PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871219

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871219

Fuel Cell Electric Vehicle (FCEV) Powertrain Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

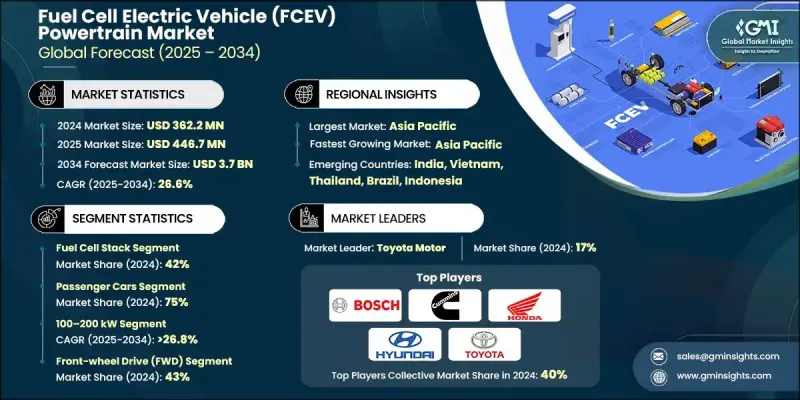

The Global Fuel Cell Electric Vehicle (FCEV) Powertrain Market was valued at USD 362.2 million in 2024 and is estimated to grow at a CAGR of 26.6% to reach USD 3.7 Billion by 2034.

The market is being driven by rapid technological advancements, with automakers introducing next-generation fuel cell systems that are more efficient, compact, and scalable. Recent developments emphasize modular designs that can be integrated into passenger vehicles, commercial fleets, and stationary applications, enhancing both performance and manufacturing efficiency. Improvements in catalyst technology, along with reduced use of precious metals, have lowered system costs, while government support and funding for hydrogen infrastructure have accelerated market adoption. Automated production techniques and roll-to-roll manufacturing processes are transforming fuel cell component production, ensuring better consistency and efficiency. High power density and optimized integration in advanced systems have further enhanced adoption, particularly in regions investing in hydrogen mobility and clean energy policies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $362.2 Million |

| Forecast Value | $3.7 Billion |

| CAGR | 26.6% |

In 2024, the passenger cars segment held a 75% share and is expected to grow at a CAGR of 27.1% from 2025 to 2034. The segment benefits from increased model availability, infrastructure expansion, and technological advances that improve efficiency, range, and refueling speed. Luxury and premium models increasingly utilize modular fuel cell powertrains to meet evolving energy management standards and consumer expectations.

The 100-200 kW powertrain segment generated USD 150.1 million in 2024 and is poised to grow owing to its suitability for medium-duty commercial vehicles, luxury passenger cars, and smaller commercial units. Standardized designs and economies of scale make this range versatile, offering high performance, cost-efficiency, and effective packaging for mainstream applications.

Asia Pacific Fuel Cell Electric Vehicle (FCEV) Powertrain Market held 46% share in 2024, driven by supportive government policies, investments in hydrogen infrastructure, and automaker initiatives. Increased local production, R&D investment, and partnerships between automakers and energy providers are fostering a robust hydrogen ecosystem. China, the largest market in the region, is benefiting from fleet electrification initiatives and government incentives for FCEV adoption, with rising demand in commercial and logistics sectors further boosting growth.

Key players operating in the Global Fuel Cell Electric Vehicle (FCEV) Powertrain Market include Nikola, Honda Motor, Ballard Power, PowerCell, Toyota Motor, Bosch, Cummins, General Motors, Plug Power, and Hyundai Motor. Companies are strengthening their position by investing heavily in research and development to enhance fuel cell efficiency, durability, and power density. Strategic partnerships with energy providers, government agencies, and automotive manufacturers are helping build hydrogen refueling networks and supply chains. Firms are introducing modular and scalable powertrains for multiple vehicle segments, expanding their portfolio to include passenger, commercial, and industrial applications.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Power Output

- 2.2.5 Drive

- 2.2.6 Range

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Government incentives and zero-emission regulations

- 3.2.1.3 Advancements in hydrogen production and refueling infrastructure

- 3.2.1.4 Declining fuel cell costs and improved efficiency

- 3.2.1.5 Rising demand for long-range and heavy-duty mobility solutions

- 3.2.1.6 Collaboration between automakers and energy companies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High hydrogen production and storage costs

- 3.2.2.2 Limited hydrogen refueling infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Green hydrogen production expansion

- 3.2.3.2 Hydrogen infrastructure development partnerships

- 3.2.3.3 Technological innovation in fuel cell components

- 3.2.3.4 Integration with renewable energy systems

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 PEM fuel cell technology maturity

- 3.7.1.2 Hydrogen storage technology status

- 3.7.1.3 Balance of plant optimization

- 3.7.1.4 Integration and control systems

- 3.7.2 Emerging technologies

- 3.7.2.1 Solid-state fuel cells

- 3.7.2.2 Advanced membrane technologies

- 3.7.2.3 Next-generation storage solutions

- 3.7.2.4 AI-driven system optimization

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 Component-level pricing analysis

- 3.8.2 System-level pricing trends

- 3.8.3 Regional price variations

- 3.9 Pricing strategy analysis

- 3.9.1 Value-based pricing models

- 3.9.2 Competitive pricing strategies

- 3.9.3 Volume discount structures

- 3.10 Production statistics and manufacturing analysis

- 3.10.1 Global production overview

- 3.10.2 Manufacturing capacity analysis

- 3.10.3 Production technology assessment

- 3.10.4 Supply chain manufacturing

- 3.11 Cost breakdown analysis

- 3.11.1 Fuel cell stack cost structure

- 3.11.2 Balance of plant cost analysis

- 3.11.3 Integration and assembly costs

- 3.11.4 Total cost of ownership analysis

- 3.12 Patent analysis

- 3.12.1 Patent landscape overview

- 3.12.2 Key technology patents

- 3.12.3 IP licensing strategies

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 R&D investment analysis

- 3.14.1 Global R&D spending trends

- 3.14.2 Corporate R&D initiatives

- 3.14.3 Government research programs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Fuel cell stack

- 5.3 Hydrogen storage tank

- 5.4 Electric motor

- 5.5 Power control unit (PCU)

- 5.6 Battery system

- 5.7 Air compressor & humidifier

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Power Output, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Below 100 kW

- 7.3 100-200 kW

- 7.4 Above 200 kW

Chapter 8 Market Estimates & Forecast, By Drive, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Front-wheel drive (FWD)

- 8.3 Rear-wheel drive (RWD)

- 8.4 All-wheel drive (AWD)

Chapter 9 Market Estimates & Forecast, By Range, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Up to 400 km

- 9.3 400-600 km

- 9.4 Above 600 km

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Major fuel cell powertrain manufacturers

- 11.1.1 Ballard Power

- 11.1.2 Bloom Energy

- 11.1.3 Bosch

- 11.1.4 Cummins

- 11.1.5 Honda Motor

- 11.1.6 Horizon Fuel Cell Technologies

- 11.1.7 Hyundai Motor

- 11.1.8 Intelligent Energy

- 11.1.9 ITM Power

- 11.1.10 Plug Power

- 11.1.11 SFC Energy

- 11.1.12 Toyota Motor

- 11.1.13 Weichai Power

- 11.1.14 General Motor

- 11.2 Component and technology suppliers

- 11.2.1 Aisin

- 11.2.2 Denso

- 11.2.3 Mahle

- 11.2.4 Mitsubishi Heavy

- 11.2.5 PowerCell

- 11.2.6 Schaeffler

- 11.2.7 Toshiba Energy

- 11.3 Emerging and innovative fuel cell companies

- 11.3.1 GenCell Energy

- 11.3.2 Hydrogenious

- 11.3.3 Hyster-Yale

- 11.3.4 Nikola

- 11.3.5 Nuvera Fuel