- 8.16 PT Pupuk Sriwidjaja Palembang (Pusri)

- 8.17 Statkraft

- 8.18 Scatec

- 8.19 Talus Renewables

- 8.20 Yara International

- 8.21 Industry Segmentation