PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885804

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885804

US Cranial Implant Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

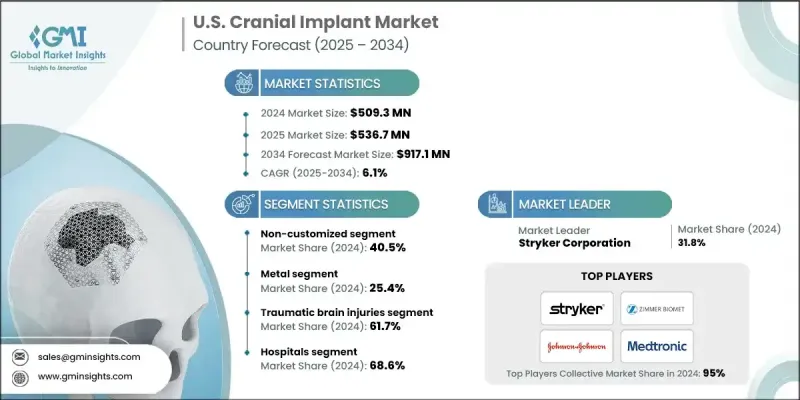

U.S. Cranial Implant Market was valued at USD 509.3 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 917.1 million by 2034.

Growth in this field is supported by an increasing number of traumatic brain injuries, a strong clinical focus on reconstructive neurosurgery, and continuous advancements in personalized implant technologies. The United States holds one of the most advanced cranial implant landscapes, backed by a structured regulatory environment, well-developed surgical networks, and rapid adoption of patient-specific devices. Cranial implants play an essential role in procedures designed to replace or reinforce sections of the skull damaged by trauma, congenital abnormalities, tumors, or neurological surgeries. These implants are integral to restoring cranial structure, maintaining brain protection, and improving both functional and aesthetic outcomes for patients requiring complex reconstruction. As the number of individuals experiencing cranial injuries or postoperative defects increases, the requirement for durable, biocompatible materials continues to escalate. Healthcare providers are also shifting toward techniques that combine greater precision with faster surgical execution, which reinforces demand for advanced cranial implant solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $509.3 Million |

| Forecast Value | $917.1 million |

| CAGR | 6.1% |

The non-customized category accounted for a 40.5% share in 2024. These standardized implants remain essential in U.S. trauma and emergency environments because they allow surgeons to act quickly without the wait times associated with custom preparation.

The metal implant segment was valued at 25.4% share in 2024 and continues to be widely selected for its mechanical strength, resilience, and reliability. Titanium-based devices are especially popular in cases that require maximum cranial stabilization and long-term durability.

The neurosurgery centers segment held a 26.6% share in 2024. These facilities specialize in neurological procedures and handle a high volume of reconstruction surgeries, contributing significantly to the procedural volume within the cranial implant industry.

Leading companies in the U.S. Cranial Implant Market include 3di, Medtronic, Matrix Surgical USA, Stryker Corporation, Renishaw, Zimmer Biomet Holdings, 3D Systems, KLS Martin Group, B. Braun SE, Johnson & Johnson, Acumed LLC, Integra LifeSciences Holdings Corporation, and Kelyniam Global. Companies operating in the U.S. Cranial Implant Market are advancing their market position by developing personalized implant solutions supported by 3D printing, image-guided modeling, and advanced biomaterials. Many firms are expanding their titanium and polymer implant portfolios to address both routine and complex reconstruction needs. Strategic partnerships with neurosurgery centers and hospitals help streamline surgeon training and improve clinical adoption. Manufacturers are also strengthening their regulatory compliance programs to accelerate product approvals and ensure consistent quality across customized and non-customized implants.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Material trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.2.5 Country trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing cases of traumatic brain injuries (TBI)

- 3.2.1.2 Growing prevalence of neurological disorders and skull deformities

- 3.2.1.3 Advancements in 3D printing and custom implant technologies

- 3.2.1.4 Increasing adoption of biocompatible and smart materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cranial implants and surgical procedures

- 3.2.2.2 Stringent regulatory approvals and compliance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of personalized cranial reconstruction

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Customized

- 5.3 Non-customized

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Metal

- 6.3 Polymer

- 6.3.1 Polyetheretherketone (PEEK)

- 6.3.2 Polymethylmethacrylate (PMMA)

- 6.3.3 Other polymers

- 6.4 Ceramic

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Traumatic brain injuries

- 7.3 Tumor resection cases

- 7.4 Neurosurgical reconstructive procedures

- 7.4.1 Biomimetic cranial reconstructive procedures

- 7.4.2 Post-traumatic reconstructions

- 7.4.3 Other neurosurgical reconstructive procedures

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital

- 8.3 Neurosurgery centers

- 8.4 Academic and research institutes

Chapter 9 Company Profiles

- 9.1 3di

- 9.2 3d Systems

- 9.3 Acumed LLC

- 9.4 B. Braun SE

- 9.5 Integra LifeSciences Holdings Corporation

- 9.6 Johnson & Johnson

- 9.7 Kelyniam Global

- 9.8 KLS Martin Group

- 9.9 Matrix Surgical USA

- 9.10 Medtronic

- 9.11 Renishaw

- 9.12 Stryker Corporation

- 9.13 Zimmer Biomet Holdings