PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871223

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871223

Piezoelectric Polymers for Energy Harvesting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

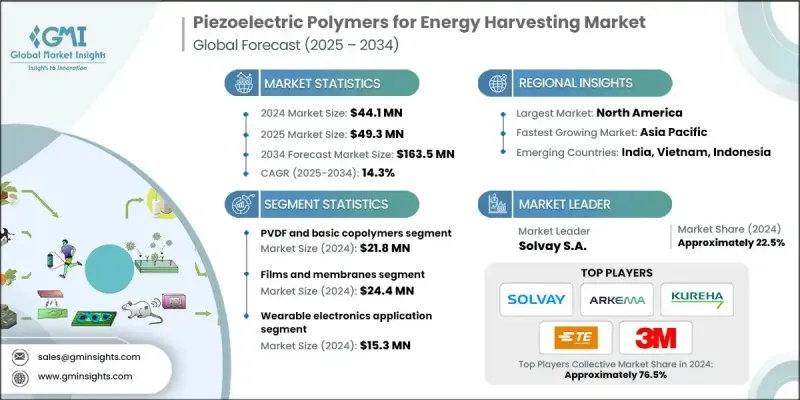

The Global Piezoelectric Polymers for Energy Harvesting Market was valued at USD 44.1 million in 2024 and is estimated to grow at a CAGR of 14.3% to reach USD 163.5 million by 2034.

The market's growth is driven by the expanding adoption of wearables and IoT devices, which require compact, lightweight, and flexible power sources. Piezoelectric polymers offer a sustainable solution for continuous energy generation, enabling sensors, health monitors, and connected devices to operate without frequent battery replacement. Rising demand is particularly evident in consumer electronics, healthcare monitoring, and fitness tracking applications. Enhanced performance of PVDF and PVDF-TrFE polymers has improved mechanical flexibility, durability, and energy conversion efficiency, allowing these materials to power next-generation energy-harvesting systems. Continuous research and material innovations are helping expand commercial adoption, enabling applications in both industrial and consumer electronics sectors. These polymers provide lightweight, versatile, and self-powered solutions that are increasingly preferred for flexible electronics and micro-energy harvesting devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.1 million |

| Forecast Value | $163.5 million |

| CAGR | 14.3% |

The PVDF and basic copolymers segment was valued at USD 21.8 million in 2024 and is expected to grow at a CAGR of 13.9% from 2025 to 2034. These polymers are favored for their reliable piezoelectric performance, adaptability, and ease of processing. They are widely applied in wearables, miniaturized sensors, and consumer electronics, providing efficient, self-sustaining energy solutions. Their cost-effectiveness and versatility support consistent adoption across industrial and consumer applications.

The films and membranes segment reached USD 24.4 million in 2024 and is projected to grow at a CAGR of 14.4% during 2025-2034. Films and membranes are the most used forms because of their flexibility, ease of manufacturing, and compatibility with wearable and electronic systems. They allow compact device designs, easy layering, and patterning to improve energy conversion efficiency. Their use is increasing in smart textiles and flexible electronics, enabling in-device energy generation from user movements.

North America Piezoelectric Polymers for Energy Harvesting Market held a 33.5% share in 2024. Demand in the region is growing as industries adopt self-powered sensing solutions across healthcare, industrial automation, and infrastructure applications. Smart infrastructure, military applications, and wearables are driving adoption in the U.S., supported by strong R&D and regulatory focus on energy efficiency. Investments in smart cities and national infrastructure projects are promoting the integration of polymer-based energy harvesters in sensors across roads, bridges, and urban environments. Manufacturers are enhancing polymer durability and efficiency to ensure long lifespans and reliable performance in harsh conditions, facilitating commercial-scale deployment.

Key players in the Piezoelectric Polymers for Energy Harvesting Market include 3M Company, Arkema Group, TE Connectivity, Kureha Corporation, Solvay S.A., and others. Companies in the Piezoelectric Polymers for Energy Harvesting Market are pursuing several strategies to strengthen their market position. They are investing heavily in R&D to improve energy conversion efficiency, mechanical durability, and material flexibility for next-generation energy harvesters. Partnerships with electronics and wearable device manufacturers help secure adoption in industrial and consumer applications. Firms are diversifying product lines to cater to miniaturized sensors, smart textiles, and flexible electronics. Scaling production capacity, optimizing supply chains, and enhancing cost-effectiveness are further enabling global market penetration.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Polymer Type

- 2.2.3 Form

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain complexity

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2021 - 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 PVDF and Basic Copolymers

- 5.2.1 Pure PVDF Films

- 5.2.2 PVDF-HFP Copolymers

- 5.2.3 Basic PVDF Composites

- 5.3 P(VDF-TrFE) Advanced Copolymers

- 5.3.1 P(VDF-TrFE) Thin Films

- 5.3.2 P(VDF-TrFE) Nanofibers

- 5.3.3 MEMS-Compatible P(VDF-TrFE)

- 5.4 Polymer-Ceramic Composites

- 5.4.1 PVDF-BaTiO3 Composites

- 5.4.2 PVDF-ZnO Nanocomposites

- 5.4.3 Multi-phase Ceramic-Polymer Systems

- 5.5 Specialty and Emerging Polymers

- 5.5.1 Bio-based Piezoelectric Polymers

- 5.5.2 Conductive Polymer Blends

- 5.5.3 Research-stage Novel Polymers

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Films and membranes

- 6.2.1 Thin films (<10 μm)

- 6.2.2 Standard films (10-100 μm)

- 6.2.3 Thick films (>100 μm)

- 6.3 Fibers and textiles

- 6.3.1 Electrospun nanofibers

- 6.3.2 Core-spun yarns

- 6.3.3 Woven piezoelectric fabrics

- 6.4 Bulk and composite structures

- 6.4.1 3D-printed structures

- 6.4.2 Molded components

- 6.4.3 Layered composite systems

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million, , Kilo Tons)

- 7.1 Key trends

- 7.2 Wearable electronics

- 7.2.1 Smart textiles and e-fabrics

- 7.2.2 Fitness trackers and health monitors

- 7.2.3 Smart watches and accessories

- 7.2.4 Electronic skin (e-skin) applications

- 7.3 IoT sensors and wireless networks

- 7.3.1 Environmental monitoring sensors

- 7.3.2 Industrial IoT sensors

- 7.3.3 Smart city infrastructure sensors

- 7.3.4 Agricultural and remote monitoring

- 7.4 Medical devices and implants

- 7.4.1 Implantable pacemaker systems

- 7.4.2 Biosensors and monitoring devices

- 7.4.3 Prosthetics and assistive devices

- 7.4.4 Drug delivery systems

- 7.5 Structural health monitoring

- 7.5.1 Bridge and infrastructure monitoring

- 7.5.2 Building structural monitoring

- 7.5.3 Pipeline and utility monitoring

- 7.6 Automotive applications

- 7.6.1 Tire pressure monitoring systems

- 7.6.2 Vehicle structural monitoring

- 7.6.3 In-cabin sensor networks

- 7.7 Aerospace and defense

- 7.7.1 Aircraft structural monitoring

- 7.7.2 Military sensor networks

- 7.7.3 Space applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Solvay S.A.

- 9.2 Arkema Group

- 9.3 3M Company

- 9.4 Kureha Corporation

- 9.5 Daikin Industries

- 9.6 Smart Material Corp

- 9.7 Measurement Specialties / TE Connectivity

- 9.8 PI Ceramic

- 9.9 Noliac A/S

- 9.10 CeramTec

- 9.11 Piezotech S.A.

- 9.12 USound GmbH

- 9.13 EnOcean GmbH

- 9.14 Energiot Ltd

- 9.15 Ionix Advanced Technologies

- 9.16 Johnson Matthey

- 9.17 Murata Manufacturing

- 9.18 Morgan Advanced Materials

- 9.19 Honeywell International

- 9.20 Others (Harri, etc.)

- 9.21 Matregenix

- 9.22 APC International

- 9.23 Physik Instrumente

- 9.24 Cedrat Technologies

- 9.25 Perpetuum