PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876576

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876576

Europe Biomedical Refrigerators and Freezers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

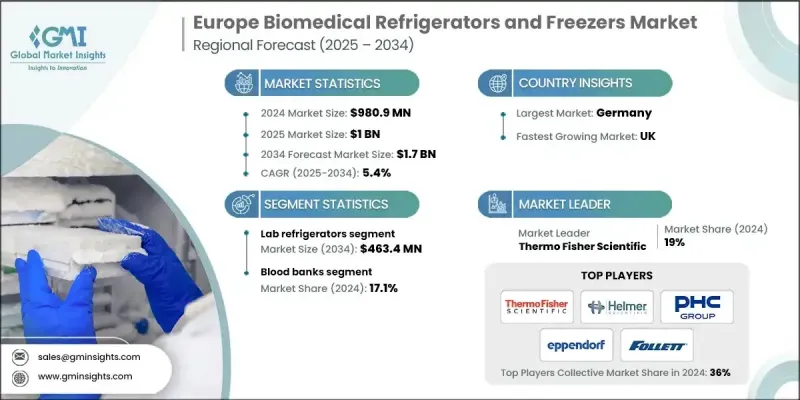

Europe Biomedical Refrigerators and Freezers Market was valued at USD 980.9 million in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 1.7 billion by 2034.

Market growth is driven by the rising prevalence of chronic illnesses across Europe, a growing aging population, technological advancements in refrigeration systems, and increased investments in biopharmaceutical and life science research. The surge in chronic conditions such as diabetes, cardiovascular diseases, and cancer has heightened the demand for consistent and safe storage of temperature-sensitive products, including biological samples, vaccines, insulin, and diagnostic reagents. Biomedical refrigerators and freezers play a crucial role in ensuring that medical and research materials are stored under controlled conditions to maintain their stability and efficacy. Additionally, the expanding focus on personalized medicine and biologics has encouraged innovation in cold storage systems with improved precision and energy efficiency. Healthcare facilities, laboratories, and long-term care centers across the region rely heavily on advanced biomedical refrigeration systems to safeguard sensitive medical supplies. The growing elderly demographic is further increasing hospitalization rates and laboratory testing volumes, creating a steady demand for reliable and regulation-compliant cold chain equipment throughout the healthcare ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $980.9 Million |

| Forecast Value | $1.7 Billion |

| CAGR | 5.4% |

The lab refrigerators segment was valued at USD 267.4 million in 2024 and is anticipated to reach USD 463.4 million by 2034. Laboratory refrigerators are precision-engineered storage units that maintain stable temperature conditions for preserving sensitive materials such as biological samples, reagents, pharmaceuticals, and chemicals. They are vital components in research centers, diagnostic laboratories, and clinical facilities, as they ensure the safety and quality of temperature-dependent materials used in experiments and diagnostics.

The blood banks segment accounted for a 17.1% share in 2024. The expansion of this segment is fueled by increased healthcare demands, technological innovation, and strict regulatory compliance in blood storage and handling. Growing requirements for blood transfusions in treatments, surgeries, and chronic disease management have accelerated the adoption of advanced refrigeration systems to maintain blood quality and extend shelf life.

Germany Biomedical Refrigerators and Freezers Market reached USD 210.9 million in 2024, supported by the country's robust healthcare infrastructure and its strong pharmaceutical and biotechnology sectors. The nation's commitment to sustainability, precision engineering, and regulatory excellence has made it a key hub for high-performance biomedical refrigeration technology. The presence of advanced hospitals, research facilities, and biobanks, along with Germany's leadership in manufacturing, further strengthens the country's ability to design and export next-generation refrigeration solutions across the European region.

Key companies operating within the Europe Biomedical Refrigerators and Freezers Market include PHC Corporation, Eppendorf, Aegis Scientific, Angelantoni Life Science, Follett Products, NuAire, B Medical Systems, Fiocchetti Scientific, Stirling Ultracold, Thermo Fisher Scientific, Azbil Corporation, Vestfrost Solutions, EVERmed, Binder, and Helmer Scientific. To strengthen their position in the Europe Biomedical Refrigerators and Freezers Market, leading manufacturers are emphasizing product innovation, energy efficiency, and compliance with international safety and temperature standards. Many companies are expanding their product portfolios to include eco-friendly, digitally monitored refrigeration units designed for precise temperature control. Strategic collaborations with hospitals, research organizations, and pharmaceutical firms are helping enhance market reach and improve product adoption. Firms are also investing in automation, remote monitoring capabilities, and smart control systems to improve operational efficiency and minimize maintenance requirements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases across Europe

- 3.2.1.2 Growing investment in biopharmaceutical research

- 3.2.1.3 Increasing geriatric population base

- 3.2.1.4 Technological advancements in biomedical refrigerators and freezers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental regulations and sustainability concerns

- 3.2.2.2 High cost of advanced equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of biobanks across the region

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Plasma freezers

- 5.3 Blood bank refrigerators

- 5.4 Lab refrigerators

- 5.5 Lab freezers

- 5.6 Ultra-low temperature freezers

- 5.7 Shock freezers

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Blood banks

- 6.3 Pharmacies

- 6.4 Hospitals

- 6.5 Research labs

- 6.6 Diagnostic centers

- 6.7 Other end use

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Germany

- 7.3 UK

- 7.4 France

- 7.5 Spain

- 7.6 Italy

- 7.7 Netherlands

Chapter 8 Company Profiles

- 8.1 Aegis Scientific

- 8.2 Azbil Corporation

- 8.3 Angelantoni Life Science

- 8.4 B Medical Systems

- 8.5 Binder

- 8.6 Eppendorf

- 8.7 EVERmed

- 8.8 Follett Products

- 8.9 Fiocchetti Scientific

- 8.10 Helmer Scientific

- 8.11 NuAire

- 8.12 PHC Corporation

- 8.13 Stirling Ultracold

- 8.14 Thermo Fisher Scientific

- 8.15 Vestfrost Solutions