PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871228

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871228

Redox Flow Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

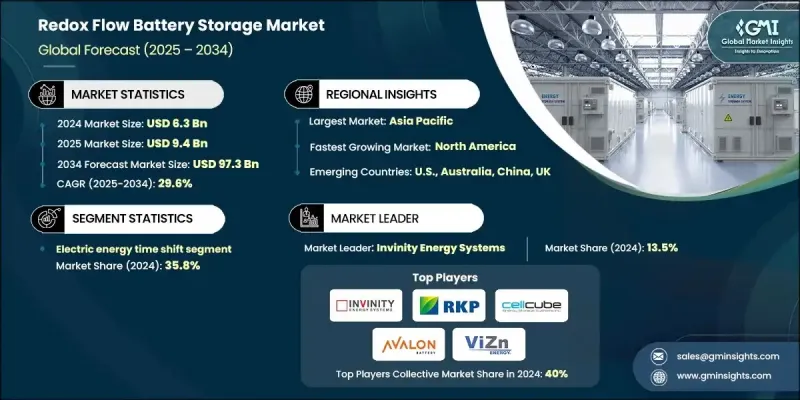

The Global Redox Flow Battery Storage Market was valued at USD 6.3 Billion in 2024 and is estimated to grow at a CAGR of 29.6% to reach USD 97.3 Billion by 2034.

The sharp growth is fueled by the accelerating deployment of renewable energy sources such as wind and solar, which inherently require stable and efficient long-duration storage systems. Redox flow batteries (RFBs) are increasingly gaining preference due to their ability to discharge over extended periods, typically between 4 and 24 hours. This makes them well-suited for managing the fluctuations in renewable generation and for enhancing grid reliability. In addition to enabling effective time-shifting of excess power, RFBs support critical functions like frequency control and load balancing. Global utilities and governments are ramping up investments in advanced storage technologies as part of broader efforts to modernize energy infrastructure and support clean energy transitions. The scalability, safety, and recyclability of RFB systems also contribute to their growing adoption, particularly in regions aiming for sustainable, fire-safe energy storage solutions in both urban and rural settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $97.3 Billion |

| CAGR | 29.6% |

A defining advantage of redox flow batteries is their modular design, which separates power output from energy storage capacity, enabling flexible scaling for diverse applications. This unique trait positions RFBs as the go-to option for multi-hour energy storage uses, including grid support and renewable integration. With growing demand for 8 to 12-hour discharge systems, these batteries are being prioritized in energy portfolios seeking stability and cost-efficiency. Their chemical composition is inherently non-flammable, eliminating risks associated with thermal events, which makes them a safe choice for community-level or critical infrastructure storage. This, combined with recyclable electrolyte solutions, aligns RFBs with the push for sustainable energy solutions across global markets.

The electric energy time shift segment held 35.8% share in 2024, and is forecasted to grow at a CAGR of 29.7% through 2034. RFBs perform exceptionally in these applications by charging during periods of low electricity demand and discharging when consumption spikes. This enables utilities to better manage peak loads while taking advantage of variable pricing models. Their extended discharge duration and high cycling capabilities make them ideal for reshaping energy use patterns, particularly in power systems heavily reliant on solar or wind.

U.S. Redox Flow Battery Storage Market will reach USD 14.5 Billion by 2034. Its expansion is underpinned by federal policies supporting clean energy adoption, energy security, and domestic manufacturing of battery systems. Encouragement from innovation-focused programs is helping local manufacturers and startups bring new chemistries and solutions to market. With the U.S. energy grid increasingly affected by climate-related stressors, utilities and state governments are actively pursuing fire-safe, long-duration storage technologies. RFBs, with their modular architecture and deep cycle capabilities, are being deployed for everything from renewable storage to critical infrastructure resilience.

Leading participants shaping the Global Redox Flow Battery Storage Market include ESS, Avalon Battery, Rongke Power, Voltstorage, Sumitomo Electric, Elestor, Invinity Energy Systems, CellCube Energy Storage Systems, Everflow, Primus Power, Largo, ViZn Energy Systems, and VRB Energy. Companies in the redox flow battery storage market are actively investing in advanced chemistries, such as vanadium-based or hybrid electrolytes, to enhance system efficiency and extend battery life. Strategic collaborations with energy providers, governments, and research institutes are enabling faster commercialization and deployment across global energy grids. Many players are scaling up their production capacities to meet increasing demand for long-duration energy storage, while others are customizing systems for niche applications like microgrids, remote electrification, and industrial backup.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Critical materials supply chain mapping

- 3.1.2 Manufacturing equipment and process requirements

- 3.1.3 Quality control and testing infrastructure

- 3.1.4 Supply chain integration opportunities

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Price trend analysis (USD/MW)

- 3.7.1 By region

- 3.8 Investment and funding landscape analysis

- 3.9 Emerging technology trends and developments

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Electric energy time shift

- 5.3 Frequency regulation

- 5.4 Renewable integration

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Avalon Battery

- 7.2 CellCube Energy Storage Systems

- 7.3 Elestor

- 7.4 ESS

- 7.5 Everflow

- 7.6 Invinity Energy Systems

- 7.7 Largo

- 7.8 Primus Power

- 7.9 Rongke Power

- 7.10 Sumitomo Electric

- 7.11 ViZn Energy Systems

- 7.12 Voltstorage

- 7.13 VRB Energy