PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876555

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876555

Wearable Sweat Analysis Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

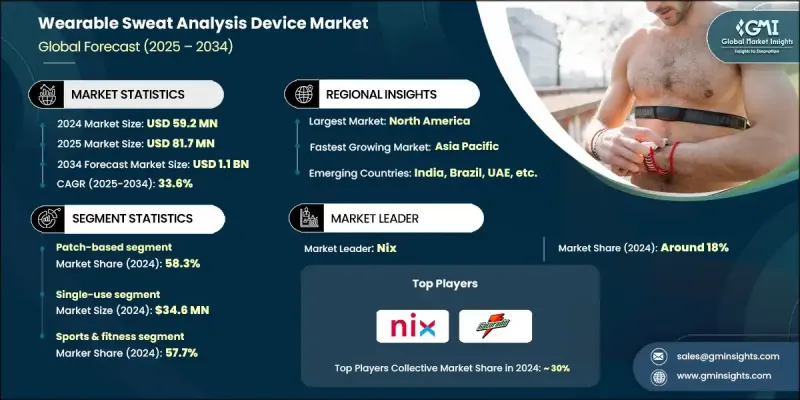

The Global Wearable Sweat Analysis Device Market was valued at USD 59.2 million in 2024 and is estimated to grow at a CAGR of 33.6% to reach USD 1.1 billion by 2034.

The market is experiencing rapid growth driven by increasing demand for non-invasive diagnostic tools, growing adoption of wearable technology in fitness and healthcare, and major advancements in sensor miniaturization. The development of flexible electronics, nanomaterials, and microfluidic systems has enhanced the precision, comfort, and integration of sweat-based monitoring devices. These innovations have made it possible for sensors to be embedded into compact patches or lightweight wearables while maintaining high data accuracy and performance. With their ability to analyze multiple biomarkers simultaneously, these devices are becoming increasingly relevant for both consumer wellness tracking and clinical diagnostics. The combination of personalization, real-time health insights, and data connectivity is positioning sweat analysis wearables as a transformative tool in modern healthcare and sports performance monitoring. As technology evolves, the usability, accuracy, and affordability of these devices are expected to further accelerate their global adoption across fitness, medical, and research applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $59.2 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 33.6% |

The growing use of wearable sweat sensors in the sports and fitness sector is one of the strongest drivers of market expansion. Athletes and fitness enthusiasts rely on these devices to assess hydration levels, electrolyte balance, and fatigue during workouts or competitions. With a rising number of active individuals globally, the adoption of such advanced wearables continues to surge. These devices not only provide insights into physical performance but also play a key role in preventing dehydration and optimizing recovery routines.

The patch-based devices segment held a 58.3% share in 2024. These flexible, skin-mounted wearables feature microfluidic channels and biochemical sensors that analyze sweat composition in real time. Their lightweight, disposable design makes them ideal for short-term monitoring in both athletic and medical environments. In addition to providing real-time data, many of these patches offer visual indicators and wireless connectivity for seamless synchronization with mobile health applications. The simplicity and comfort of these devices have made them highly popular among consumers seeking quick and convenient performance tracking solutions.

The reusable segment held a 41.7% share in 2024. Designed for long-term use, these durable devices are commonly integrated into smart wearables like wristbands, armbands, and headbands. Equipped with robust sensor systems, they are capable of continuous sweat monitoring across multiple sessions. Their long-lasting nature and data reliability make them well-suited for chronic disease management, professional sports training, and telehealth-based remote monitoring.

North America Wearable Sweat Analysis Device Market held 70.4% share in 2024 and is expected to maintain strong growth through 2034. The region's leadership stems from high consumer awareness, a thriving health tech startup ecosystem, and heavy investment in research and innovation. The advanced healthcare infrastructure and widespread adoption of preventive health technologies further support market expansion. Wearable sweat sensors are increasingly embraced across sports, wellness, and medical applications, reflecting North America's strong emphasis on personalized and data-driven health monitoring.

Prominent players in the Global Wearable Sweat Analysis Device Market include Epicore Biosystems, FLOWBIO, Gatorade, hDrop, Nix, Onalabs, and Xsensio. Companies in the Wearable Sweat Analysis Device Market are focusing on innovation, collaboration, and integration to enhance their competitive standing. Many are investing in R&D to develop sensors with higher sensitivity, longer battery life, and better biocompatibility. Strategic partnerships with sports brands, medical institutions, and technology firms help accelerate product validation and market penetration. Firms are also emphasizing user-centric design to improve comfort, aesthetics, and usability while ensuring accurate real-time biomarker tracking.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Category trends

- 2.2.4 Application trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for wearable personalized health monitoring devices

- 3.2.1.2 Technological advancements in sensor miniaturization

- 3.2.1.3 Increasing adoption in the sports & fitness industry

- 3.2.1.4 Surging demand for non-invasive diagnostics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited clinical validation & accuracy concerns

- 3.2.2.2 Regulatory complexity & approval challenges

- 3.2.3 Opportunities

- 3.2.3.1 Development of multi-analyte sensors

- 3.2.3.2 Integration with digital health platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Investment and funding scenario

- 3.7 Sweat biomarker landscape

- 3.8 Sustainable material innovation

- 3.9 Market entry strategies for new players

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

- 3.13 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Patch-based

- 5.3 Wearable device

Chapter 6 Market Estimates and Forecast, By Category, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single-use

- 6.3 Reusable

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Sports & fitness

- 7.3 Healthcare & clinical

- 7.4 Consumer wellness

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Rest of the World

Chapter 9 Company Profiles

- 9.1 Epicore Biosystems

- 9.2 FLOWBIO

- 9.3 Gatorade

- 9.4 hDrop

- 9.5 Nix

- 9.6 Onalabs

- 9.7 Xsensio