PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876566

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876566

Compressed Natural Gas (CNG) Vehicle System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

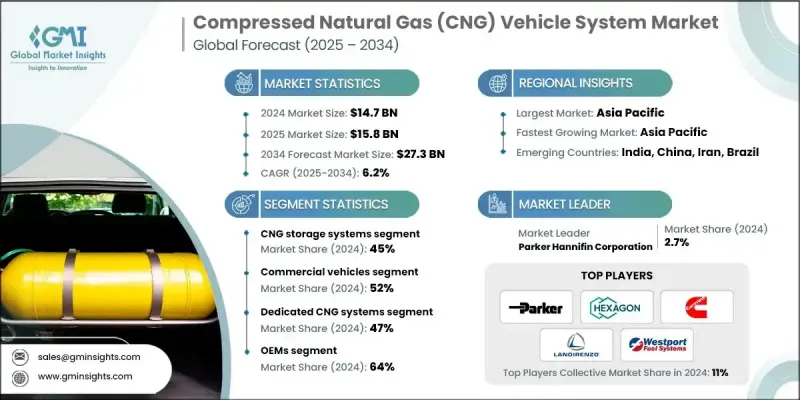

The Global Compressed Natural Gas (CNG) Vehicle System Market was valued at USD 14.7 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 27.3 billion by 2034.

The market expansion is driven by stringent emission and carbon reduction regulations across major automotive regions, encouraging OEMs and fleet operators to adopt cleaner fuel alternatives such as CNG. Compared to diesel and gasoline vehicles, CNG-powered vehicles emit substantially lower levels of CO2, NOx, and particulate matter, helping manufacturers comply with environmental regulations like Euro 6 and Bharat Stage VI standards for both passenger and commercial vehicles. The cost advantage of CNG further supports market growth, as it costs approximately 30-40% less per kilometer than gasoline or diesel, offering significant savings for fleet operators and cost-conscious consumers. Global crude oil price volatility has prompted governments, particularly in emerging regions, to incentivize CNG adoption as a strategy to reduce fuel import dependence. Investment in CNG refueling and distribution infrastructure is improving accessibility, with public-private partnerships and government-funded initiatives expanding station networks along highways and urban corridors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.7 Billion |

| Forecast Value | $27.3 Billion |

| CAGR | 6.2% |

The CNG storage systems segment generated USD 6.66 billion in 2024 and is expected to reach USD 12.21 billion by 2034. This segment benefits from advances in lightweight composite materials, with research showing potential cost reductions of 30-50% in manufacturing composite tanks.

The dedicated CNG systems segment held a 47% share in 2024 and is projected to grow at a CAGR of 7.8% from 2025 to 2034. These vehicles are popular among fleets and urban transit systems due to their fuel efficiency and low emissions. Although existing CNG infrastructure remains limited, manufacturers are focusing on optimizing engine designs and storage systems to improve reliability, making dedicated systems central to sustainable transportation initiatives.

US Compressed Natural Gas (CNG) Vehicle System Market accounted for a 91% share and generated USD 106.4 million in 2024. While the US represents a smaller portion of the global opportunity, it remains a mature market with limited growth compared to regions focusing heavily on alternative fuels, largely due to the country's abundant petroleum resources.

Key players operating in the Compressed Natural Gas (CNG) Vehicle System Market include Westport Fuel Systems, Parker Hannifin, Hexagon Composites, Clean Energy Fuels, Cummins, BRC Gas, Galileo Technologies, Luxfer, Landi Renzo, and Worthington Industries. Companies in the Compressed Natural Gas (CNG) Vehicle System Market are employing multiple strategies to strengthen their position and expand market share. They are investing in research and development to enhance engine efficiency, storage capacity, and fuel system durability. Strategic collaborations with automotive OEMs allow seamless integration of CNG systems into new vehicle models. Firms are expanding their global distribution networks, establishing partnerships with fueling infrastructure providers, and supporting government initiatives for cleaner transportation.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 System

- 2.2.4 Vehicle

- 2.2.5 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent emission regulations

- 3.2.1.2 Rising fuel cost differentials

- 3.2.1.3 Expanding refueling infrastructure

- 3.2.1.4 OEMs integration and technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited refueling infrastructure in emerging regions

- 3.2.2.2 High initial conversion and storage costs

- 3.2.3 Market opportunities

- 3.2.3.1 Government subsidies and incentives

- 3.2.3.2 Fleet electrification-hybrid integration

- 3.2.3.3 Growing urban public transport demand

- 3.2.3.4 Lightweight composite cylinder development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology readiness & maturity assessment

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

- 3.14 Business model analysis

- 3.14.1 Equipment sales vs leasing models

- 3.14.2 Service and maintenance revenue streams

- 3.14.3 Infrastructure-as-a-service models

- 3.14.4 Fuel supply contract structures

- 3.15 End Use survey insights & requirements

- 3.16 Risk assessment & mitigation strategies

- 3.16.1 Technology risk analysis

- 3.16.2 Market risk factors

- 3.16.3 Regulatory risk assessment

- 3.16.4 Supply chain risk evaluation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Product and service benchmarking

- 4.8 R&D investment analysis

- 4.9 Vendor selection criteria

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 CNG storage systems

- 5.2.1 Type I (Steel)

- 5.2.2 Type II (Steel+composite)

- 5.2.3 Type III (Aluminum+composite)

- 5.2.4 Type IV (Full composite)

- 5.3 Fuel delivery systems

- 5.3.1 Pressure regulators

- 5.3.2 Fuel injectors

- 5.3.3 Electronic control units

- 5.3.4 Fuel lines & fittings

- 5.4 Conversion kits

- 5.4.1 Complete retrofit systems

- 5.4.2 Bi-fuel conversion kits

- 5.4.3 Dedicated CNG systems

- 5.5 Other components

- 5.5.1 Safety systems

- 5.5.2 Gauges & indicators

- 5.5.3 Installation accessories

Chapter 6 Market Estimates & Forecast, By System, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Dedicated CNG systems

- 6.3 Bi-fuel (CNG/Gasoline) systems

- 6.4 Dual-fuel (CNG/Diesel) systems

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Heavy commercial vehicles (HCV)

- 7.3.3 Medium commercial vehicles (MCV)

- 7.4 Off-highway vehicles

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEMs (Original equipment manufacturer)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.3.8 Poland

- 9.3.9 Romania

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Vietnam

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Iran

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 BRC Gas

- 10.1.2 Chart Industries

- 10.1.3 Clean Energy Fuel

- 10.1.4 Cummins

- 10.1.5 Hexagon Composites

- 10.1.6 Landi Renzo

- 10.1.7 Luxfer

- 10.1.8 Parker Hannifin

- 10.1.9 Westport Fuel Systems

- 10.1.10 Worthington Industries

- 10.2 Regional companies

- 10.2.1 Allison Transmission

- 10.2.2 Angi Energy Systems

- 10.2.3 Faber Industrie

- 10.2.4 Quantum Fuel Systems Technologies

- 10.2.5 Swagelok Company

- 10.2.6 Trillium CNG

- 10.2.7 WEH

- 10.3 Emerging companies

- 10.3.1 Ashok Leyland

- 10.3.2 Beijing Tianhai Industry

- 10.3.3 Censtar Science & Technology

- 10.3.4 Galileo Technologies

- 10.3.5 IMPCO Technologies