PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876544

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876544

Automotive Paint Robot System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

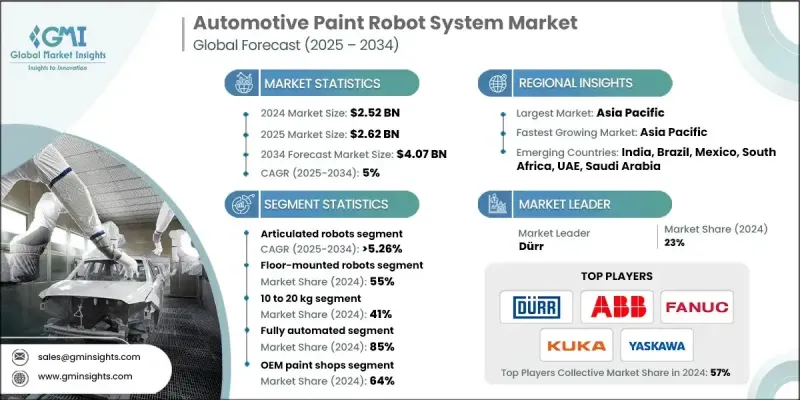

The Global Automotive Paint Robot System Market was valued at USD 2.52 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 4.07 billion by 2034.

The growing adoption of automation across automotive production facilities is driving this market, as manufacturers seek enhanced precision, uniformity, and sustainability in vehicle painting operations. Automotive paint robot systems, designed to automate body handling, coating, and finishing, have become essential to modern vehicle manufacturing lines. Rising global vehicle output, the accelerating transition toward electric vehicles, and increasing demand for customized finishes are major factors contributing to market expansion. Robotic painting offers consistent coating thickness, superior finish quality, and minimal material waste while ensuring faster cycle times and higher efficiency. These systems also support manufacturers' sustainability goals by reducing emissions and improving energy efficiency. Moreover, stricter environmental regulations, pressure to reduce operational costs, and the ongoing trend toward digital and green manufacturing are further fueling investments in automated paint shops. With robotic painting technology delivering repeatable results and eliminating inconsistencies associated with manual operations, automakers are prioritizing advanced paint robotics to achieve higher productivity and precision in every production stage.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.52 billion |

| Forecast Value | $4.07 billion |

| CAGR | 5% |

The articulated robots segment held 69% share in 2024 and is projected to grow at a CAGR of 5.26% from 2025 to 2034. This dominance is attributed to their versatility, extended reach, and ability to handle complex vehicle geometries with ease. These robots, equipped with multiple joints and typically six or more axes, provide smooth and precise motion like that of a human arm, making them ideal for automotive paint applications that demand accuracy and adaptability. Their capability to manage intricate painting angles and contours enhances the overall finish quality while maintaining efficiency on large-scale production lines.

The floor-mounted robots segment held a 55% share in 2024 and is expected to grow at a CAGR of 5.63% through 2034. Floor-mounted configurations remain the most adopted setup in manufacturing facilities due to their stability, ease of integration, and compatibility with existing production layouts. These robots are fixed directly onto pedestals or plant floors, providing a solid base for the robotic arm and paint applicator, which allows for precise control and steady operation during high-speed painting cycles. Their robust structure and adaptability make them an essential part of large automotive assembly lines.

Asia Pacific Automotive Paint Robot System Market held a 50% share and generated USD 1.25 billion in 2024. The region's strong position is supported by rapid industrialization, large-scale automotive manufacturing, and rising investment in automation technologies. Countries including China, Japan, South Korea, and India are leading this growth through strategic initiatives that promote smart manufacturing, robotics, and Industry 4.0 adoption. These government-backed programs and high levels of technological innovation have positioned the region as a major hub for advanced manufacturing and automation development.

Key players operating in the Global Automotive Paint Robot System Market include KUKA, FANUC, ABB, Durr, Comau, Kawasaki Heavy Industries, Staubli Robotics, Yaskawa Electric, and Omron. Leading companies in the Automotive Paint Robot System Market are strengthening their competitive position through innovation, collaboration, and expansion of technological capabilities. They are focusing on research and development to introduce intelligent robotic painting solutions with higher accuracy, energy efficiency, and digital integration. Partnerships with automotive manufacturers are enabling tailored automation systems designed to meet specific production requirements. Companies are also expanding their manufacturing capacity and service networks to cater to rising demand in emerging markets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Robot

- 2.2.3 Mounting

- 2.2.4 Pay load

- 2.2.5 Automation level

- 2.2.6 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for automotive customization

- 3.2.1.2 High-volume vehicle production requirements

- 3.2.1.3 Labor cost reduction pressures

- 3.2.1.4 Environmental regulations

- 3.2.1.5 Technological advancements in robotics

- 3.2.1.6 Sustainability initiatives by manufacturers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Complex maintenance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Electric vehicle production growth

- 3.2.3.3 Collaborative robotics development

- 3.2.3.4 Integration of AI and IoT

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Regulatory landscape

- 3.9.1 North America

- 3.9.2 Europe

- 3.9.3 Asia Pacific

- 3.9.4 Latin America

- 3.9.5 Middle East and Africa

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By robot

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

- 3.14 Investment and supply chain analysis

- 3.14.1 Investment and funding trends analysis

- 3.14.2 Supply chain dynamics and raw material impact

- 3.15 Operational excellence, sustainability, and workforce management

- 3.15.1 Quality standards and performance benchmarking

- 3.15.2 Environmental impact and sustainability initiatives

- 3.15.3 Workforce impact and skills requirements analysis

- 3.15.4 Training and development programs assessment

- 3.16 Vendor and risk management

- 3.16.1 Vendor evaluation criteria and selection framework

- 3.16.2 Risk assessment and mitigation strategies

- 3.17 Impact of Automation on Securing High-Specification Contracts

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New mounting launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Robot, 2021 - 2034 (USD Bn, Units)

- 5.1 Key trends

- 5.2 Articulated robots

- 5.3 Cartesian robots

- 5.4 Scara robots

- 5.5 Collaborative robots

Chapter 6 Market Estimates & Forecast, By Mounting, 2021 - 2034 (USD Bn, Units)

- 6.1 Key trends

- 6.2 Floor-mounted robots

- 6.3 Wall-mounted robots

- 6.4 Rail-mounted robots

Chapter 7 Market Estimates & Forecast, By Pay Load, 2021 - 2034 (USD Bn, Units)

- 7.1 Key trends

- 7.2 Up to 5 kg

- 7.3 5 to 10 kg

- 7.4 10 to 20 kg

- 7.5 Above 20 kg

Chapter 8 Market Estimates & Forecast, By Automation Level, 2021 - 2034 (USD Bn, Units)

- 8.1 Key trends

- 8.2 Fully automated

- 8.3 Semi-automated

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Bn, Units)

- 9.1 Key trends

- 9.2 OEM paint shops

- 9.3 Tier-1 supplier facilities

- 9.4 Aftermarket and collision repair centers

- 9.5 Specialty vehicle manufacturing

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Indonesia

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 South Korea

- 10.4.9 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ABB

- 11.1.2 Comau

- 11.1.3 Denso

- 11.1.4 Durr

- 11.1.5 Epson Robots

- 11.1.6 FANUC

- 11.1.7 Kawasaki Heavy Industries

- 11.1.8 KUKA

- 11.1.9 Mitsubishi Electric

- 11.1.10 Nachi-Fujikoshi

- 11.1.11 Omron

- 11.1.12 Panasonic

- 11.1.13 Staubli Robotics

- 11.1.14 Yaskawa Electric

- 11.2 Regional Players

11.2.1. 3 M Company

- 11.2.2 Doosan Robotics

- 11.2.3 Elite Robots

- 11.2.4 Hyundai Robotics

- 11.2.5 Reis Robotics

- 11.2.6 Universal Robots

- 11.3 Emerging Players / Disruptors

- 11.3.1 Franka Emika

- 11.3.2 Precise Automation

- 11.3.3 Rethink Robotics

- 11.3.4 Standard Bots

- 11.3.5 Techman Robot