PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876617

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876617

Fullerene-Based Specialty Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

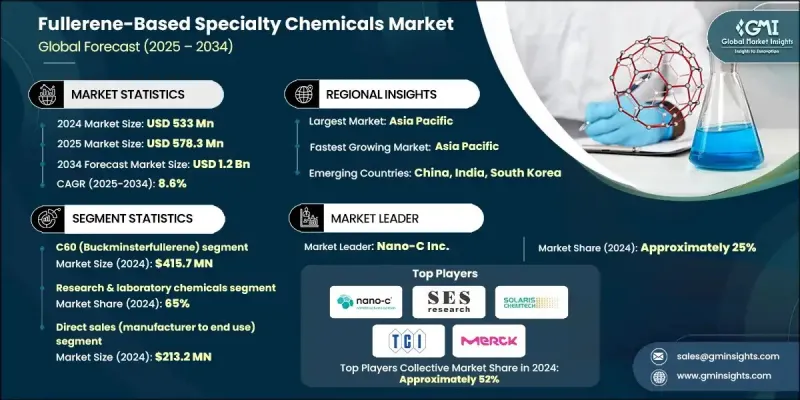

The Global Fullerene-Based Specialty Chemicals Market was valued at USD 533 million in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 1.2 billion by 2034.

Growth momentum is primarily driven by expanding opportunities in organic photovoltaics (OPV) and related electronic applications, supported by significant advancements in fullerene functionalization and synthesis. Enhanced solubility, stability, and electron-accepting properties of C-60 and C-70 fullerenes are accelerating their integration into organic electronics and energy systems. The strong research funding for nanotechnology, coupled with maturing regulatory frameworks and policy incentives, continues to expand the scope of fullerene-based materials across energy, electronics, and pharmaceutical R&D. As the demand for high-performance nanomaterials rises, fullerenes and their derivatives are increasingly recognized for their potential in next-generation devices, flexible electronics, and advanced chemical formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $533 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 8.6% |

In 2024, the electronics and OPV segment generated USD 117.3 million, representing a 22% share. The segment continues to thrive on advancements in organic electronics and the growing adoption of solution-processable fullerene derivatives that ensure improved scalability and device performance. The use of these advanced materials in flexible and energy-efficient technologies is fueling further demand across multiple sectors.

The direct sales channel was valued at USD 213.2 million in 2024, captured a 40% share, and is forecast to grow at an 8.6% CAGR through 2034. This channel remains dominant due to the highly specialized nature of fullerene products, which often require tailored specifications, rigorous quality control, and close collaboration between manufacturers and end users such as research organizations, electronics firms, and pharmaceutical companies.

Asia-Pacific Fullerene-Based Specialty Chemicals Market generated USD 255.9 million and held a 48% share in 2024. The region is expected to grow at a 10.2% CAGR during 2025-2034. Strong growth is supported by robust electronics manufacturing capabilities, an extensive chemical supply infrastructure, and active government initiatives promoting nanomaterials and next-generation photovoltaic research. China, Japan, South Korea, and India remain at the forefront of production and innovation, supported by dynamic start-up ecosystems and advanced R&D programs.

Key players operating in the Global Fullerene-Based Specialty Chemicals Market include Nano-C Inc., SES Research Inc., Solaris Chem, TCI (Tokyo Chemical Industry), Sigma-Aldrich / Merck KGaA, American Elements, Strem Chemicals, Ossila, Alfa Aesar (Thermo Fisher), Frontier Carbon Corporation, ACS Material, and Abvigen Inc. Companies in the Fullerene-Based Specialty Chemicals Market are actively investing in research and development to enhance material performance and expand their application base. Strategic collaborations and long-term supply agreements are being formed to strengthen production efficiency and ensure consistent product quality. Several players are diversifying their product portfolios by developing high-purity and functionalized derivatives to meet the evolving needs of advanced electronic and photovoltaic applications. Many firms are also optimizing their distribution networks, focusing on direct partnerships with key end users to provide customized solutions and technical support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Application trends

- 2.2.3 Distribution Channel trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.2 Pitfalls & Challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product format

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 C60 (buckminsterfullerene)

- 5.2.1 95% purity grade

- 5.2.2 99% purity grade

- 5.2.3 99.5% purity grade

- 5.2.4 99.9% purity grade

- 5.3 C70 fullerene

- 5.3.1 Standard grade

- 5.3.2 High purity grade

- 5.4 Functionalized Fullerene Derivatives

- 5.4.1 PCBM ([6,6]-Phenyl-C61-butyric Acid Methyl Ester)

- 5.4.2 ICBA (Indene-C60 Bisadduct)

- 5.4.3 Water-soluble fullerene derivatives

- 5.4.4 Custom functionalized derivatives

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Research & laboratory chemicals

- 6.2.1 Academic & university research

- 6.2.2 Pharmaceutical R&D applications

- 6.2.3 Material science research

- 6.2.4 Government research institutes

- 6.2.5 Commercial research services

- 6.3 Electronics & organic photovoltaics

- 6.3.1 Organic photovoltaic (OPV) applications

- 6.3.2 Semiconductor applications

- 6.3.3 Electronic component integration

- 6.3.4 Display technology applications

- 6.4 Specialty industrial applications

- 6.4.1 Advanced catalyst applications

- 6.4.2 Specialty coatings & materials

- 6.4.3 Tribological applications

- 6.4.4 Niche industrial uses

- 6.5 Contract research & custom synthesis

- 6.5.1 Pharmaceutical contract research

- 6.5.2 Technology company R&D support

- 6.5.3 Custom derivative development

- 6.5.4 Specialized research chemical services

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales (manufacturer to end use)

- 7.3 Chemical distributors

- 7.4 Specialty chemical suppliers

- 7.5 Online chemical marketplaces

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Nano-C Inc.

- 9.2 SES Research Inc.

- 9.3 Solaris Chem

- 9.4 TCI (Tokyo Chemical Industry)

- 9.5 Sigma-Aldrich / Merck KGaA

- 9.6 American Elements

- 9.7 Strem Chemicals

- 9.8 Ossila

- 9.9 Alfa Aesar (Thermo Fisher)

- 9.10 Frontier Carbon Corporation

- 9.11 ACS Material

- 9.12 Abvigen Inc.