PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876593

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876593

Food Extrusion Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

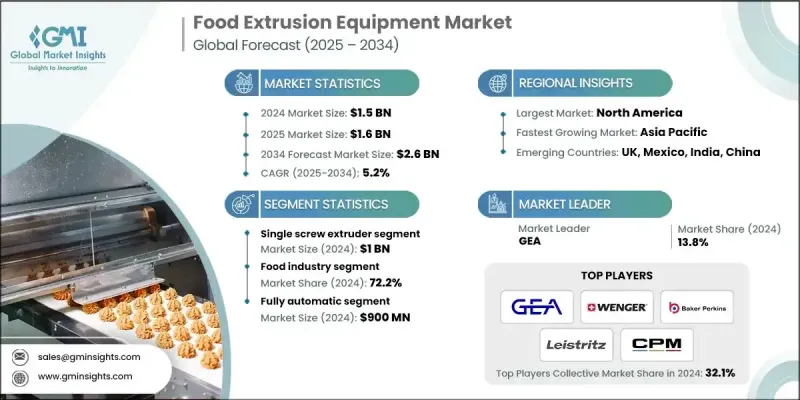

The Global Food Extrusion Equipment Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 2.6 billion by 2034.

Increasing consumer interest in plant-based alternatives to meat and seafood is creating substantial opportunities for specialized extrusion technologies. High moisture extrusion cooking (HMEC) is enabling manufacturers to achieve fibrous, meat-like textures in alternative protein products, fueling demand for advanced twin-screw extruders designed for high moisture meat analogues (HMMA). The shift toward flexitarian diets, driven by consumers looking for sustainable, animal-free protein options, is further supporting this trend. At the same time, the rising preference for snacks that combine great taste with nutritional benefits aligns well with extrusion technology. This process enables the creation of low-fat, high-protein, and high-fiber foods through precise control of temperature, pressure, and ingredient composition. Extrusion offers an efficient, continuous method that merges several manufacturing stages into a single operation, significantly reducing energy and water consumption while optimizing floor space and production speed. These advantages make extrusion a cost-effective and sustainable choice in a highly competitive food manufacturing environment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 5.2% |

In 2024, the single-screw extruders segment generated USD 1 billion. Their growth is largely driven by lower investment requirements and operational simplicity, making them an attractive choice for small and medium-sized enterprises (SMEs) and manufacturers in developing regions. These systems provide a practical and affordable entry point for businesses seeking to expand or modernize production without large capital expenditures.

The fully automatic systems segment generated USD 900 million in 2024. The increasing adoption of automated extruders has greatly enhanced product consistency, precision, and overall efficiency. Advanced automation technologies, including sensors, programmable logic controllers (PLCs), and real-time monitoring tools, allow manufacturers to maintain strict control over key production variables such as temperature, feed rate, pressure, and moisture. With minimal operator intervention, these systems significantly reduce the risk of human error and ensure uniform product quality across large production volumes.

United States Food Extrusion Equipment Market accounted for 81.8% share in 2024, generating USD 420 million. The country's market is characterized by advanced manufacturing capabilities, stringent regulatory standards, and a strong focus on automation and food safety. A mature processed food sector, including categories like snacks, cereals, pet food, and alternative proteins, continues to drive investments in extrusion systems that offer high throughput, consistent quality, and compliance with regulatory guidelines set by the FDA and USDA.

Leading companies operating in the Global Food Extrusion Equipment Market include Bausano, Bonnot, GEA, Buhler, CPM, B&P Littleford, Cowin Extrusion, Leistritz, Baker Perkins, Wenger, Legris, Coperion, Steer World, Xtrutech, and Xinda Corp. These players are focusing on continuous innovation and technical advancement to stay ahead in this evolving landscape. Major manufacturers in the Global Food Extrusion Equipment Market are focusing on a mix of strategic initiatives to strengthen their global presence. Many are investing heavily in research and development to design machines capable of handling novel ingredients and delivering enhanced texture control for plant-based products. Companies are also entering strategic partnerships and collaborations to expand their technology portfolios and reach new regional markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Mode of operation

- 2.2.4 Capacity

- 2.2.5 Application

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 The plant-based revolution

- 3.2.1.2 Demand for better for you and functional snacks

- 3.2.1.3 Operational efficiency and versatility

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment and operating costs

- 3.2.2.2 Operational complexity and skill gap

- 3.2.3 Opportunities

- 3.2.3.1 Integration of industry 4.0

- 3.2.3.2 Development for novel ingredients and upcycling

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap Analysis

- 3.9 Risk assessment and mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single screw extruder

- 5.3 Twin screw extruder

Chapter 6 Market Estimates and Forecast, By Mode of Operation Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 3,000 kg/hr

- 7.3 3,000-10,000 kg/hr

- 7.4 Above 10,000 kg/hr

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pet food & aqua feed

- 8.3 Cereals & snacks

- 8.4 Plant-based proteins

- 8.5 Food ingredients

- 8.6 Others (confectionery products, etc.)

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Food industry

- 9.3 Animal feed industry

- 9.4 Others (research institutions, etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 B&P Littleford

- 12.2 Baker Perkins

- 12.3 Bausano

- 12.4 Bonnot

- 12.5 Buhler

- 12.6 Coperion

- 12.7 Cowin Extrusion

- 12.8 CPM

- 12.9 GEA

- 12.10 Legris

- 12.11 Leistritz

- 12.12 Steer World

- 12.13 Wenger

- 12.14 Xinda Corp.

- 12.15 Xtrutech