PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876605

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876605

Automotive Collision Avoidance Radar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

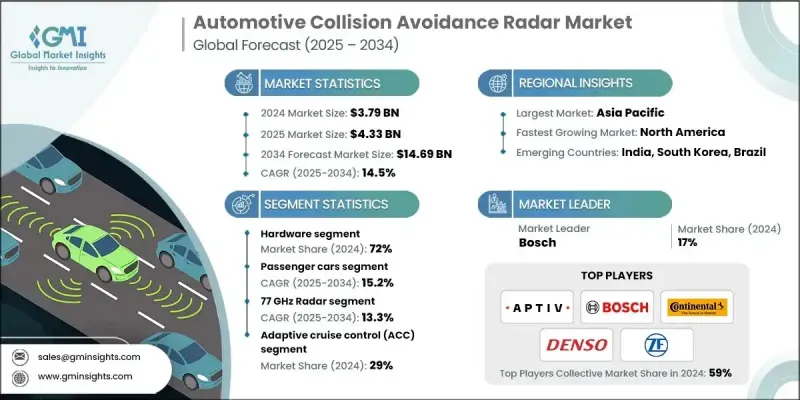

The Global Automotive Collision Avoidance Radar Market was valued at USD 3.79 billion in 2024 and is estimated to grow at a CAGR of 14.5% to reach USD 14.69 billion by 2034.

The increasing focus on road safety and the ongoing need to reduce vehicle collisions caused by human error are driving the adoption of radar-based safety systems in vehicles. These systems provide active detection and response capabilities to identify both stationary and moving obstacles, enabling vehicles to react effectively to potential hazards. The steady integration of radar into modern vehicles is supported by advancements in sensor technology, which have enabled both short-range and long-range radar applications for detecting pedestrians, cyclists, and other vehicles in complex traffic environments. Despite their effectiveness, certain applications still require improved detection range, particularly for smaller or hidden obstacles. However, as radar technology continues to evolve and manufacturing costs decline, the potential for adoption in commercial fleets, aftermarket systems, and autonomous vehicle platforms is expanding rapidly. With growing support from traffic safety data analytics and research from leading transportation authorities, radar-based collision avoidance systems are becoming a cornerstone of next-generation vehicle safety and automated driving technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.79 Billion |

| Forecast Value | $14.69 Billion |

| CAGR | 14.5% |

The hardware segment held 72% share in 2024. Hardware remains the core element of collision avoidance radar systems, as regulations often mandate the inclusion of physical sensors to ensure reliable detection and response functions. Regulatory standards for vehicle safety are also expected to drive additional demand for radar components in new vehicle models as manufacturers prepare for enhanced performance and compliance requirements.

The passenger vehicle segment will grow at a CAGR of 15.2% between 2025 and 2034. The dominance of this segment is attributed to the large-scale production of passenger cars and the growing incorporation of advanced safety systems within this category. Increased radar deployment in passenger vehicles has also stimulated the growth of a strong aftermarket ecosystem that supports radar hardware, integrated sensor fusion software, and service solutions, allowing suppliers to scale production efficiently while maintaining cost-effectiveness.

United States Automotive Collision Avoidance Radar Market generated USD 731.8 million in 2024. Regulatory influence remains a significant driver for radar adoption in the region. The growing integration of radar with Advanced Driver Assistance Systems (ADAS) reinforces its critical role in enhancing driver awareness and minimizing the risk of road accidents. Radar-enabled safety solutions capable of identifying vehicles, pedestrians, and cyclists under diverse driving conditions are becoming increasingly standard in new vehicle models, supporting the nation's broader goal of improving transportation safety and reliability.

Leading companies shaping the Global Automotive Collision Avoidance Radar Market include Valeo, Veoneer, Aptiv, Denso, Bosch, Hella, ZF Friedrichshafen, Hyundai Mobis, Continental, and NXP Semiconductors. Major companies in the Automotive Collision Avoidance Radar Market are focusing on innovation, cost efficiency, and strategic collaboration to reinforce their competitive positioning. Many are investing in advanced radar chipsets, multi-mode radar systems, and 4D imaging radar to enhance detection accuracy and range. Strategic partnerships with automakers and technology providers are being formed to integrate radar seamlessly with ADAS and autonomous driving systems. Firms are also working toward the miniaturization of components and cost reduction to enable broader adoption across various vehicle classes.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced driver-assistance systems (ADAS)

- 3.2.1.2 Stringent government safety regulations globally

- 3.2.1.3 Growing EV and autonomous vehicle market

- 3.2.1.4 Technological advancements in radar sensors (short- and long-range)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system integration complexity

- 3.2.2.2 Reduces sensor reliability in harsh conditions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with AI-based predictive analytics

- 3.2.3.2 Expansion into commercial vehicles and trucking

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability & environmental aspects

- 3.10.1 Carbon Footprint Assessment

- 3.10.2 Circular Economy Integration

- 3.10.3 E-Waste Management Requirements

- 3.10.4 Green Manufacturing Initiatives

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Investment landscape & funding trends

- 3.13.1 Venture capital and private equity investments in radar start-ups

- 3.13.2 Government R&D funding programs for automotive safety tech

- 3.13.3 Public-private partnerships for radar infrastructure development

- 3.13.4 M&A trends and strategic funding analysis

- 3.14 Economic impact assessment

- 3.14.1 Employment generation and skilled workforce requirements

- 3.14.2 Impact on regional gdp contribution from radar manufacturing

- 3.14.3 Export-import dynamics of radar components

- 3.14.4 Cost competitiveness analysis across regions

- 3.15 Risk and sensitivity analysis

- 3.15.1 Supply-side vulnerabilities

- 3.15.2 Demand-side sensitivity to oem production cycles

- 3.15.3 Policy and trade sensitivity (tariffs, import/export restrictions)

- 3.15.4 Cybersecurity and data privacy vulnerabilities in radar software

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Radar Sensor

- 5.2.2 Control Unit / ECU

- 5.3 Software

- 5.3.1 Collision Avoidance Algorithms

- 5.3.2 Driver Assistance Software

- 5.4 Services

- 5.4.1 Integration & Installation Services

- 5.4.2 Maintenance & Support Services

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger Cars

- 6.2.1 Compact/Economy

- 6.2.2 Mid-size/Family

- 6.2.3 Luxury/Premium

- 6.2.4 SUVs/Crossovers

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial

- 6.3.2 Heavy Trucks

- 6.3.3 Buses/Transit

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 24 GHz Radar

- 7.3 77 GHz Radar

- 7.4 79 GHz Radar

- 7.5 UWB (Ultra-Wideband)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Adaptive Cruise Control (ACC)

- 8.3 Automatic Emergency Braking (AEB)

- 8.4 Blind Spot Detection (BSD)

- 8.5 Lane Change Assist (LCA)

- 8.6 Parking Assistance

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Aptiv

- 10.1.2 Bosch

- 10.1.3 Continental

- 10.1.4 Denso

- 10.1.5 Hyundai Mobis

- 10.1.6 Infineon Technologies

- 10.1.7 Magna

- 10.1.8 Mobileye

- 10.1.9 NXP Semiconductors

- 10.1.10 Renesas Electronics

- 10.1.11 Valeo

- 10.1.12 ZF Friedrichshafen

- 10.2 Regional Players

- 10.2.1 Adient

- 10.2.2 Autoliv

- 10.2.3 Gentherm

- 10.2.4 Hella

- 10.2.5 JTEKT

- 10.2.6 Keihin

- 10.2.7 Lear

- 10.2.8 Marelli

- 10.2.9 Panasonic Automotive

- 10.2.10 Visteon

- 10.3 Emerging Players / Disruptors

- 10.3.1 AEye

- 10.3.2 Analog Devices

- 10.3.3 Arbe Robotics

- 10.3.4 Echodyne

- 10.3.5 Qorvo

- 10.3.6 Texas Instruments

- 10.3.7 Uhnder

- 10.3.8 Veoneer