PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876578

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876578

Automotive Neural Processing Unit (NPU) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

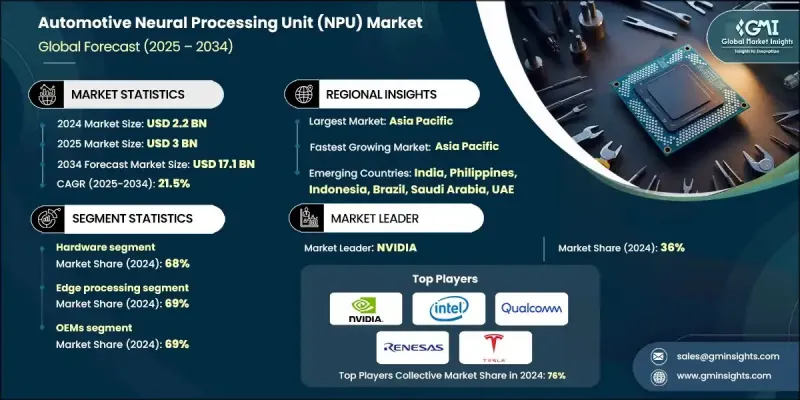

The Global Automotive Neural Processing Unit (NPU) Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 17.1 billion by 2034.

The expanding use of NPUs in vehicles is revolutionizing intelligent mobility by enabling cars to process vast sensor data in real time, interpret their surroundings, and execute rapid, data-driven decisions. These specialized chips power deep learning applications for advanced driver-assistance systems (ADAS), autonomous vehicles, and in-cabin intelligence, significantly enhancing safety, energy optimization, and driving comfort. Automotive manufacturers and Tier-1 suppliers are designing next-generation computing architectures that support predictive analytics, low-latency data fusion, and real-time vehicle decision-making. The ongoing shift toward electrification and connected mobility has further accelerated NPU adoption for predictive energy control, advanced battery management, and vehicle-to-grid coordination. These processors also improve route optimization and range prediction in electric vehicles by learning from environmental conditions and driver behavior. Integration of NPUs with edge and cloud computing enables over-the-air (OTA) updates, intelligent diagnostics, and remote optimization, strengthening sustainability efforts. The COVID-19 pandemic also sped up digital transformation in the automotive value chain, as manufacturers increasingly relied on AI, simulation, and remote diagnostics to ensure production resilience and develop self-healing automotive systems with AI at the edge.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $17.1 Billion |

| CAGR | 21.5% |

The hardware segment held a 68% share in 2024 and is projected to grow at a CAGR of 20.5% through 2034. Hardware continues to dominate the market because NPUs are at the heart of AI-based vehicle computing. Integrated within advanced processors and SoCs, they enable high-speed, low-latency, parallel data processing essential for ADAS, autonomous driving, and infotainment systems. Automakers are heavily investing in hardware innovation to support efficient, real-time decision-making directly within the vehicle ecosystem, minimizing reliance on cloud connectivity and improving processing efficiency at the edge.

The edge processing segment held a 69% share in 2024 and is estimated to grow at a CAGR of 20.6% from 2025 to 2034. Edge-based AI processing is gaining prominence because it allows vehicles to process large data volumes directly on board, reducing delays and ensuring faster decision-making in critical safety applications such as driver monitoring, object detection, and navigation. By reducing dependence on external networks, edge NPUs deliver improved performance, reliability, and responsiveness under varying connectivity conditions, reinforcing their role as a vital component in intelligent vehicle design.

China Automotive Neural Processing Unit (NPU) Market held a 37% share and generated USD 423.9 million in 2024. The country's rapid progress in intelligent and self-driving vehicle technologies has positioned it as a major growth hub. Supportive government initiatives and national policies have encouraged domestic semiconductor innovation and AI hardware localization. Leading Chinese technology firms are designing automotive-grade NPUs for real-time sensor fusion, perception, and autonomous control, further strengthening regional competitiveness and reducing foreign dependency in automotive AI computing.

Key players operating in the Global Automotive Neural Processing Unit (NPU) Market include NVIDIA, Tesla, AMD, Renesas, Intel (Mobileye), NXP, Hailo, Amazon, IBM, and Qualcomm. To strengthen their position, companies in the automotive neural processing unit industry are focusing on developing high-performance, energy-efficient chipsets that support next-generation autonomous and connected vehicle applications. Many firms are forming partnerships with leading automakers and Tier-1 suppliers to integrate their NPUs into vehicle control systems and ADAS platforms. R&D investments are being directed toward advancing edge AI computing, optimizing deep learning algorithms, and enhancing chip scalability for complex automotive workloads. Moreover, semiconductor manufacturers are expanding production capabilities and focusing on software-hardware co-design to ensure flexible deployment across EVs and autonomous fleets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Processing Type

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing ADAS & autonomous vehicle adoption

- 3.2.1.2 Rising demand for ai-powered infotainment systems

- 3.2.1.3 Regulatory push for vehicle safety & security standards

- 3.2.1.4 Shift toward software-defined vehicle architectures

- 3.2.1.5 Edge computing requirements for real-time processing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial implementation and maintenance costs

- 3.2.2.2 Supply chain vulnerabilities & semiconductor shortages

- 3.2.3 Market opportunities

- 3.2.3.1 Neuromorphic computing integration

- 3.2.3.2 V2X communication & edge computing expansion

- 3.2.3.3 Autonomous fleet deployment

- 3.2.3.4 Software monetization models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Business Case & ROI Analysis

- 3.12.1 Total cost of ownership framework

- 3.12.2 ROI calculation methodologies

- 3.12.3 Implementation timeline & milestones

- 3.12.4 Risk assessment & mitigation strategies

- 3.13 Sustainability and environmental impact analysis

- 3.13.1 Lifecycle assessment and environmental modeling

- 3.13.2 Sustainable design and optimization

- 3.13.3 Environmental compliance and reporting

- 3.13.4 Green technology and innovation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LAMEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 NPU chips

- 5.2.2 Accelerators

- 5.2.3 Processors

- 5.3 Software

- 5.3.1 AI frameworks

- 5.3.2 SDKs

- 5.3.3 Drivers

- 5.4 Services

- 5.4.1 Integration

- 5.4.2 Maintenance

- 5.4.3 Consulting

Chapter 6 Market Estimates & Forecast, By Processing, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.1.1 Edge processing

- 6.1.2 Cloud processing

- 6.1.3 Hybrid processing

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchbacks

- 7.2.2 Sedans

- 7.2.3 SUV

- 7.2.4 MPVs

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

- 7.4 Electric Vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Advanced Driver Assistance Systems (ADAS)

- 8.3 Autonomous Driving

- 8.4 In-Vehicle Infotainment (IVI)

- 8.5 Driver Monitoring Systems (DMS)

- 8.6 Traffic Sign & Object Recognition

- 8.7 Predictive Maintenance & Vehicle Diagnostics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 LAMEA

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 South Africa

- 10.5.5 Saudi Arabia

- 10.5.6 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Advanced Micro Devices

- 11.1.2 Broadcom

- 11.1.3 Intel

- 11.1.4 MediaTek

- 11.1.5 Mobileye Global

- 11.1.6 NVIDIA

- 11.1.7 Qualcomm Technologies

- 11.1.8 Tesla

- 11.2 Regional Players

- 11.2.1 Aptiv

- 11.2.2 Continental

- 11.2.3 Infineon Technologies

- 11.2.4 NXP Semiconductors

- 11.2.5 Renesas Electronics

- 11.2.6 Robert Bosch

- 11.2.7 STMicroelectronics

- 11.2.8 Valeo

- 11.3 Emerging Players

- 11.3.1 Ambarella

- 11.3.2 Black Sesame Technologies

- 11.3.3 Blaize

- 11.3.4 Esperanto Technologies

- 11.3.5 Hailo Technologies

- 11.3.6 Horizon Robotics

- 11.3.7 Kneron