PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876565

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876565

U.S. AI-Driven Retinal Screening Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

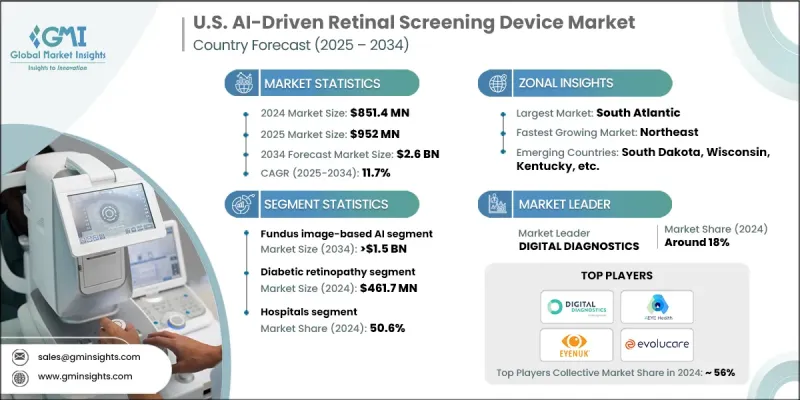

U.S. AI-Driven Retinal Screening Device Market was valued at USD 851.4 million in 2024 and is estimated to grow at a CAGR of 11.7% to reach USD 2.6 billion by 2034.

The market is fueled by the rising prevalence of diabetic retinopathy and age-related eye conditions, advancements in deep learning and image recognition, and growing awareness around early eye disease detection. The expanding geriatric population and increasing emphasis on preventive eye care are further accelerating adoption. AI-enabled retinal screening systems deliver rapid, reliable evaluations of retinal abnormalities, and their integration into ophthalmology clinics, primary care centers, pharmacies, and mobile units is improving access to advanced eye diagnostics. As healthcare shifts toward proactive, technology-driven eye care, AI-based screening tools are increasingly essential for detecting retinal conditions early and enhancing patient outcomes across diverse care settings. Recent innovations in deep learning have significantly enhanced the precision and efficiency of image-based diagnostics. AI algorithms can identify subtle retinal changes often missed by human observation, enabling earlier, more accurate diagnoses. These systems continuously improve through learning algorithms, increasing their effectiveness over time.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $851.4 Million |

| Forecast Value | $2.6 Billion |

| CAGR | 11.7% |

The diabetic retinopathy segment generated USD 461.7 million in 2024. AI-driven screening is transforming diabetic retinopathy diagnosis by enabling early, autonomous assessments in primary care environments. These systems analyze retinal images for microaneurysms, hemorrhages, and other disease indicators, often reducing the need for specialist reviews and accelerating treatment initiation.

The hospitals segment held 50.6% share in 2024, benefiting from high patient volumes and the capacity to invest in advanced technology. Hospitals are deploying AI retinal screening devices to streamline diagnostics, enhance efficiency, and reduce specialist workloads, particularly during routine examinations and chronic disease management programs.

South Atlantic AI-Driven Retinal Screening Device Market held a 19.6% share in 2024. States in this zone are witnessing strong uptake due to a sizable elderly population and high diabetes prevalence. Healthcare providers are integrating AI retinal screening into primary care and community clinics to support early detection and alleviate pressure on specialists. Telehealth adoption and mobile screening units are also expanding, making AI solutions critical for preventive eye care, especially in underserved areas.

Key players in the U.S. AI-Driven Retinal Screening Device Market include Topcon Healthcare, Visionix, EYENUK, DIGITAL DIAGNOSTICS, AEYE Health, Notal Vision, iCare, Remidio, Evolucare, Optomed, and Forus Health. Companies in the U.S. AI-Driven Retinal Screening Device Market are adopting several strategies to strengthen their foothold. They are investing in research and development to enhance AI algorithms for improved diagnostic accuracy and broader disease detection. Strategic partnerships with healthcare providers, telemedicine platforms, and technology firms expand market reach and integration. Firms are also focusing on training programs for clinicians and technicians to ensure seamless adoption. Product diversification, mobile and cloud-based solutions, and targeted marketing campaigns help increase accessibility and awareness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Zonal/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Zonal trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetic retinopathy and age-related eye diseases

- 3.2.1.2 Rise in awareness and demand for early diagnosis in ophthalmology

- 3.2.1.3 Supportive regulatory environment for AI in healthcare

- 3.2.1.4 Advancements in deep learning and image recognition technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 High initial implementation cost

- 3.2.3 Opportunities

- 3.2.3.1 Development of portable and smartphone-based screening tools

- 3.2.3.2 AI-powered predictive analytics for disease progression

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Investment landscape

- 3.7 Reimbursement scenario

- 3.8 Technology evolution timeline

- 3.9 Impact of AI on clinical workflows and decision-making

- 3.10 Deployment model outlook

- 3.11 Emerging use cases & applications

- 3.11.1 Systemic disease screening from retinal images

- 3.11.2 Cardiovascular risk assessment

- 3.11.3 Neurological condition detection

- 3.12 Value chain analysis

- 3.12.1 Hardware manufacturers

- 3.12.2 AI algorithm developers

- 3.12.3 Software platform providers

- 3.12.4 Healthcare service providers

- 3.12.5 End use integration partners

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

- 3.16 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fundus image-based AI

- 5.3 OCT-based AI

- 5.4 Multi-modal AI

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diabetic retinopathy

- 6.3 Age-related macular degeneration

- 6.4 Glaucoma

- 6.5 Cataract

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ophthalmology clinics

- 7.4 Mobile clinics/Rural camps

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Zone, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 East North Central

- 8.2.1 Illinois

- 8.2.2 Indiana

- 8.2.3 Michigan

- 8.2.4 Ohio

- 8.2.5 Wisconsin

- 8.3 West South Central

- 8.3.1 Arkansas

- 8.3.2 Louisiana

- 8.3.3 Oklahoma

- 8.3.4 Texas

- 8.4 South Atlantic

- 8.4.1 Delaware

- 8.4.2 Florida

- 8.4.3 Georgia

- 8.4.4 Maryland

- 8.4.5 North Carolina

- 8.4.6 South Carolina

- 8.4.7 Virginia

- 8.4.8 West Virginia

- 8.4.9 Washington, D.C.

- 8.5 Northeast

- 8.5.1 Connecticut

- 8.5.2 Maine

- 8.5.3 Massachusetts

- 8.5.4 New Hampshire

- 8.5.5 Rhode Island

- 8.5.6 Vermont

- 8.5.7 New Jersey

- 8.5.8 New York

- 8.5.9 Pennsylvania

- 8.6 East South Central

- 8.6.1 Alabama

- 8.6.2 Kentucky

- 8.6.3 Mississippi

- 8.6.4 Tennessee

- 8.7 West North Central

- 8.7.1 Iowa

- 8.7.2 Kansas

- 8.7.3 Minnesota

- 8.7.4 Missouri

- 8.7.5 Nebraska

- 8.7.6 North Dakota

- 8.7.7 South Dakota

- 8.8 Pacific Central

- 8.8.1 Alaska

- 8.8.2 California

- 8.8.3 Hawaii

- 8.8.4 Oregon

- 8.8.5 Washington

- 8.9 Mountain States

- 8.9.1 Arizona

- 8.9.2 Colorado

- 8.9.3 Utah

- 8.9.4 Nevada

- 8.9.5 New Mexico

- 8.9.6 Idaho

- 8.9.7 Montana

- 8.9.8 Wyoming

Chapter 9 Company Profiles

- 9.1 AEYE Health

- 9.2 DIGITAL DIAGNOSTICS

- 9.3 evolucare

- 9.4 EYENUK

- 9.5 Forus Health

- 9.6 iCare

- 9.7 NOTAL VISION

- 9.8 OPTOMED

- 9.9 remidio

- 9.10 Topcon Healthcare

- 9.11 Visionix