PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871239

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871239

Automotive Stamping Press Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

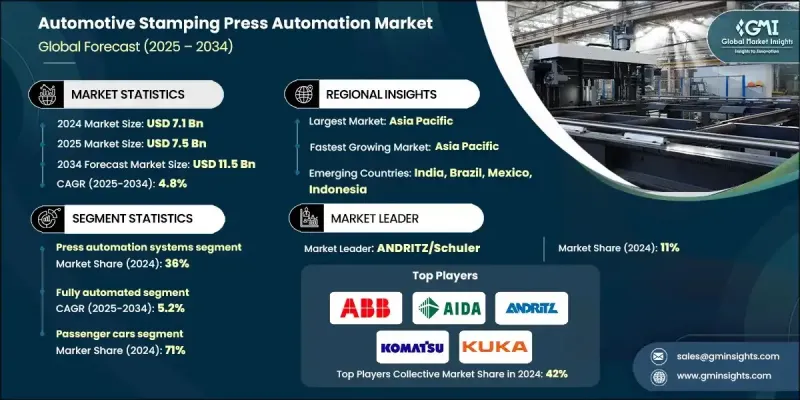

The Global Automotive Stamping Press Automation Market was valued at USD 7.1 Billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 11.5 Billion by 2034.

The market holds a crucial role in automotive manufacturing, as it focuses on the automated forming, shaping, and assembly of metal vehicle components. The growing use of robotics, CNC machinery, and automated control systems is enhancing production precision, speed, and repeatability across vehicle manufacturing processes. The rapid expansion of the electric vehicle segment is also reshaping stamping automation, as EV production requires lightweight and complex structural parts. Manufacturers are increasingly investing in advanced automation to support the processing of high-strength steel, aluminum, and composite materials. The integration of Industry 4.0 technologies including IoT, smart sensors, and predictive maintenance has further transformed the sector. These innovations optimize production efficiency by enabling real-time monitoring, automated quality checks, and predictive equipment maintenance. This integration reduces downtime, improves energy efficiency, and ensures high throughput and accuracy in automotive component production. With automation increasingly essential to maintain global competitiveness, demand for advanced stamping systems continues to rise across passenger, commercial, and electric vehicle manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 4.8% |

The press automation systems segment accounted for a 36% share in 2024. This segment is primarily driven by the adoption of servo-driven press technology, which offers superior accuracy, flexibility, and energy efficiency compared to traditional hydraulic presses. Servo presses enable operators to fine-tune forming parameters in real time, reduce material waste, and efficiently process diverse materials such as aluminum alloys and high-strength steel. Their growing use in the production of electric vehicle components underscores their value in precision manufacturing environments.

The fully automated segment is expected to grow at a CAGR of 5.2% from 2025 to 2034. This category integrates high-speed presses, robotic handling systems, and intelligent process control solutions that enable continuous, uninterrupted production. By minimizing manual intervention, these systems enhance throughput, product consistency, and operational safety while reducing cycle times and production costs. Fully automated stamping lines are now central to achieving lean manufacturing objectives and maintaining uniform quality standards across large-scale automotive production facilities.

United States Automotive Stamping Press Automation Market generated USD 1.09 Billion in 2024. Growth in the U.S. market is being driven by a renewed focus on domestic manufacturing and the adoption of advanced automation technologies. Automotive producers are increasingly investing in next-generation stamping systems to improve flexibility, productivity, and quality across both passenger and commercial vehicle production. The reshoring of manufacturing operations and the focus on supply chain resilience continue to strengthen demand for automated solutions in the region.

Key companies operating in the Global Automotive Stamping Press Automation Market include ABB, Komatsu Industries, KUKA, FANUC, AIDA Engineering, AMADA, SEYI Machinery, Bihler of America, ANDRITZ/Schuler, and Universal Robots. To reinforce their position, leading players in the automotive stamping press automation industry are adopting strategies centered on technological innovation, partnerships, and capacity expansion. Companies are developing intelligent servo-driven systems that integrate AI and IoT for predictive maintenance, improved energy control, and enhanced process optimization. Strategic alliances with automakers and robotics firms are helping expand automation solutions across production facilities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Automation Level

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of EVs and lightweight materials

- 3.2.1.2 Integration of Industry 4.0 and smart factory technologies

- 3.2.1.3 Rising vehicle production in emerging markets

- 3.2.1.4 Demand for high-quality, consistent metal components

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment for advanced automation

- 3.2.2.2 Complexity in integrating multi-material stamping processes

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of EV and lightweight vehicle programs

- 3.2.3.2 Adoption of AI-driven predictive maintenance and process optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability & environmental aspects

- 3.11.1 Carbon Footprint Assessment

- 3.11.2 Circular Economy Integration

- 3.11.3 E-Waste Management Requirements

- 3.11.4 Green Manufacturing Initiatives

- 3.12 Use cases and applications

- 3.13 Best-case scenario

- 3.14 Investment landscape

- 3.14.1 Capital expenditure trends in stamping automation

- 3.14.2 Private equity and venture funding activity

- 3.14.3 Mergers, acquisitions, and strategic partnerships

- 3.14.4 Return on investment and payback period analysis

- 3.15 Market adoption trends

- 3.15.1 Rate of automation adoption across vehicle types

- 3.15.2 Adoption by automation level: semi-automated vs fully automated

- 3.15.3 Integration of IoT and AI technologies

- 3.15.4 Adoption barriers and enablers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Press Automation systems

- 5.3 Robotic Material Handling

- 5.4 Process Control & Monitoring

- 5.5 Integration & services

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Semi-Automated

- 6.3 Fully Automated

- 6.4 Smart/Connected

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial Vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Body-in-White (BIW)

- 8.3 Powertrain

- 8.4 Safety/Structural

- 8.5 Other

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 ABB

- 10.1.2 AIDA Engineering

- 10.1.3 AMADA

- 10.1.4 ANDRITZ/Schuler

- 10.1.5 Bihler of America

- 10.1.6 FANUC

- 10.1.7 Komatsu Industries

- 10.1.8 KUKA

- 10.1.9 SEYI Machinery

- 10.1.10 Universal Robots

- 10.2 Regional Players

- 10.2.1 Acro Metal Stamping

- 10.2.2 American Axle & Manufacturing

- 10.2.3 ArtiFlex Manufacturing

- 10.2.4 Challenge Manufacturing

- 10.3 Emerging Players / Disruptors

- 10.3.1 AmeriStar

- 10.3.2 Arcade Metal Stamping

- 10.3.3 Automation Tool & Die (ATD)

- 10.3.4 Eagle Press & Equipment