PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871229

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871229

Casing Centralizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

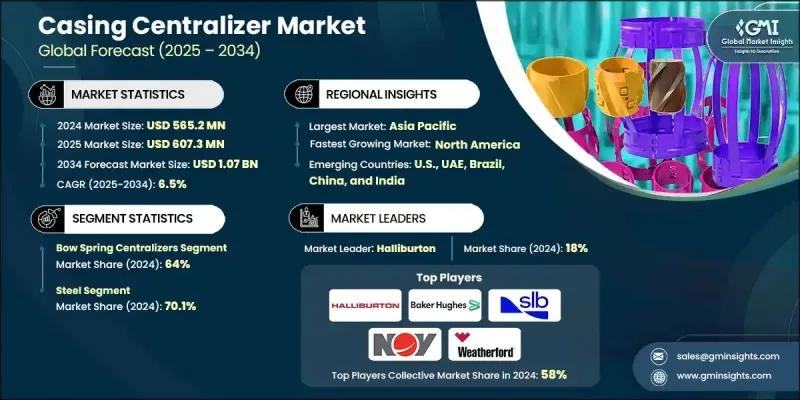

The Global Casing Centralizer Market was valued at USD 565.2 million in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 1.07 Billion by 2034.

Growing energy security demands are fueling large-scale investments across the oil and gas sector, while the rising need for advanced drilling components continues to strengthen the market outlook. The increasing focus on unconventional resource extraction through shale and horizontal drilling projects is significantly boosting the adoption of precision-engineered casing centralization tools, which are critical for maintaining wellbore integrity. Technological progress is enabling next-generation centralizers with improved design and performance to meet operational demands in challenging geological settings. The deployment of these solutions is becoming essential for enhancing well performance, reducing non-productive time, and ensuring consistent drilling results. Operators are reimagining construction and completion strategies, focusing on cost efficiency and better drilling outcomes. The demand for high-performance tools in critical well environments is shaping industry trends, supported by integrated service models that deliver both immediate operational benefits and long-term well health. These trends reflect a strong shift toward optimized workflows and smarter drilling practices, which are crucial for increasing asset value and ensuring well longevity in dynamic field conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $565.2 Million |

| Forecast Value | $1.07 billion |

| CAGR | 6.5% |

The rigid centralizers segment is forecasted to grow at a CAGR of 6% between 2025 and 2034. Their strong support and superior stability in horizontal and deviated well paths make them a preferred option for high-load applications. Built using materials such as aluminum and cast steel, these centralizers feature either straight or spiral vanes that provide full circumferential coverage, along with beveled edges that help reduce friction during casing runs. Continued innovation in structural design and durability, aimed at maintaining optimal standoff and reducing operational drag, will drive adoption across complex well environments where reliable performance is non-negotiable.

The steel centralizers segment is expected to register a CAGR of 6% through 2034. These units offer a cost-efficient solution for traditional drilling operations, delivering robust mechanical strength at a lower price point. Enhanced with surface coatings and corrosion-resistant treatments, steel centralizers now offer longer service life and improved resilience in corrosive environments. Their ability to meet the needs of large-scale projects while maintaining structural integrity under pressure makes them a dependable choice across numerous drilling applications.

U.S. Casing Centralizer Market held an 82% share in 2024, contributing USD 463.3 million. The country's casing centralizer market continues to thrive on the back of extensive oil and gas exploration, particularly in unconventional fields. Precision casing placement remains vital for well integrity, especially in complex drilling programs. As the industry embraces advanced materials and designs, including adjustable centralizers and polymer-based configurations, operational accuracy and cementing effectiveness are improving across various drilling campaigns. Evolving standards and techniques further support the adoption of innovative solutions that enhance efficiency and consistency in well construction.

Prominent industry players influencing the Global Casing Centralizer Market include JC Petro, Summit Casing, Crimson Oil Tools, Shaanxi United Mechanical Co., Ltd., Amroc Bremse Oil Tools Pvt. Ltd., SLB, NOV, Maxwell Oil Tools GmbH, Weatherford, Lake Petro, NeOz Energy, Ferro-Tube Oil Tools Co., L.P., Equip Outlet Inc., Avantgarde Oil Services Limited, Oilmec Middleast, Centek, Halliburton, Baker Hughes, Drilling Tools International, and Kwikzip. To establish a strong foothold in the Casing Centralizer Market, companies are implementing several key strategies. Many are focusing on innovation in material science and product design to improve durability and reduce operational costs. Strategic collaborations with drilling contractors and oilfield service providers are enhancing product deployment and customer reach. Companies are also expanding their manufacturing capacities and regional presence to cater to high-growth markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product type trends

- 2.4 Material trends

- 2.5 Application trends

- 2.6 Drilling type trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of casing centralizer

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Key innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Bow spring centralizers

- 5.3 Rigid centralizers

- 5.4 Semi-Rigid centralizers

- 5.5 Others

Chapter 6 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Aluminum

- 6.4 Composite/Polymer

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Onshore

- 7.3 Offshore

- 7.4 Others

Chapter 8 Market Size and Forecast, By Drilling Type, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Unconventional

- 8.3 Conventional

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Norway

- 9.3.3 Netherlands

- 9.3.4 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Indonesia

- 9.4.4 Australia

- 9.4.5 Thailand

- 9.4.6 Malaysia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.5.4 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Mexico

Chapter 10 Company Profiles

- 10.1 Amroc Bremse Oil Tools Pvt. Ltd.

- 10.2 Avantgarde Oil Services Limited

- 10.3 Baker Hughes

- 10.4 Centek

- 10.5 Crimson Oil Tools

- 10.6 Drilling Tools International

- 10.7 Equip Outlet Inc.

- 10.8 Ferro-Tube Oil Tools Co, L.P.

- 10.9 Halliburton

- 10.10 JC Petro

- 10.11 Kwikzip

- 10.12 Lake Petro

- 10.13 Maxwell Oil Tools GmbH

- 10.14 NeOz Energy

- 10.15 NOV

- 10.16 Oilmec Middle East

- 10.17 Shaanxi United Mechanical Co., Ltd.

- 10.18 SLB

- 10.19 Summit Casing

- 10.20 Weatherford