PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871303

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871303

Point of Care Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

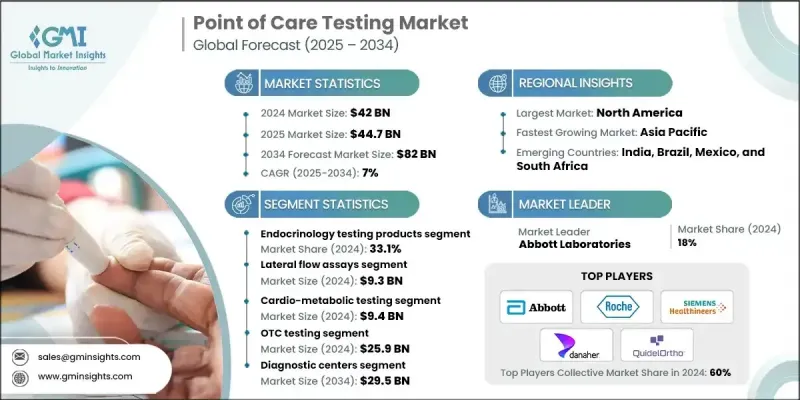

The Global Point of Care Testing Market was valued at USD 42 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 82 billion by 2034.

The market's expansion is driven by increasing disease prevalence in developing nations, the growing number of diagnostic laboratories equipped with advanced testing technologies, and significant investments in research and development. Rising demand for rapid, accurate diagnostics in emergency care and remote locations is pushing governments and healthcare organizations to adopt innovative POC testing solutions. Point-of-care testing enables clinicians to obtain fast, lab-grade results directly at the patient's location, facilitating quick medical decisions and reducing dependence on central labs. Devices use advanced technologies such as microfluidic platforms, immunoassays, and lateral flow assays to analyze blood, urine, or saliva, often providing results within minutes. Modern devices often integrate with mobile apps or electronic health records, improving accessibility in rural and underserved areas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42 Billion |

| Forecast Value | $82 Billion |

| CAGR | 7% |

The endocrinology testing products segment held a substantial share of 33.1% in 2024. This segment is growing steadily due to the increasing prevalence of endocrine disorders, including diabetes and thyroid-related conditions, which demand rapid and accurate diagnostics. Advances in biosensors, immunoassays, and microfluidic technology have improved test efficiency and accuracy. Devices like glucose meters and HbA1c analyzers are evolving into smart tools connected to mobile apps for remote monitoring and telehealth applications.

The lateral flow assays segment was valued at USD 9.3 billion in 2024. LFAs are paper-based diagnostic devices that detect target substances in liquid samples using antibodies. They are widely used due to their simplicity, speed, and ease of use. Rising incidences of infectious diseases have accelerated the demand for LFAs, which allow healthcare providers to quickly screen, diagnose, and respond to patients, supporting faster treatment decisions and better outcomes.

U.S. Point of Care Testing Market was valued at USD 12.5 billion in 2024. Growth is being driven by increasing disease prevalence, particularly diabetes, and the rising adoption of fast, technology-enabled diagnostic solutions. The U.S. healthcare sector's focus on innovation and accessibility has positioned it as a leading market for point-of-care testing technologies.

Key players in the Global Point of Care Testing Market include Meridian Bioscience, Abbott Laboratories, Bio-Rad Laboratories, LifeScan IP Holdings, LLC, Acon Laboratories, Becton, Dickinson, and Company, Danaher Corporation, BioMerieux SA, Dexcom, Inc., QuidelOrtho Corporation, Dragerwerk AG & Co. KGaA, F. Hoffmann-La Roche Ltd., Medtronic Plc, Nova Biomedical, Siemens Healthineers AG, and Sysmex Corporation. Companies in the Point of Care Testing Market are leveraging multiple strategies to strengthen their market presence. They are heavily investing in R&D to develop faster, more accurate, and connected diagnostic devices. Strategic collaborations, partnerships, and acquisitions allow firms to expand product portfolios and enter new regional markets. Many are focusing on technological innovation, integrating AI, connectivity, and digital health platforms into devices to improve data management and telemedicine capabilities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Products trends

- 2.2.3 Technology trends

- 2.2.4 Prescription trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Upward trend in disease prevalence among developing countries

- 3.2.1.2 Surging number of pathology labs and services equipped with advanced diagnostic equipment

- 3.2.1.3 Technological advancements in point of care tests

- 3.2.1.4 Increasing research and development investment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of product development

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand in remote and rural areas

- 3.2.3.2 Integration with digital health platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Asia Pacific

- 3.4.3 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Endocrinology testing products

- 5.2.1 Glucose monitoring

- 5.2.1.1 Strips

- 5.2.1.2 Meters

- 5.2.1.3 Lancets

- 5.2.2 Cholesterol testing products

- 5.2.3 Pregnancy testing products

- 5.2.4 Fertility testing products

- 5.2.5 Thyroid function tests

- 5.2.1 Glucose monitoring

- 5.3 Cardiometabolic testing products

- 5.3.1 Cardiac marker testing products

- 5.3.1.1 hsTnI (High-Sensitivity Troponin I)

- 5.3.1.2 BNP (B-Type Natriuretic Peptide)

- 5.3.1.3 D-dimer

- 5.3.1.4 CK-MB (Creatine Kinase-MB)

- 5.3.1.5 Myoglobin

- 5.3.1.6 Other Cardiac Marker Testing

- 5.3.2 Blood gas (Lung function)

- 5.3.3 Metabolite testing products

- 5.3.3.1 Electrolytes testing

- 5.3.3.2 Liver function

- 5.3.3.2.1 Bilirubin

- 5.3.3.2.2 Alanine transaminase (ALT)

- 5.3.3.3 Kidney function

- 5.3.3.3.1 Creatinine

- 5.3.3.3.2 Urea

- 5.3.3.3.3 Uric Acid

- 5.3.4 HBA1C testing products

- 5.3.1 Cardiac marker testing products

- 5.4 Infectious disease testing products

- 5.4.1 Influenza testing products

- 5.4.2 HIV testing products

- 5.4.3 Hepatitis C testing products

- 5.4.4 Sexually transmitted disease (STD) testing products

- 5.4.5 Healthcare-associated infection (HAI) testing products

- 5.4.6 Respiratory infection testing products

- 5.4.7 Tropical disease testing products

- 5.4.8 Other infectious disease testing products

- 5.5 Coagulation testing products

- 5.5.1 PT/INR testing products

- 5.5.2 Activated clotting time (ACT/APTT) testing products

- 5.6 Tumor/cancer marker testing products

- 5.7 Urinalysis testing products

- 5.8 Hematology testing products

- 5.9 Drug-of-abuse (DoA) testing products

- 5.10 Fecal occult testing products

- 5.11 Other products

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Lateral flow assays

- 6.3 Dipsticks

- 6.4 Microfluidics

- 6.5 Molecular diagnostics

- 6.6 Immunoassays

- 6.7 Agglutination assays

- 6.8 Flow-through

- 6.9 Solid phase

- 6.10 Biosensors

- 6.10.1 Electrochemical

- 6.10.2 Optical

- 6.10.3 Thermal

- 6.10.4 Mass-sensitive

- 6.10.5 Other biosensors

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Cardio metabolic testing

- 7.3 Infectious disease testing

- 7.4 Nephrology testing

- 7.5 Drug-of-abuse (DoA) testing

- 7.6 Blood glucose testing

- 7.7 Pregnancy testing

- 7.8 Cancer biomarker testing

- 7.9 Other applications

Chapter 8 Market Estimates and Forecast, By Prescription, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 OTC testing

- 8.3 Prescription-based testing

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Research laboratories

- 9.5 Home-care settings

- 9.6 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 1.1.1 U.S.

- 1.1.2 Canada

- 10.3 Europe

- 1.1.3 Germany

- 1.1.4 UK

- 1.1.5 France

- 1.1.6 Spain

- 1.1.7 Italy

- 1.1.8 Netherlands

- 10.4 Asia Pacific

- 1.1.9 China

- 1.1.10 Japan

- 1.1.11 India

- 1.1.12 Australia

- 1.1.13 South Korea

- 10.5 Latin America

- 1.1.14 Brazil

- 1.1.15 Mexico

- 1.1.16 Argentina

- 10.6 Middle East and Africa

- 1.1.17 South Africa

- 1.1.18 Saudi Arabia

- 1.1.19 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Laboratories

- 11.2 Acon Laboratories

- 11.3 Becton, Dickinson, and Company

- 11.4 BioMerieux SA

- 11.5 Bio-Rad Laboratories, Inc.

- 11.6 Danaher Corporation

- 11.7 Dexcom, Inc

- 11.8 Dragerwerk AG & Co. KGaA

- 11.9 F. Hoffmann-La Roche Ltd.

- 11.10 LifeScan IP Holdings, LLC

- 11.11 Medtronic Plc

- 11.12 Meridian Bioscience, Inc.

- 11.13 Nova Biomedical

- 11.14 QuidelOrtho Corporation

- 11.15 Siemens Healthineers AG

- 11.16 Sysmex Corporation