PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937432

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937432

Automotive Metal Stamping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

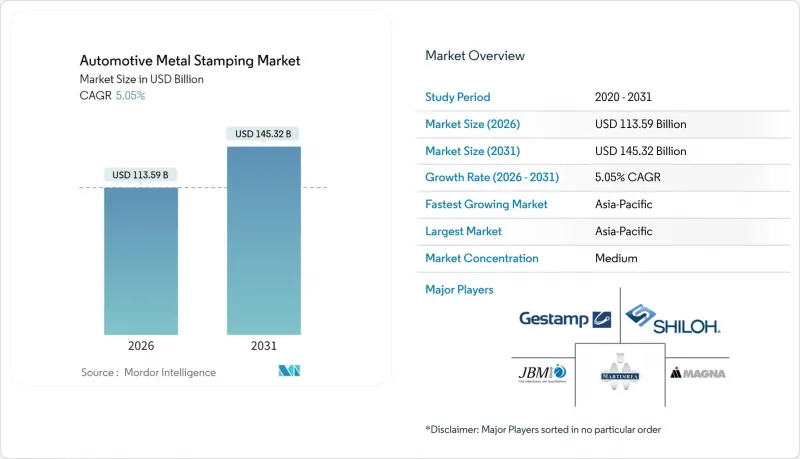

The Automotive Metal Stamping Market was valued at USD 108.13 billion in 2025 and estimated to grow from USD 113.59 billion in 2026 to reach USD 145.32 billion by 2031, at a CAGR of 5.05% during the forecast period (2026-2031).

Rising vehicle electrification, lightweighting mandates, and a steady rebound in global automobile output keep the automotive metal stamping market resilient across passenger and commercial vehicle programs. Stamped parts underpin every modern body structure, battery enclosure, and chassis module, making the technology indispensable as OEMs juggle internal-combustion, hybrid, and battery-electric architectures. Material migration toward aluminum and advanced high-strength steel (AHSS) continues, but steel dominates in cost and supply-chain familiarity, allowing stampers to scale volumes quickly whenever production rebounds. Simultaneously, hot-stamping and servo-press upgrades let suppliers achieve thinner gauges and higher strengths without sacrificing dimensional integrity. Integrated digital twins, inline vision systems, and closed-loop controls are moving from pilot lines to mainstream operations as automakers demand zero-defect delivery and traceability to support over-the-air vehicle software updates.

Global Automotive Metal Stamping Market Trends and Insights

Increasing Automobile Production Rebound (Post-2025)

Global vehicle assemblies are climbing pre-pandemic peaks, prompting stampers to reopen idled presses and accelerate tool builds. Hyundai Steel's planned Louisiana complex will deliver numerous automotive steel annually from 2029, cutting carbon intensity by three-fifths via electric-arc routes and positioning regional lines for higher electric-vehicle (EV) output . Capacity expansions illustrate how the automotive metal stamping market aligns capital spending with renewed OEM model launches. Suppliers can juggle AHSS, conventional grades, and aluminum blanks on the same servo press and win incremental orders as platforms diversify. Their flexibility shortens new-model lead times when OEMs request pilot lots for software-defined vehicles in smaller, more frequent batches.

Lightweighting Push for Better Fuel Economy & EV Range

Each kilogram removed from a vehicle lifts fleet fuel economy targets and lengthens EV range, so stampers now trial AHSS families that exceed 1.2 GPa while remaining cold-formable. ArcelorMittal and KIRCHHOFF Automotive validated Fortiform grades that surpass dual-phase steel bending metrics, enabling thinner gauges without extra draw-bead complexity . Down-gauged lids, closures, and reinforcement brackets created through such grades keep the automotive metal stamping market on course to supply lighter yet stronger parts. The transition forces shops to buy higher-tonnage servo presses and tailor-welded-blank lasers that marry dissimilar thicknesses inside one panel. Aluminum uptake runs parallel, so tier-ones must balance furnace lines for heat-treatable 6xxx alloys alongside pickling and galvanizing for AHSS sheets.

Volatile Steel & Aluminum Prices

Raw material swings can erase thin margins because metal outlays exceed three-fifths of stamping cost. Tariff hikes on aluminum billet-US proposals indicate rates climbing exponentially-would ripple across blank suppliers and push tier-ones to renegotiate annual price clauses. Larger players hedge on commodity exchanges or lock multi-year offtake with mills, cushioning volatility. Smaller shops within the automotive metal stamping market face working-capital strain, prompting joint-procurement pools or consortia to gain leverage.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Recovery of Chinese & Indian Auto Supply Chains

- OEM Adoption of Mega-Stamp Body Structures

- Shortage of Skilled Tool-and-Die Makers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Blanking captured 26.64% of 2025 revenue, underscoring its integral role in cutting sheet stock to net-shape blanks before downstream forming. This share illustrates how the automotive metal stamping market size still relies on high-speed mechanical presses for flat-pattern preparation. Continuous coil lines with inline surface inspection uphold the dimensional accuracy needed for outer panels. Embossing, although smaller, is registering the fastest 5.11% CAGR as design studios request textures that remove secondary decorative steps.

OEM requests for NVH damping ribs and stiffening beads lift embossing line orders. High-tonnage presses with programmable slide motions create deep patterns without thinning the base metal, meeting crashworthiness standards. As structures evolve toward fewer parts, embossing raises local stiffness, allowing gauge reduction. Consequently, capital outlays in servo-driven presses ensure suppliers can toggle among blanking, coining, and light embossing, expanding service menus while retaining core blanking volumes. This approach keeps the automotive metal stamping market diversified but resilient.

Sheet-metal forming contributed 42.62% of 2025 turnover, proving that traditional progressive dies still anchor the automotive metal stamping market share for high-volume inner panels and sub-assemblies. Automated coil feeds and quick-die-change carts maximize uptime, letting suppliers meet compressed model cycles. Hot-stamping trails in revenue but shows the strongest 5.17% CAGR, driven by EV crash-rail applications that require martensitic strengths near 1.5 GPa.

New furnaces with multi-zone quench control help prevent hydrogen embrittlement, and robotic vacuum transfer limits scale build-up. Tier-ones offering conventional and hot-stamping win platform bundles from OEM purchasing teams looking to rationalize supplier counts. Progressive-die and transfer-die systems remain essential for brackets and reinforcement plates. Still, servo-press retrofits lift, forming limits on AHSS sheets and illustrating the incremental technology migration sustaining the automotive metal stamping market.

The Automotive Metal Stamping Market Report is Segmented by Technology (Blanking, Embossing, and More), Process (Roll Forming, Hot Stamping, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Material (Steel and More), Application (Body Panels, Transmission & Structural Components, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 37.89% of global revenue in 2025 and is growing at a robust CAGR of 5.13% through 2031, aided by China's restart of assembly lines and India's policy-backed localization drives. Clusters around Shanghai, Guangzhou, Pune, and Chennai attract servo-press installations, enabling output of AHSS roof rails and hot-stamped side-sills for domestic EV models. Government incentives for new-energy vehicles ensure sustained tool-shop backlogs through the decade-end, bolstering the region's automotive metal stamping market presence.

North America maintains technology leadership through investments in smart-factory upgrades and near-shoring by Korean and Japanese steel majors. Hyundai Steel's Louisiana plant will supply coil stock for southern assembly corridors, shortening logistics and lowering embodied carbon in stamped parts. U.S. and Mexican tier-ones adopt cloud-MES platforms to synchronize press uptime with OEM production sequencing, capturing penalty-avoidance bonuses while elevating service levels within the automotive metal stamping market.

Europe sustains an innovation edge despite high labor costs. Projects like thyssenkrupp Materials Processing Europe's Stuttgart upgrade link IoT sensors to AI-driven process control, slashing scrap and raising predictive maintenance accuracy. Lightweighting directives under EU fleet targets channel R&D toward multi-material joining, reinforcing supplier know-how. South America, the Middle East, and Africa remain smaller contributors. Still, rising CKD assembly hubs usher in greenfield presses, particularly for pickup trucks and compact SUVs, setting the stage for future gains.

- Magna International

- Gestamp Automocion

- Shiloh Industries

- Martinrea International

- JBM Group

- Aisin Seiki

- G-TEKT

- Tower International

- D&H Industries

- PDQ Tool & Stamping

- Alcoa

- American Industrial Company

- Manor Tool & Manufacturing

- Tempco Manufacturing

- Wisconsin Metal Parts

- Lindy Manufacturing

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Automobile Production Rebound

- 4.2.2 Lightweighting Push For Better Fuel Economy & EV Range

- 4.2.3 Growth Of Hot-Stamped Battery Enclosures In EVs

- 4.2.4 Rapid Recovery Of Chinese & Indian Auto Supply Chains

- 4.2.5 OEM Adoption Of Mega-Stamp Body Structures

- 4.2.6 Closed-Loop Digital Twins Enabling Zero-Defect Stamping

- 4.3 Market Restraints

- 4.3.1 Volatile Steel & Aluminum Prices

- 4.3.2 Shortage Of Skilled Tool-And-Die Makers

- 4.3.3 High Cap-Ex For Servo & Hydraulic Presses

- 4.3.4 Regional Metal Supply Disruptions

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Technology

- 5.1.1 Blanking

- 5.1.2 Embossing

- 5.1.3 Coining

- 5.1.4 Flanging

- 5.1.5 Bending

- 5.1.6 Deep Drawing

- 5.1.7 Others

- 5.2 By Process

- 5.2.1 Roll Forming

- 5.2.2 Hot Stamping

- 5.2.3 Sheet-Metal Forming

- 5.2.4 Progressive-Die Stamping

- 5.2.5 Transfer-Die Stamping

- 5.2.6 Metal Fabrication

- 5.2.7 Others

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By Material

- 5.4.1 Steel

- 5.4.2 Aluminum

- 5.4.3 Others

- 5.5 By Application

- 5.5.1 Body Panels

- 5.5.2 Transmission and Structural Components

- 5.5.3 Exhaust Components

- 5.5.4 Chassis and Suspension Parts

- 5.5.5 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle-East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Egypt

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle-East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Magna International

- 6.4.2 Gestamp Automocion

- 6.4.3 Shiloh Industries

- 6.4.4 Martinrea International

- 6.4.5 JBM Group

- 6.4.6 Aisin Seiki

- 6.4.7 G-TEKT

- 6.4.8 Tower International

- 6.4.9 D&H Industries

- 6.4.10 PDQ Tool & Stamping

- 6.4.11 Alcoa

- 6.4.12 American Industrial Company

- 6.4.13 Manor Tool & Manufacturing

- 6.4.14 Tempco Manufacturing

- 6.4.15 Wisconsin Metal Parts

- 6.4.16 Lindy Manufacturing

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment