PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876592

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876592

AI-Driven Retinal Screening Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

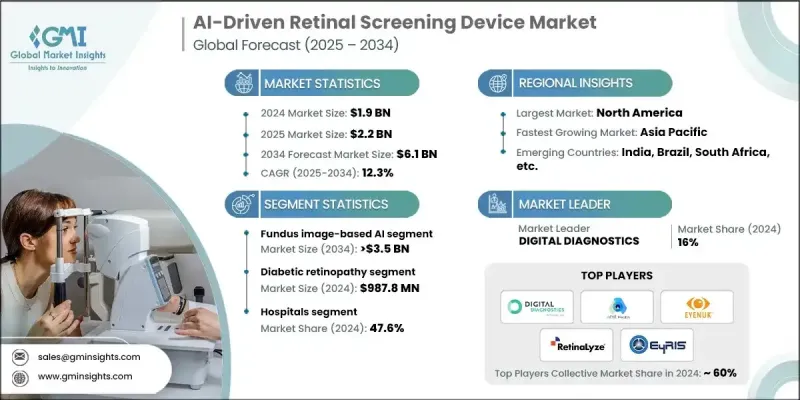

The Global AI-Driven Retinal Screening Device Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 12.3% to reach USD 6.1 billion by 2034.

Rising diabetes prevalence, growing technological innovation, and increasing adoption of AI-based medical imaging tools are among the major forces driving this growth. Expanding awareness programs and screening initiatives, supported by government and private healthcare systems, are further propelling demand. The integration of artificial intelligence into retinal diagnostics enables precise, real-time screening and supports early detection of multiple eye conditions. As healthcare providers move toward preventive care and remote diagnostics, AI-powered retinal devices are becoming essential tools for improving global eye health outcomes and enhancing accessibility, especially in low-resource regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 12.3% |

Advancements in deep learning algorithms, imaging technologies, and portable diagnostic equipment have significantly enhanced the performance and usability of AI-based retinal screening systems. These devices now provide real-time analytics, detect multiple eye disorders simultaneously, and seamlessly integrate with digital health record systems. The emergence of compact and cloud-enabled imaging tools has made retinal screening faster, more affordable, and more accessible across various healthcare settings. Next-generation AI algorithms are becoming more refined, capable of identifying subtle retinal changes that allow for earlier interventions and personalized treatment planning. Alongside global health organizations, local authorities, and medical institutions, they are implementing awareness drives and mass screening campaigns to fight preventable blindness. Mobile diagnostic units with AI technology are reaching underserved communities, while AI screening tools are being incorporated into standard checkups to strengthen early detection and preventive eye care. AI-driven retinal screening devices rely on machine learning algorithms to interpret images of the retina, providing accurate and timely identification of major ocular diseases and improving accessibility to quality eye diagnostics.

In 2024, the fundus image-based AI segment held 56.7% and is projected to reach USD 3.5 billion by 2034, growing at a CAGR of 12.7%. This segment's dominance is attributed to the rising demand for early detection of vision-threatening eye diseases. Fundus image-based AI tools use high-resolution 2D retinal images to detect surface-level irregularities, including microaneurysms, hemorrhages, and optic disc abnormalities. These models are trained to recognize conditions such as diabetic and hypertensive retinopathy, enabling rapid and reliable diagnostics through automated image assessment.

The diabetic retinopathy segment reached USD 987.8 million in 2024. As one of the primary causes of vision loss among individuals with diabetes, diabetic retinopathy continues to be the most common application for AI-driven screening solutions. These devices deliver rapid, non-invasive analysis of retinal images and can function effectively in primary healthcare environments without requiring specialist intervention. Their implementation in diabetes care facilities and community clinics has greatly expanded screening outreach, particularly in regions with limited access to ophthalmology services. The high prevalence and preventable nature of diabetic retinopathy continue to make it the most influential segment within the industry.

North America AI-Driven Retinal Screening Device Market held a 47.3% share in 2024. Market expansion in the region is driven by widespread innovation, an advanced healthcare ecosystem, and a heightened focus on accelerating diagnosis using AI technologies. The region's established infrastructure, coupled with strong awareness of preventive eye health and the presence of numerous AI healthcare startups, supports steady adoption of these systems. A growing incidence of diabetes and aging-related eye conditions is also fueling demand for intelligent retinal screening tools capable of fast and accurate disease detection.

Prominent companies operating in the Global AI-Driven Retinal Screening Device Market include iCare, RetinaLyze, Heart Eye, EYENUK, Retmarker, Airdoc, AEYE Health, Evolucare, Topcon Healthcare, Remidio, and MONA. Health, Forus Health, Identifeye Health, Visionix, Digital Diagnostics, and EyRIS. These players continue to invest in technological innovation and market expansion to strengthen their global presence. Leading companies in the AI-driven retinal screening device market are employing multiple strategies to enhance their competitive position. A major focus lies in research and development to create advanced AI algorithms capable of detecting a wider range of retinal conditions with greater accuracy. Many firms are forming strategic alliances with hospitals, clinics, and telemedicine providers to expand the deployment of AI-based screening tools. Companies are also emphasizing the integration of their systems with electronic health record platforms to enable seamless clinical workflows.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes

- 3.2.1.2 Rising geriatric population

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising awareness and screening programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 Stringent regulatory guidelines

- 3.2.3 Opportunities

- 3.2.3.1 Multi-disease detection platform development

- 3.2.3.2 Integration with mobile health (mHealth)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Investment landscape

- 3.7 Reimbursement scenario

- 3.8 Technology evolution timeline

- 3.9 Emerging use cases & applications

- 3.9.1 Systemic disease screening from retinal images

- 3.9.2 Cardiovascular risk assessment

- 3.9.3 Neurological condition detection

- 3.10 Value chain analysis

- 3.10.1 Hardware manufacturers

- 3.10.2 AI algorithm developers

- 3.10.3 Software platform providers

- 3.10.4 Healthcare service providers

- 3.10.5 End use integration partners

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

- 3.14 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fundus image-based AI

- 5.3 OCT-based AI

- 5.4 Multi-modal AI

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diabetic retinopathy

- 6.3 Age-related macular degeneration

- 6.4 Glaucoma

- 6.5 Cataract

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ophthalmology clinics

- 7.4 Mobile clinics/Rural camps

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AEYE Health

- 9.2 Airdoc

- 9.3 DIGITAL DIAGNOSTICS

- 9.4 evolucare

- 9.5 EYENUK

- 9.6 EyRIS

- 9.7 Forus Health

- 9.8 HEART EYE

- 9.9 iCare

- 9.10 identifeye HEALTH

- 9.11 MONA.health

- 9.12 remidio

- 9.13 RetinaLyze

- 9.14 Retmarker

- 9.15 Topcon Healthcare

- 9.16 Visionix