PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871167

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871167

Europe Medical Adhesive Tapes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

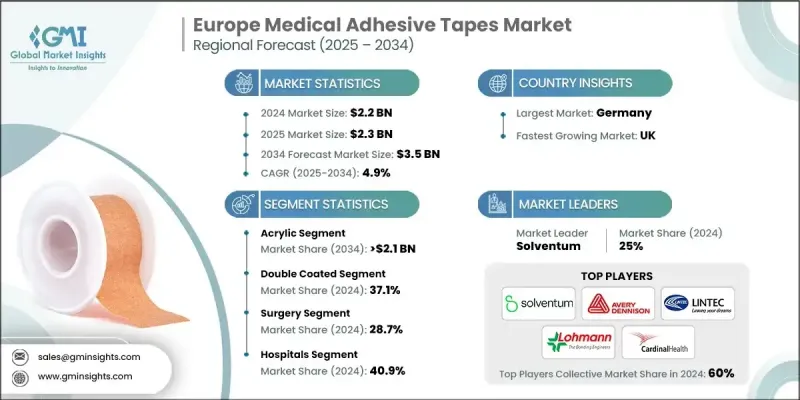

Europe Medical Adhesive Tapes Market was valued at USD 2.2 Billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 3.5 Billion by 2034.

The industry expansion is driven by Europe's aging population, the rising need for chronic disease management, and the increasing number of surgical procedures across hospitals and clinics. Additionally, the growth of cosmetic dermatology, the rapid expansion of aesthetic treatment centers, and the integration of adhesive technologies with wearable medical devices are contributing significantly to market development. As more consumers embrace advanced healthcare technologies, demand for high-performance, skin-friendly adhesive tapes continues to grow. These innovations are leading to improved functionality and comfort for patients, boosting the adoption of medical tapes designed for both short- and long-term use. The growing popularity of minimally invasive surgeries and home-based medical care has further accelerated the need for reliable and gentle adhesive solutions across the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 4.9% |

With healthcare systems moving toward remote monitoring, the adoption of wearable medical devices has surged. These devices, including glucose trackers, heart rate sensors, and temperature patches, require medical adhesive tapes that can securely attach to the skin for prolonged durations without causing irritation or premature detachment. This shift is driving the demand for next-generation tapes featuring breathability, elasticity, and hypoallergenic materials. Manufacturers are investing in advanced formulations that can maintain secure adhesion under various conditions, creating new growth opportunities for product innovation in the European market.

The double-coated segment held a 37.1% share in 2024. These tapes feature adhesive layers on both sides of a central carrier, allowing them to bond effectively between two surfaces. Their ability to securely attach devices or components to the skin while maintaining comfort makes them indispensable in the production of medical devices and wound care products. Double-coated medical adhesive tapes are gaining prominence due to their multifunctionality and superior bonding strength, which allow for the development of complex wearable devices and advanced wound care systems. Their dual-sided adhesion offers flexibility in product design, supporting the manufacturing of more innovative and reliable medical solutions.

The surgical application segment held a 28.7% share in 2024. Adhesive tapes used in surgical procedures are designed to secure drapes, dressings, and medical tools while maintaining a sterile environment. These specialized tapes are made with breathable and hypoallergenic materials to ensure comfort and adhesion even in high-moisture conditions. They play a vital role in preventing infections, maintaining surgical field integrity, and stabilizing instruments during procedures. The increasing number of surgical interventions across Europe continues to drive consistent demand for these tapes, which are essential for improving efficiency and safety in operating rooms.

Germany Medical Adhesive Tapes Market reached USD 494.8 million in 2024. The steady rise in inpatient surgical volumes across specialties such as orthopedics, gynecology, neurosurgery, and general surgery is fueling market expansion. This increasing surgical activity has led to higher consumption of medical adhesive tapes, which are essential for post-operative care and wound management. The ongoing focus on patient safety, hygiene, and advanced recovery solutions is further driving product innovation in the German market, setting a strong precedent for regional growth across Europe.

Prominent companies operating in the Europe Medical Adhesive Tapes Market include Berry Global Group, Nitto Denko Corporation, Medline Industries, Smith & Nephew, Lohmann GmbH, Johnson & Johnson, Solventum, Medtronic, Paul Hartmann, Lintec Corporation, Avery Dennison Corporation, Nichiban, Cardinal Health, Flexcon Company, McKesson Corporation, and Henkel AG & Co. KGaA. Leading companies in the Europe Medical Adhesive Tapes Market are pursuing innovation-driven strategies to strengthen their competitive presence. Many are focusing on research and development to introduce advanced adhesive technologies that provide superior comfort, breathability, and compatibility with medical devices. Strategic collaborations with healthcare providers and device manufacturers are helping expand their product applications in wound care, surgical use, and wearables. Companies are also investing in biocompatible and hypoallergenic formulations to meet stringent European healthcare standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Type trends

- 2.2.3 Adhesive trends

- 2.2.4 Application trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Aging population and demand for chronic disease management across Europe

- 3.2.1.2 Rising surgical procedures across Europe

- 3.2.1.3 Growth in cosmetic procedures and aesthetic clinics

- 3.2.1.4 Growing integration with wearable medical devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of raw materials

- 3.2.2.2 Stringent EU medical device regulation

- 3.2.3 Market opportunities

- 3.2.3.1 Smart adhesive tapes for digital health integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Germany

- 3.4.2 UK

- 3.5 Technological advancements

- 3.6 Supply chain analysis

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Acrylic

- 5.3 Silicone

- 5.4 Rubber

Chapter 6 Market Estimates and Forecast, By Adhesive, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single coated

- 6.3 Double coated

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Surgery

- 7.3 Wound dressing

- 7.4 Device fixation

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Europe

- 9.2.1 Germany

- 9.2.2 UK

- 9.2.3 France

- 9.2.4 Spain

- 9.2.5 Italy

Chapter 10 Company Profiles

- 10.1 Avery Dennison Corporation

- 10.2 Berry Global Group

- 10.3 Cardinal Health

- 10.4 Flexcon Company

- 10.5 Henkel AG & Co. KGaA

- 10.6 Johnson & Johnson

- 10.7 Lintec Corporation

- 10.8 Lohmann GmbH

- 10.9 McKesson Corporation

- 10.10 Medline Industries

- 10.11 Medtronic

- 10.12 Nichiban

- 10.13 Nitto Denko Corporation

- 10.14 Paul Hartmann

- 10.15 Smith & Nephew

- 10.16 Solventum