PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876597

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876597

Europe Cranial Implant Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

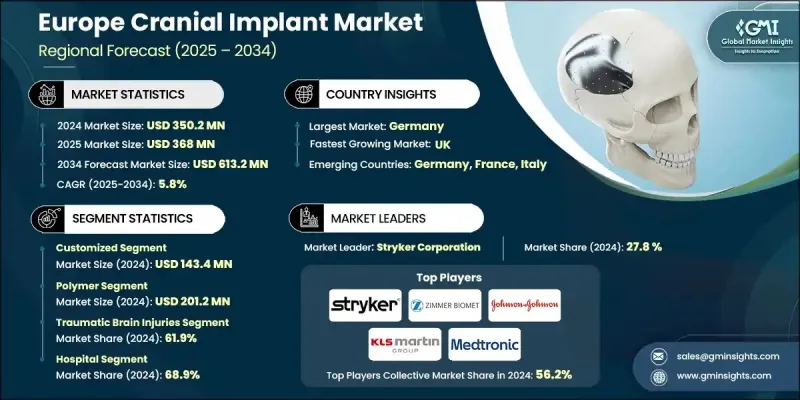

Europe Cranial Implant Market was valued at USD 350.2 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 613.2 million by 2034.

Market expansion is fueled by a rising number of traumatic brain injuries, congenital skull abnormalities, and complex neurosurgical procedures. Continuous advancements in biomaterials, including bioresorbable polymers, titanium mesh, and customized 3D-printed implants, have significantly improved both functional and aesthetic outcomes after surgery. A cranial implant is a highly specialized device used in cranioplasty, a surgical procedure that restores or reconstructs skull defects. These implants serve multiple roles: they protect the brain in damaged or missing skull areas, restore the natural head contour, and, in some cases, improve neurological function. Depending on the clinical requirement, implants may be pre-manufactured or uniquely designed using 3D imaging and additive manufacturing to replicate a patient's skull anatomy. The market is undergoing a technological transformation, shaped by innovations such as artificial intelligence (AI), 3D printing, and robotic-assisted systems that are enhancing precision, customization, and surgical outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $350.2 Million |

| Forecast Value | $613.2 Million |

| CAGR | 5.8% |

The non-customized cranial implant segment generated USD 143.4 million in 2024 and is forecast to grow steadily at a CAGR of 5.7% throughout 2034. Non-customized implants continue to hold an essential place in cranial reconstruction surgeries, especially in situations where rapid response and cost-effective procedures are critical. Pre-fabricated implants are manufactured in standard dimensions and configurations, allowing surgeons to perform quick implantations during emergency or resource-limited operations, ensuring both efficiency and safety.

The traumatic brain injury segment held a 61.9% share in 2024. This category remains a major contributor to the overall market due to the high prevalence of trauma-related cranial defects and the increasing adoption of advanced implant solutions. Rising utilization of biocompatible materials such as titanium, PMMA, and PEEK for customized implants is enhancing patient recovery and surgical success rates. Designed through advanced imaging techniques, these implants help minimize risks like post-operative infections and cerebrospinal fluid leakage, while offering improved functional stability and cosmetic restoration.

Germany continues to lead the Europe Cranial Implant Market, demonstrating substantial growth potential driven by technological innovation and a mature healthcare ecosystem. The country's advanced medical infrastructure, specialized neurosurgical capabilities, and rapidly aging demographic have made it a prime hub for cranial reconstruction procedures. German medical centers are increasingly adopting customized implant designs supported by cutting-edge imaging and digital design platforms. Furthermore, ongoing research in biomaterials and additive manufacturing is strengthening the production of patient-specific PEEK and titanium implants, improving surgical precision and long-term patient outcomes.

Key companies operating in the Europe Cranial Implant Market include Zimmer Biomet Holdings, Medtronic, Renishaw, Johnson & Johnson, Fin-ceramica Faenza S.p.A., 3di, Acumed LLC, Stryker Corporation, evonos GmbH & Co. KG, 3D Systems, KLS Martin Group, B. Braun SE, Integra LifeSciences Holdings Corporation, and Xilloc Medical Int B.V. To strengthen their position, companies in the Europe cranial implant industry are emphasizing innovation, collaboration, and product diversification. Many firms are investing in research and development to design next-generation implants that are lighter, stronger, and more biocompatible. Strategic partnerships with hospitals, surgical centers, and research institutions are enhancing access to clinical expertise and accelerating product validation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 Application trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing cases of traumatic brain injuries (TBI)

- 3.2.1.2 Growing prevalence of neurological disorders and skull deformities

- 3.2.1.3 Advancements in 3D printing and custom implant technologies

- 3.2.1.4 Increasing adoption of biocompatible and smart materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cranial implants and surgical procedures

- 3.2.2.2 Stringent regulatory approvals and compliance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of healthcare infrastructure in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Europe

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Customized

- 5.3 Non-customized

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Metal

- 6.3 Polymer

- 6.3.1 Polyetheretherketone (PEEK)

- 6.3.2 Polymethylmethacrylate (PMMA)

- 6.3.3 Other polymers

- 6.4 Ceramic

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Traumatic brain injuries

- 7.3 Tumor resection cases

- 7.4 Neurosurgical reconstructive procedures

- 7.4.1 Biomimetic cranial reconstructive procedures

- 7.4.2 Post-traumatic reconstructions

- 7.4.3 Other neurosurgical reconstructive procedures

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital

- 8.3 Neurosurgery centers

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Germany

- 9.3 UK

- 9.4 France

- 9.5 Spain

- 9.6 Italy

- 9.7 Netherlands

Chapter 10 Company Profiles

- 10.1 3di

- 10.2 3d Systems

- 10.3 Acumed LLC

- 10.4 B. Braun SE

- 10.5 evonos GmbH & Co. KG

- 10.6 Fin-ceramica Faenza S.p.A.

- 10.7 Integra LifeSciences Holdings Corporation

- 10.8 Johnson & Johnson

- 10.9 KLS Martin Group

- 10.10 Medtronic

- 10.11 Renishaw

- 10.12 Stryker Corporation

- 10.13 Xilloc Medical Int B.V.

- 10.14 Zimmer Biomet Holdings