PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885795

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885795

AI-Powered Pathology Analysis System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

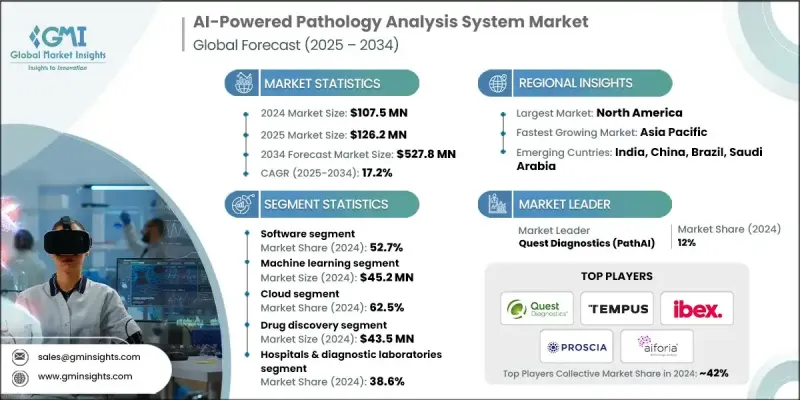

The Global AI-Powered Pathology Analysis System Market was valued at USD 107.5 million in 2024 and is estimated to grow at a CAGR of 17.2% to reach USD 527.8 million by 2034.

The market expansion is driven by the rising adoption of digital pathology and telepathology, the growing need for faster and more accurate diagnostic results, the increasing prevalence of chronic diseases, and continuous advancements in AI algorithms. Shortages of skilled pathologists are encouraging the adoption of automated solutions, while integration of AI with genomic and multi-omics data is creating advanced diagnostic capabilities. Digital pathology enables remote access to high-resolution slide images, facilitating collaboration across geographies, and telepathology allows specialists to consult on cases from distant locations. AI-powered platforms enhance image analysis, support decision-making, and offer real-time quality control prior to expert review. These systems utilize artificial intelligence to analyze medical images, detect disease patterns, and assist pathologists in achieving faster, more consistent, and highly accurate diagnoses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $107.5 Million |

| Forecast Value | $527.8 Million |

| CAGR | 17.2% |

The software segment held a 52.7% share in 2024, driven by rising adoption in drug discovery and clinical trials. Hospitals and laboratories are increasingly deploying software solutions to automate workflows and integrate with electronic health record (EHR) systems, enhancing efficiency and productivity.

The machine learning segment was valued at USD 45.2 million in 2024, as machine learning algorithms, including convolutional neural networks (CNNs) and generative adversarial networks (GANs), enable analysis of complex histopathological patterns, supporting early disease detection.

North America AI-Powered Pathology Analysis System Market held a 47.7% share in 2024. The region benefits from advanced healthcare infrastructure, high adoption of digital pathology, and substantial investments in AI research. Key US companies, including TEMPUS, PHILIPS, and PROSCIA, are collaborating with hospitals and pharmaceutical firms to deploy AI solutions in diagnostics, biomarker development, and clinical trials. Regulatory clarity and integration with EHR systems further support adoption and deployment in the region.

Leading companies in the AI-Powered Pathology Analysis System Market include IBEX, HOLOGIC, QRITIVE, Tribune Health, aiforia, Aiosyn, Mindpeak, VISIOPHARM, PathAI, Roche, Quest Diagnostics, PHILIPS, TEMPUS, Deep Bio, KFBIO, and Indica Labs. Market players are strengthening their position by investing in R&D to enhance algorithm accuracy and expand diagnostic capabilities. They are forming strategic partnerships with hospitals, laboratories, and pharmaceutical firms, while scaling software deployment and AI integration across clinical workflows. Geographic expansion, acquisitions, and collaborations are also central strategies, along with integrating platforms with EHR systems to improve interoperability. Companies focus on launching advanced analytics tools, machine learning-based solutions, and AI-powered workflow automation to solidify their market presence and accelerate adoption in diagnostics, drug development, and clinical research.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Technology trends

- 2.2.4 Deployment mode trends

- 2.2.5 Use case trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for faster diagnostic turnaround time with improved accuracy

- 3.2.1.2 Rising prevalence of chronic diseases

- 3.2.1.3 Advancements in AI algorithms

- 3.2.1.4 Growing adoption of digital pathology and telepathology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory approval complexities

- 3.2.2.2 Data privacy & security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing focus on AI integration in cancer screening and early detection programs

- 3.2.3.2 Development of cloud-based AI pathology platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Emerging applications and use cases

- 3.7 Investment and funding landscape

- 3.8 Policy evolution and changes

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

- 3.13 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Image analysis & pattern recognition

- 5.2.2 Predictive analytics tools

- 5.2.3 Workflow automation software

- 5.2.4 Diagnostic decision support

- 5.3 Hardware

- 5.3.1 Whole slide imaging (WSI) scanners

- 5.3.2 Digital pathology systems

- 5.3.3 Microscopes

- 5.3.4 Storage systems

- 5.4 Services

- 5.4.1 Implementation & integration

- 5.4.2 Consulting & training

- 5.4.3 Managed AI services

- 5.4.4 Maintenance & support

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Machine learning (ML)

- 6.2.1 Convolutional neural networks (CNNS)

- 6.2.2 Generative adversarial networks (GANS)

- 6.2.3 Recurrent neural networks (RNNS)

- 6.2.4 Other neural networks

- 6.3 Computer vision-based image analysis

- 6.4 Natural language processing (NLP)

Chapter 7 Market Estimates and Forecast, By Deployment Mode, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premise

Chapter 8 Market Estimates and Forecast, By Use Case, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Drug discovery

- 8.3 Disease diagnosis & prognosis

- 8.4 Clinical workflow

- 8.5 Training & education

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals & diagnostic laboratories

- 9.3 Life sciences companies

- 9.4 Research institutes & academic centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East & Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 aetherAI

- 11.2 aiforia

- 11.3 Aiosyn

- 11.4 deep bio

- 11.5 HOLOGIC

- 11.6 IBEX

- 11.7 indica labs

- 11.8 KFBIO

- 11.9 mindpeak

- 11.10 PHILIPS

- 11.11 PROSCIA

- 11.12 QRITIVE

- 11.13 Quest Diagnostics (PathAI)

- 11.14 Roche

- 11.15 TEMPUS

- 11.16 tribun HEALTH

- 11.17 VISIOPHARM