PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876533

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876533

Automotive Laser Welding System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

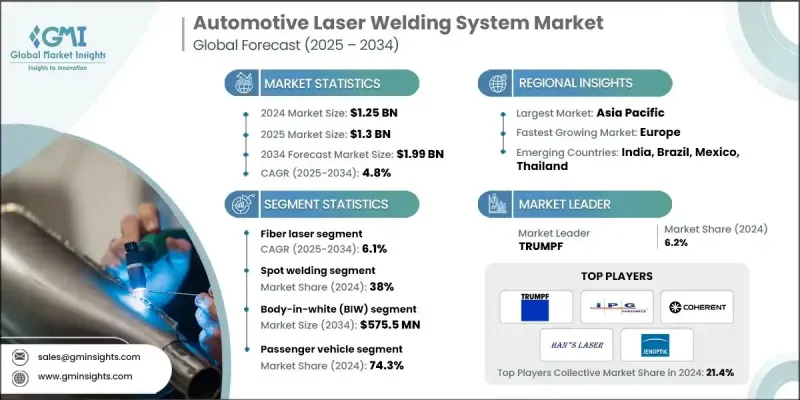

The Global Automotive Laser Welding System Market was valued at USD 1.25 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 1.99 billion by 2034.

The steady expansion of the automotive sector, driven by rising vehicle production and growing demand in developing economies, is creating strong opportunities for advanced manufacturing solutions. Automakers are actively investing in laser welding technologies to achieve higher precision, productivity, and consistent quality while meeting evolving production standards. The increasing shift toward high-performance, lightweight vehicles made from aluminum and hybrid alloys is further amplifying the demand for laser-based welding systems. Laser welding offers exceptional accuracy, minimal thermal distortion, and superior strength retention, making it ideal for joining thin or dissimilar materials without compromising structural integrity. Continued innovation in beam control, adaptive sensors, and automated monitoring technologies enhances reliability and reduces manufacturing defects. These advancements not only improve production efficiency but also ensure uniform quality and repeatability across mass-production environments, reinforcing the importance of laser welding in modern automotive manufacturing processes. The market's evolution is being shaped by a growing focus on automation, digitalization, and sustainability in vehicle production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.25 Billion |

| Forecast Value | $1.99 Billion |

| CAGR | 4.8% |

The fiber laser segment is anticipated to register a CAGR of 6.1% between 2025 and 2034. Its superior beam precision, energy efficiency, and ability to weld lightweight and mixed materials make fiber lasers highly favored in the automotive industry. Their performance benefits, including high welding speed and lower operating costs, are driving adoption in electric vehicle manufacturing and advanced body structures. As automakers emphasize precision, durability, and cost-effectiveness, fiber laser systems are becoming essential components of next-generation production facilities.

The spot welding segment accounted for a 38% share in 2024. Laser spot welding remains a critical process in vehicle body assembly, offering rapid, strong, and accurate welds. The integration of robotic automation and high-powered fiber lasers in spot welding enhances productivity, minimizes material waste, and ensures consistent weld quality. This technological progress aligns with the automotive industry's increasing focus on lightweight design, faster production cycles, and reduced downtime in manufacturing operations.

U.S. Automotive Laser Welding System Market held a share of 85.4% in 2024. The country continues to lead in adopting advanced laser welding technologies for applications demanding maximum precision and reliability. The growing commercialization of electric vehicles, robust R&D investments, and strong collaboration between industry and research institutions are sustaining innovation in laser welding within the U.S. market. Manufacturers are emphasizing high-quality production and automation, further driving technological integration in automotive plants nationwide.

Key companies operating in the Global Automotive Laser Welding System Market include TRUMPF, IPG Photonics, Coherent, Jenoptik, Han's Laser Technology, FANUC, Amada Weld Tech, Laserline, Golden Laser, and Baison Laser. Leading companies in the Automotive Laser Welding System Market are strengthening their market position through technological innovation, capacity expansion, and strategic partnerships. They are investing extensively in R&D to develop advanced laser sources, real-time monitoring solutions, and energy-efficient systems that meet evolving manufacturing needs. Collaborations with automotive OEMs and industrial automation providers are enabling the creation of customized welding platforms optimized for electric vehicles and lightweight materials. Companies are also expanding their geographic presence and production facilities to meet increasing global demand.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Laser

- 2.2.2 Welding

- 2.2.3 Application

- 2.2.4 Vehicle

- 2.2.5 Region

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component manufacturers

- 3.1.1.3 System integrators

- 3.1.1.4 OEM

- 3.1.1.5 End use

- 3.1.1 Supplier landscape

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of automotive production capacity

- 3.2.1.2 Demand for high precision and lightweight materials

- 3.2.1.3 Shift toward energy-efficient manufacturing processes

- 3.2.1.4 Advancements in laser beam control and monitoring systems

- 3.2.1.5 Growing adoption of electric and hybrid vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment cost

- 3.2.2.2 Limited availability of skilled laser welding operators

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of electric and hybrid vehicle segment

- 3.2.3.2 Expansion in battery module and powertrain welding applications

- 3.2.3.3 Rising adoption of Industry 4.0 and smart manufacturing

- 3.2.3.4 Technological advancements in multi-material welding solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 By component

- 3.9.2 By region

- 3.10 Cost Breakdown Analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

- 3.14 Future trends

- 3.14.1 Technology roadmap & innovation trajectory in automotive

- 3.14.2 Emerging applications & market expansion opportunities

- 3.14.3 Autonomous vehicle impact & component requirements

- 3.14.4 Sustainable manufacturing & green technology integration

- 3.14.5 Digital transformation & smart manufacturing integration

- 3.15 Automotive client requirements & industry priorities

- 3.15.1 High precision & repeatability demands for automotive quality

- 3.15.2 Robotics & automation integration requirements

- 3.15.3 Ev battery welding specifications & standards

- 3.15.4. Compliance with AWS D8.10 M:2021 & AIAG CQI-15 standards

- 3.15.5 Energy efficiency & total cost of ownership in automotive

- 3.15.6 Local service network & technical support expectations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Laser, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Fiber laser

- 5.3 CO2 laser

- 5.4 Solid-state laser

- 5.5 Diode laser

Chapter 6 Market Estimates & Forecast, By Welding, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Spot welding

- 6.3 Seam welding

- 6.4 Hybrid welding

- 6.5 Remote welding

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Body-in-White (BIW)

- 7.3 Powertrain components

- 7.4 Battery manufacturing (EVs)

- 7.5 Exhaust systems

- 7.6 Chassis & structural parts

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger Vehicle

- 8.2.1 SUV

- 8.2.2 Hatchback

- 8.2.3 Sedan

- 8.3 Commercial Vehicle

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 Singapore

- 9.4.6 Thailand

- 9.4.7 Vietnam

- 9.4.8 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Bystronic Laser

- 10.1.2 Coherent

- 10.1.3 FANUC

- 10.1.4 Han's Laser Technology

- 10.1.5 IPG Photonics

- 10.1.6 Jenoptik

- 10.1.7 TRUMPF

- 10.2 Regional Players

- 10.2.1 Amada Weld Tech

- 10.2.2 HGTECH

- 10.2.3 Laser Photonics

- 10.2.4 Laserax

- 10.2.5 Precitec

- 10.2.6 Prima Power

- 10.2.7 Sino-Galvo Technology

- 10.2.8 Emerson Electric (Branson Ultrasonics)

- 10.3 Emerging Players and Disruptors

- 10.3.1 ALPHA LASER

- 10.3.2 Baison Laser

- 10.3.3 Control Laser

- 10.3.4 Golden Laser

- 10.3.5 KEYENCE

- 10.3.6 Laserline

- 10.3.7 LaserStar Technologies

- 10.3.8 Miyachi Unitek

- 10.3.9 Perfect Laser

- 10.3.10 Sahajanand Laser Technology