PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871078

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871078

Automotive Hydrogen Fuel Cell Stack Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

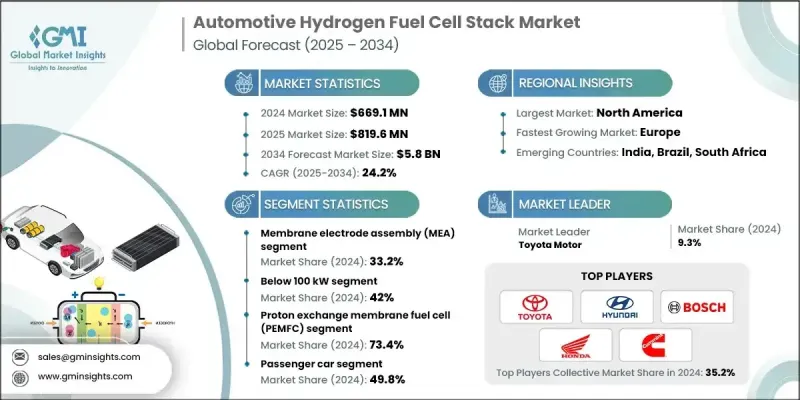

The Global Automotive Hydrogen Fuel Cell Stack Market was valued at USD 669.1 million in 2024 and is estimated to grow at a CAGR of 24.2% to reach USD 5.8 Billion by 2034.

Rising global awareness about environmental challenges such as air pollution and climate change is accelerating the transition toward zero-emission mobility. Hydrogen-powered vehicles emit only water vapor, positioning them as a clean and sustainable alternative to conventional combustion engines. The continuous evolution of fuel cell technology, driven by advances in materials science and engineering, has significantly improved the efficiency, performance, and lifespan of hydrogen fuel cells. These developments are enhancing their competitiveness with battery electric vehicles and broadening their use across automotive applications. Moreover, hydrogen's ability to be produced from multiple domestic sources reduces dependency on imported oil and contributes to energy diversification and security. Supportive government initiatives such as tax benefits, financial incentives, and research grants are further encouraging adoption by reducing manufacturing costs and promoting green transportation infrastructure. Such measures are helping accelerate the global shift toward sustainable mobility and cleaner energy ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $669.1 Million |

| Forecast Value | $5.8 Billion |

| CAGR | 24.2% |

The membrane electrode assembly (MEA) segment held a 33.2% share in 2024. Serving as the electrochemical core of a hydrogen fuel cell, the MEA is where hydrogen and oxygen combine to generate electricity. The segment reflects the ongoing technological progress in catalyst performance, membrane strength, and overall efficiency. Continued advancements in MEA development have led to reduced platinum dependency, better energy conversion, and enhanced durability, driving down production costs and extending the operational lifespan of hydrogen-powered vehicles across passenger and commercial categories.

The proton exchange membrane fuel cell (PEMFC) segment held a 73.4% share in 2024 and is expected to grow at a CAGR of 24% through 2034. PEMFCs are widely adopted in the automotive sector due to their compact size, low weight, and high power density, which make them ideal for vehicle integration where efficiency and space optimization are essential. Their low operating temperature and rapid start-up capabilities make them particularly suitable for diverse vehicle categories such as sedans, SUVs, and light commercial trucks. Continuous improvements in membrane durability and catalyst stability are further enhancing performance, enabling large-scale deployment of PEMFCs across global markets.

U.S. Automotive Hydrogen Fuel Cell Stack Market held 86.4% share in 2024. Government-backed initiatives are promoting domestic production and technological advancement in fuel cell stacks, with a focus on improving power density, cost-efficiency, and lifespan. Increasing public and private sector investment in hydrogen infrastructure, along with collaboration between automakers and component manufacturers, is advancing large-scale manufacturing and integration of hydrogen fuel cell systems for medium- and heavy-duty vehicles. The region's emphasis on clean energy and innovation continues to reinforce its leadership in hydrogen mobility solutions.

Key companies participating in the Global Automotive Hydrogen Fuel Cell Stack Market include Toyota Motor, PowerCell Sweden, Cummins, Honda Motor, Hyundai Motor, Ballard Power Systems, Symbio, Weichai Power, Robert Bosch, and EKPO Fuel Cell Technologies. Leading companies in the Automotive Hydrogen Fuel Cell Stack Market are enhancing their competitive edge through continuous research and innovation, focusing on developing high-efficiency, low-cost, and durable stack systems. Many firms are investing in next-generation materials to minimize platinum usage, boost power output, and extend fuel cell lifespan. Strategic collaborations between automakers and technology developers are accelerating large-scale production and integration of hydrogen fuel cells into commercial fleets. Companies are also prioritizing partnerships with governments to secure funding for infrastructure expansion and R&D.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Power output

- 2.2.3 Fuel cell technology

- 2.2.4 Vehicle

- 2.2.5 Sales channel

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators

- 3.2.4 OEM

- 3.2.5 End Use

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Government Incentives and Policies

- 3.3.1.2 Environmental Concerns

- 3.3.1.3 Technological Advancements

- 3.3.1.4 Energy Security and Diversification

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Production Costs

- 3.3.2.2 Limited Refueling Infrastructure

- 3.3.2.3 Hydrogen Production Challenges

- 3.3.2.4 Consumer Awareness and Perception

- 3.3.3 Market opportunities

- 3.3.3.1 Advancements in Fuel Cell Technology

- 3.3.3.2 Integration with Renewable Energy Sources

- 3.3.3.3 Expansion into Heavy-Duty Transport

- 3.3.3.4 Global Policy Support

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle east and Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technology

- 3.8.2 Emerging technology

- 3.9 Patent analysis

- 3.10 Price Trends Analysis

- 3.10.1 By product

- 3.10.2 By region

- 3.11 Cost Breakdown Analysis

- 3.12 Production statistics

- 3.12.1 Production hubs

- 3.12.2 Consumption hubs

- 3.12.3 Export and import

- 3.12.4 Tariffs and Trade Barriers

- 3.12.5 Supply Chain Resilience and Diversification

- 3.13 Sustainability and Environmental Aspects

- 3.13.1 Sustainable Practices

- 3.13.2 Waste Reduction Strategies

- 3.13.3 Energy Efficiency in Production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon Footprint Considerations

- 3.14 Supply Chain & Logistics

- 3.14.1 Hydrogen Supply Chain Infrastructure

- 3.14.2 Distribution Networks and Channels

- 3.14.3 Refueling Infrastructure Development

- 3.14.4 Cold Chain Management and Storage

- 3.14.5 Logistics Challenges and Solutions

- 3.14.6 Last-mile Delivery Considerations

- 3.15 Total Cost of Ownership (TCO) Analysis

- 3.15.1 Automotive Qualification & Testing Costs

- 3.15.2 Manufacturing & Deployment Expenses

- 3.15.3 Maintenance & Replacement Costs

- 3.15.4 TCO Comparison by Technology Type

- 3.16 Manufacturing Process & Quality Control Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Membrane electrode assembly (MEA)

- 5.3 Bipolar plates

- 5.4 Gaskets and seals

- 5.5 End plates & current collectors

- 5.6 Cooling plates

- 5.7 Manifolds & gas diffusion layers

Chapter 6 Market Estimates & Forecast, By Power output, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Below 100 kW

- 6.3 100-250 kW

- 6.4 Above 250 kW

Chapter 7 Market Estimates & Forecast, By Fuel Cell Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Proton exchange membrane fuel cell (PEMFC)

- 7.3 Solid oxide fuel cell (SOFC)

- 7.4 Alkaline fuel cell (AFC)

- 7.5 Molten carbonate fuel cell (MCFC)

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger Car

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUVs

- 8.3 Commercial Vehicle

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

- 8.4 Specialized Vehicles

- 8.4.1 Industrial vehicles

- 8.4.2 Military vehicles

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Netherlands

- 10.3.8 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 BMW

- 11.1.2 Robert Bosch

- 11.1.3 Daimler

- 11.1.4 General Motors (GM)

- 11.1.5 Honda Motor

- 11.1.6 Hyundai Mobis

- 11.1.7 Hyundai Motor

- 11.1.8 Stellantis

- 11.1.9 Toyota Motor

- 11.1.10 Volvo

- 11.2 Regional Champions

- 11.2.1 EKPO Fuel Cell Technologies

- 11.2.2 ElringKlinger

- 11.2.3 Nissan Motor

- 11.2.4 SAIC Motor

- 11.2.5 Schaeffler

- 11.2.6 Weichai Power

- 11.3 Emerging Players & Specialists

- 11.3.1 Ballard Power Systems

- 11.3.2 Doosan

- 11.3.3 Hyzon Motors

- 11.3.4 Nuvera

- 11.3.5 PowerCell

- 11.3.6 Symbio