PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876600

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876600

Digital Phenotyping Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

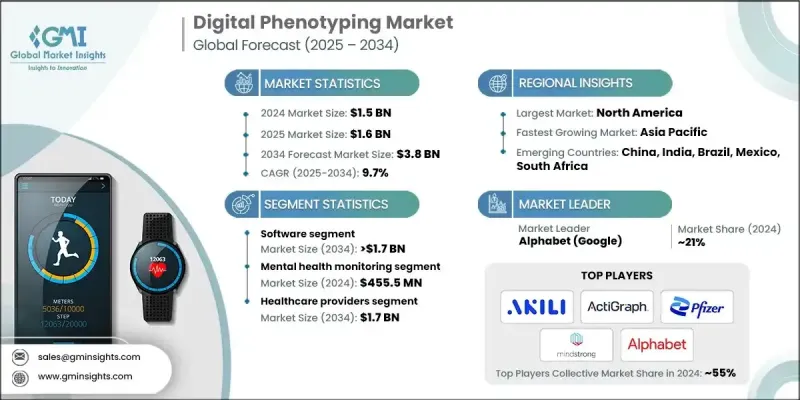

The Global Digital Phenotyping Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 3.8 billion by 2034.

Market growth is propelled by the increasing incidence of chronic diseases and mental health conditions, along with the widespread adoption of smartphones and wearable health devices. These technologies enable passive, continuous data collection through sensors that track movement, heart rate, sleep patterns, and location. The collected data form the foundation of digital phenotyping systems, supporting health monitoring and behavioral analysis. The growing integration of artificial intelligence (AI) and machine learning (ML) is further transforming the market by enabling predictive analytics, personalized treatments, and early disease detection. Additionally, digital phenotyping is redefining behavioral research and clinical trials by capturing subtle changes in human behavior through mobile device interactions, speech, and activity data. This evolving field is revolutionizing healthcare by providing insights into patient health and lifestyle patterns that were previously difficult to measure objectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 9.7% |

The software segment held a 43.3% share in 2024 and is expected to reach USD 1.7 billion by 2034, growing at a CAGR of 10.1%. This segment includes both cloud-based and on-premises platforms. Software plays a critical role in digital phenotyping by enabling the real-time collection and analysis of behavioral and physiological data using smartphone and wearable sensors. AI and ML technologies within these systems facilitate predictive modeling, anomaly detection, and continuous behavioral monitoring. The segment's growth is driven by its ability to provide actionable insights for clinicians and researchers beyond traditional clinical settings, improving patient engagement and health management outcomes across both mental and physical health applications.

The mental health monitoring segment captured USD 455.5 million in 2024. The prevalence of mental health disorders such as anxiety, depression, and bipolar disorder continues to rise worldwide, accelerating the need for scalable, technology-driven mental health solutions. The lingering effects of the COVID-19 pandemic have amplified this demand, leading to increased adoption of digital tools that allow for continuous and objective monitoring. Digital phenotyping applications use smartphone-based data and human-computer interactions to evaluate mental well-being, providing early warning signs of distress or behavioral changes. This approach helps bridge accessibility gaps in mental healthcare by offering affordable, remote, and stigma-free alternatives to traditional therapy models.

North America Digital Phenotyping Market held a 44.6% share in 2024. The region's leadership is driven by strong healthcare infrastructure, high smartphone usage, and early adoption of wearable technologies. Companies in North America are rapidly incorporating AI and ML capabilities into digital phenotyping platforms, enabling personalized treatment planning, predictive analysis, and improved patient engagement. The combination of advanced technological ecosystems and proactive healthcare innovation has positioned the region as a key growth hub for digital phenotyping adoption.

Major players in the Global Digital Phenotyping Market include Akili Interactive Labs, AliveCor, Fitbit, F. Hoffmann-La Roche, GlaxoSmithKline, ActiGraph, HumanAPI, Mindstrong, Alphabet (Google), Onnela Lab, Novartis, Sanofi, Takeda Pharmaceuticals, and Pfizer. Leading companies in the Digital Phenotyping Market are employing multiple strategies to strengthen their competitive edge and market position. Many are investing in advanced AI and ML algorithms to enhance predictive capabilities and deliver personalized health insights. Firms are expanding strategic collaborations with healthcare providers, research organizations, and digital health startups to accelerate data integration and clinical validation. Companies are also focusing on product diversification, offering cloud-based and hybrid platforms to serve varied end users.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Value addition at each stage

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of mental health and chronic conditions

- 3.2.1.2 Increasing proliferation of smartphones and wearables

- 3.2.1.3 Growing shift toward value-based and preventive care

- 3.2.1.4 Increasing expansion of telehealth and remote monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy concerns, regulatory challenges

- 3.2.2.2 Lack of standardization

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into clinical trials and pharma

- 3.2.3.2 Growing focus on behavioral research and population health analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Wearables

- 5.2.2 Biosensors

- 5.2.3 Other connected devices

- 5.3 Software

- 5.3.1 Cloud-based

- 5.3.2 On-premises

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Mental health monitoring

- 6.3 Chronic disease management

- 6.4 Behavioral research

- 6.5 Sleep and movement analysis

- 6.6 Neurodegenerative disorders

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Healthcare providers

- 7.3 Payers

- 7.4 Pharmaceutical companies

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Akili Interactive Labs

- 9.2 ActiGraph

- 9.3 AliveCor

- 9.4 Alphabet (Google)

- 9.5 F. Hoffmann-La Roche

- 9.6 Fitbit

- 9.7 GlaxoSmithKline

- 9.8 HumanAPI

- 9.9 Mindstrong

- 9.10 Novartis

- 9.11 Onnela lab

- 9.12 Pfizer

- 9.13 Sanofi

- 9.14 Takeda Pharmaceuticals