PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876594

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876594

Backside Power Delivery Network Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

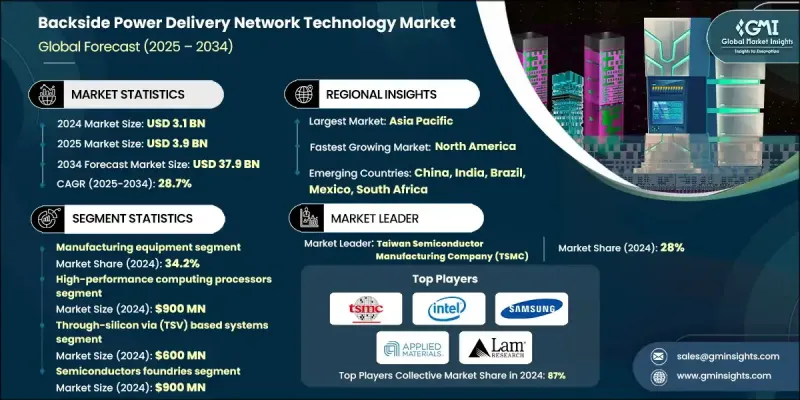

The Global Backside Power Delivery Network Technology Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 28.7% to reach USD 37.9 billion by 2034.

The rapid growth is fueled by the surging need for advanced semiconductor designs that enhance energy efficiency, reduce signal noise, and improve chip performance for AI, 5G, and high-performance computing applications. The capability of BSPDN technology to minimize IR drop and support continued transistor scaling is encouraging widespread adoption among major semiconductor foundries and chip manufacturers. The accelerating demand for artificial intelligence, data center infrastructure, and cloud-based computing is further amplifying the importance of BSPDN, as it ensures reliable and efficient power delivery in compact, high-performance devices. Moreover, the rise of 3D chip architectures and chiplet-based designs is accelerating the integration of BSPDN systems. By separating power and signal routing, this technology increases interconnect density, enhances signal integrity, and optimizes performance in advanced processors used across automotive, IoT, and next-generation computing platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $37.9 Billion |

| CAGR | 28.7% |

The manufacturing equipment segment held a 34.2% share in 2024. This segment leads the Backside Power Delivery Network Technology Market due to the rising need for innovative power delivery systems that improve manufacturing performance and energy efficiency. Companies in the semiconductor manufacturing space are adopting backside power delivery to reduce power loss, improve thermal performance, and enhance overall equipment productivity. The integration of this technology supports better heat dissipation, faster data throughput, and higher power density, making it a critical component for modern chip fabrication processes.

In 2024, the high-performance computing (HPC) processors segment generated USD 900 million. HPC processors are leading the market as they require efficient and compact power delivery systems capable of supporting demanding workloads. These processors depend on advanced packaging and interconnect technologies to minimize latency and improve bandwidth. As demand for AI-driven workloads, complex simulations, and data analytics grows, the need for reliable and scalable power solutions becomes increasingly essential. The adoption of BSPDN technology within HPC processors allows manufacturers to meet the requirements of high-speed, power-intensive computing environments, making it a key enabler of innovation in semiconductor architecture.

North America Backside Power Delivery Network Technology Market held a 29.4% share in 2024. The region's dominance is supported by strong demand for advanced computing systems, AI-driven technologies, and large-scale data centers. A well-established semiconductor ecosystem, significant R&D investments, and government support for chip manufacturing initiatives have further accelerated market development. The collaboration between technology developers and leading foundries in the region continues to foster advancements in power delivery design and integration. This dynamic environment is driving widespread adoption of advanced interconnect technologies, contributing to North America's position as a major hub for semiconductor innovation and production efficiency.

Prominent players in the Global Backside Power Delivery Network Technology Market include Synopsys Inc., Samsung Electronics, Veeco Instruments Inc., Applied Materials, Inc., Tokyo Electron Limited, ASE Technology Holding Co., Ltd., GlobalFoundries, Intel Corporation, Ansys, Inc., Taiwan Semiconductor Manufacturing Company (TSMC), Infineon Technologies AG, Amkor Technology, KLA Corporation, ASML Holding N.V., Cadence Design Systems, Inc., Lam Research Corporation, Advantest Corporation, Entegris, Inc., Onto Innovation Inc., and Screen Holdings Co., Ltd. These companies are actively engaged in advancing power delivery innovations and strengthening global semiconductor manufacturing capabilities. Key players in the Backside Power Delivery Network Technology Market are pursuing diverse strategies to reinforce their market position. A primary focus is on intensive R&D to develop advanced lithography and etching technologies that enable precise power routing and improved chip performance. Many companies are investing in equipment optimization to support high-volume production of BSPDN-enabled chips. Strategic alliances between semiconductor manufacturers, design software providers, and equipment suppliers are fostering cross-industry innovation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional Trends

- 2.2.2 Component Trends

- 2.2.3 Technology Type Trends

- 2.2.4 End Use Trends

- 2.2.5 Application Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for advanced semiconductor nodes (below 3nm) requiring improved power efficiency and reduced IR drop.

- 3.2.1.2 Increasing adoption of AI and high-performance computing (HPC) chips driving need for higher transistor density.

- 3.2.1.3 Rising use of mobile and data center processors demanding better power integrity and thermal management.

- 3.2.1.4 Technological innovation by key players like Intel and TSMC accelerating BSPDN commercialization.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex integration process and new design methodologies increase development costs.

- 3.2.2.2 Limited manufacturing capacity and dependence on advanced fabs slow large-scale adoption.

- 3.2.3 Market opportunities

- 3.2.3.1 Growing use of BSPDN in AI accelerators, GPUs, and next-generation processors.

- 3.2.3.2 Expansion of 2.5D/3D packaging technologies complementing backside power delivery.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Manufacturing Equipment

- 5.3 Materials & Consumables

- 5.4 Metrology & Inspection Systems

- 5.5 Design & Simulation Software

Chapter 6 Market Estimates and Forecast, By Technology Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Through-Silicon Via (TSV) Based Systems

- 6.3 Buried Power Rail Systems

- 6.4 Direct Backside Contact Systems

- 6.5 Hybrid Integration Systems

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 High-Performance Computing Processors

- 7.3 Mobile & Consumer Processors

- 7.4 Automotive Semiconductor Devices

- 7.5 Industrial & IoT Applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Semiconductor Foundries

- 8.3 Integrated Device Manufacturers (IDMs)

- 8.4 Equipment & Materials Suppliers

- 8.5 System Integrators & OEMs

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Taiwan Semiconductor Manufacturing Company (TSMC)

- 10.2 Intel Corporation

- 10.3 Samsung Electronics (Samsung Foundry)

- 10.4 GlobalFoundries

- 10.5 ASE Technology Holding Co., Ltd. (ASE Group)

- 10.6 Amkor Technology

- 10.7 Applied Materials, Inc.

- 10.8 Lam Research Corporation

- 10.9 ASML Holding N.V.

- 10.10 Tokyo Electron Limited

- 10.11 KLA Corporation

- 10.12 Cadence Design Systems, Inc.

- 10.13 Synopsys Inc.

- 10.14 Ansys, Inc.

- 10.15 Advantest Corporation

- 10.16 Entegris, Inc.

- 10.17 Screen Holdings Co., Ltd.

- 10.18 Veeco Instruments Inc.

- 10.19 Onto Innovation Inc.

- 10.20 Infineon Technologies AG