PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892868

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892868

U.S. Biomedical Refrigerators and Freezers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

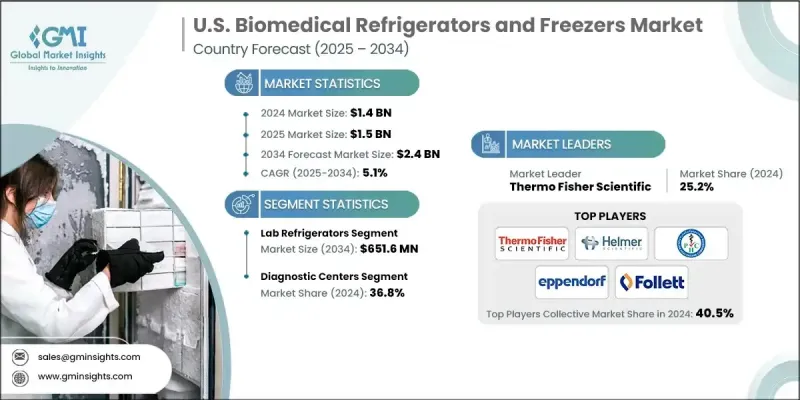

U.S. Biomedical Refrigerators and Freezers Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 2.4 billion by 2034.

This steady expansion is driven by several factors, including growing federal support for research and clinical trials, advancements in biomedical refrigeration technology, the increasing geriatric population, and the rapid development of biopharmaceuticals. Continuous funding from federal agencies such as the National Institutes of Health (NIH) plays a pivotal role, as billions are allocated annually to support life sciences research, including clinical trials that require precise cold storage for biological samples, vaccines, and investigational drugs. This financial backing not only stimulates innovation but also escalates demand for advanced refrigeration systems that safeguard temperature-sensitive materials. Additionally, the aging population in the U.S. contributes significantly to market growth, as older adults are more susceptible to chronic conditions such as cancer, diabetes, and cardiovascular diseases, which often necessitate treatments requiring secure and reliable cold storage solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 5.1% |

The blood bank refrigerators segment was valued at USD 217.8 million in 2024 and is expected to grow to USD 372.2 million by 2034, achieving a CAGR of 5.6%. These refrigeration units are specifically designed to store temperature-sensitive biological materials, reagents, and chemicals, maintaining exact temperature control essential for preserving sample integrity and supporting accurate laboratory operations.

The diagnostic centers segment held a 36.8% share in 2024. Diagnostic centers rely on biomedical refrigerators and freezers to preserve biological samples such as blood, urine, and tissue specimens under precise conditions, reducing the risk of degradation and ensuring reliable test outcomes.

Key companies operating in the U.S. Biomedical Refrigerators and Freezers Market include Stirling Ultracold, NuAire, Helmer Scientific, Thermo Fisher Scientific, Arctiko, So-Low Environmental Equipment, PHC Corporation, Aegis Scientific, Follett Products, Cardinal Health, B Medical Systems, Migali Scientific, Eppendorf, Azbil Corporation, and Haier Biomedical. Market leaders strengthen their presence by investing in R&D to develop innovative refrigeration technologies with precise temperature control, energy efficiency, and digital monitoring capabilities. Companies focus on expanding product portfolios, introducing modular and ultra-low temperature units, and enhancing software integration for remote monitoring. Strategic partnerships with research institutions, hospitals, and biopharma companies help extend reach and foster trust. Additionally, firms leverage service networks for maintenance, calibration, and retrofitting solutions to enhance customer satisfaction and loyalty, while complying with evolving regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising government support for research activities and clinical trials in the U.S.

- 3.2.1.2 Increasing geriatric population base

- 3.2.1.3 Technological advancements in biomedical refrigerators and freezers

- 3.2.1.4 Rising advancements in biopharmaceuticals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of biomedical refrigerators and freezers

- 3.2.2.2 Release of hydrofluorocarbons from refrigerators and freezers have deleterious impact on environment

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with smart technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain and distribution analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Plasma freezers

- 5.3 Blood bank refrigerators

- 5.4 Lab refrigerators

- 5.5 Lab freezers

- 5.6 Ultra-low temperature freezers

- 5.7 Shock freezers

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Blood banks

- 6.3 Pharmacies

- 6.4 Hospitals

- 6.5 Research labs

- 6.6 Diagnostic centers

- 6.7 Other End Use

Chapter 7 Company Profiles

- 7.1 Aegis Scientific

- 7.2 Azbil Corporation

- 7.3 Arctiko

- 7.4 B Medical Systems

- 7.5 Cardinal Health

- 7.6 Eppendorf

- 7.7 Follett Products

- 7.8 Helmer Scientific

- 7.9 Haier Biomedical

- 7.10 Migali Scientific

- 7.11 NuAire

- 7.12 PHC Corporation

- 7.13 So-Low Environmental Equipment

- 7.14 Stirling Ultracold

- 7.15 Thermo Fisher Scientific