PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871211

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871211

Precision Diagnostics and Medicine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

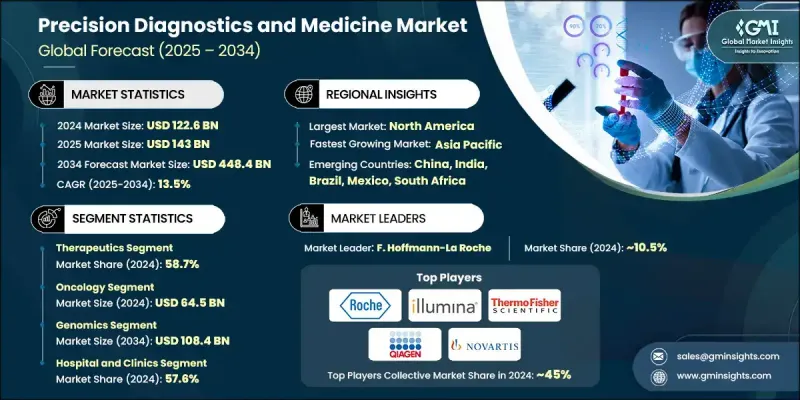

The Global Precision Diagnostics and Medicine Market was valued at USD 122.6 Billion in 2024 and is estimated to grow at a CAGR of 13.5% to reach USD 448.4 Billion by 2034.

Precision medicine is transforming healthcare by shifting from standardized treatments to highly tailored approaches based on an individual's genetic profile, lifestyle, and environment. This approach focuses on personalized strategies rather than generalized protocols, driving improved outcomes across various diseases. Rapid advancements in data-driven diagnostics, coupled with growing demand for targeted treatments, continue to shape the evolution of the market. Integration of multi-omics platforms is accelerating innovation, providing clinicians and researchers with detailed insights into complex biological systems. As precision therapies become more accessible and regulatory frameworks evolve to support quicker approval of innovative treatments, global adoption is poised to increase. Healthcare providers and biopharma companies are aligning efforts to support clinical integration, while digital technologies and companion diagnostics strengthen personalized treatment plans.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $122.6 Billion |

| Forecast Value | $448.4 Billion |

| CAGR | 13.5% |

In 2024, the therapeutics segment held 58.7% share and is forecasted to grow at a CAGR of 13.3% through 2034. The focus on designing therapies tailored to individual patient profiles is fueling this growth. Advances in cellular therapies, gene-based solutions, and immune-targeted drugs are reshaping treatment protocols, especially for complex or rare diseases. High development costs and premium drug pricing continue to drive value across this segment.

The genomics segment is anticipated to hit USD 108.4 Billion by 2034. Genomic technologies play a critical role in understanding how specific genetic variations affect disease progression and treatment response. Techniques such as next-generation sequencing and full genome analysis allow for precise identification of actionable mutations. This has significantly elevated the role of genomics in both drug development and personalized therapeutic strategies, reinforcing its significance in clinical diagnostics and research applications.

North America Precision Diagnostics and Medicine Market held 43.5% share in 2024. The region continues to lead the way, supported by robust healthcare infrastructure, high R&D investment, and the presence of top-tier pharmaceutical and biotech companies. Favorable regulatory frameworks and substantial government spending further support innovation in personalized healthcare. Additionally, the widespread availability of companion diagnostics and the presence of sophisticated genomic testing technologies contribute to the region's strong market position.

Leading companies shaping the Precision Diagnostics and Medicine Market include Illumina, Novartis, Cepheid (Danaher Corporation), Qiagen, Takeda Pharmaceutical Company Limited, Pfizer, F. Hoffmann-La Roche, Laboratory Corporation of America Holdings (Labcorp), Thermo Fisher Scientific, Bristol-Myers Squibb Company, GlaxoSmithKline, Agilent Technologies, Myriad Genetics, AstraZeneca, Quest Diagnostics, bioMerieux, Natera, Eli Lilly & Company, Abbott, and AbbVie. To expand their footprint, key players in the Precision Diagnostics and Medicine Market are focusing on strategic collaborations, partnerships, and acquisitions to enhance their product pipelines and diversify technological capabilities. Companies are investing heavily in multi-omics platforms, AI-powered data analytics, and advanced genomic solutions to improve the accuracy of diagnostics and personalization of treatments. Enhancing clinical trial precision and speeding regulatory approvals through data-driven models are also core strategies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Indication trends

- 2.2.4 Technology trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in genomics and biotechnology

- 3.2.1.2 Rising prevalence of chronic and genetic diseases

- 3.2.1.3 Increasing government initiatives and funding

- 3.2.1.4 Increased adoption of companion diagnostics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of personalized therapies and diagnostics

- 3.2.2.2 Limited reimbursement policies

- 3.2.2.3 Complex regulatory pathways

- 3.2.3 Market opportunities

- 3.2.3.1 Rapid expansion into non-oncology fields

- 3.2.3.2 Growth in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostics

- 5.2.1 Genetic tests

- 5.2.2 Biomarker-based tests

- 5.2.3 Esoteric tests

- 5.2.4 Other diagnostic tests

- 5.3 Therapeutics

- 5.3.1 Inhibitor drugs

- 5.3.2 Monoclonal antibodies

- 5.3.3 Cell and gene therapy

- 5.3.4 Antiviral and anti-retroviral drugs

- 5.3.5 Other therapeutics

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology

- 6.3 Neurology

- 6.4 Infectious diseases

- 6.5 Immunology

- 6.6 Rare and genetic disorders

- 6.7 Cardiology

- 6.8 Other indications

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Genomics

- 7.3 Bioinformatics

- 7.4 Big data analytics

- 7.5 Biomarker detection

- 7.6 High-throughput screening

- 7.7 Other technologies

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Diagnostic laboratories

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Agilent Technologies

- 10.2 Abbott

- 10.3 AbbVie

- 10.4 AstraZeneca

- 10.5 bioMerieux

- 10.6 Bristol-Myers Squibb Company

- 10.7 Cepheid (Danaher Corporation)

- 10.8 Eli Lilly & Company

- 10.9 F. Hoffmann-La Roche

- 10.10 GlaxoSmithKline

- 10.11 Illumina

- 10.12 Laboratory Corporation of America Holdings (Labcorp)

- 10.13 Myriad Genetics

- 10.14 Novartis

- 10.15 Natera

- 10.16 Pfizer

- 10.17 Qiagen

- 10.18 Quest Diagnostics

- 10.19 Takeda Pharmaceutical Company Limited

- 10.20 Thermo Fisher Scientific