PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876619

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876619

Phase Change Memory (PCM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

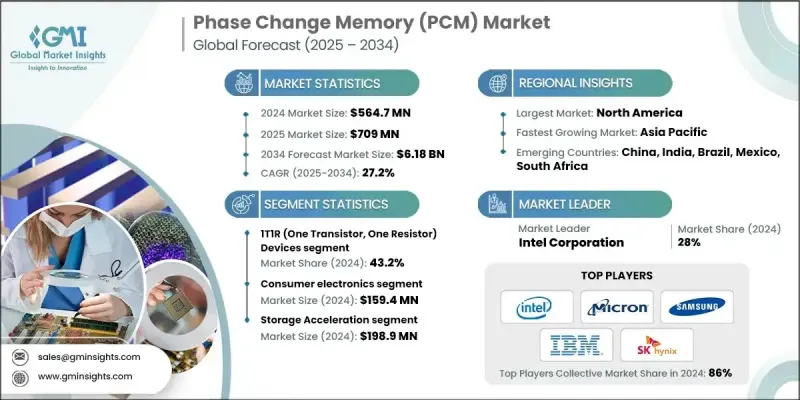

The Global Phase Change Memory (PCM) Market was valued at USD 564.7 million in 2024 and is estimated to grow at a CAGR of 27.2% to reach USD 6.18 billion by 2034.

The market's rapid expansion is driven by increasing demand for high-speed, non-volatile memory solutions that combine the speed of DRAM with the persistence of flash memory. PCM technology is gaining strong traction across AI, big data, and edge computing applications where energy efficiency, data retention, and faster access times are crucial. The ongoing shift toward system architectures that integrate larger, faster non-volatile memory blocks within or near processors is positioning PCM as a key component in next-generation computing systems. This evolution is enabling advanced use cases such as persistent caching, in-memory computing, and AI/ML workloads, supporting high-performance processing requirements. Industries such as electric vehicles, autonomous systems, and industrial automation are adopting PCM for its endurance, heat resistance, and reliability. These characteristics make PCM an ideal fit for connected and intelligent devices that require real-time processing and long-term data retention. The growing need for efficient, embedded, and scalable memory solutions across diverse industries continues to strengthen PCM's role in redefining modern memory hierarchies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $564.7 Million |

| Forecast Value | $6.18 Billion |

| CAGR | 27.2% |

The 1T1R (One Transistor, One Resistor) devices segment held 43.2% share in 2024. Its proven reliability, straightforward design, and efficient integration with existing CMOS fabrication processes make it suitable for embedded systems and automotive electronics. The architecture's predictable switching characteristics and low power leakage enhance its suitability for a range of non-volatile memory applications. With its simple structure and cost efficiency, 1T1R technology supports seamless adoption across industries seeking stable, high-speed memory options.

The consumer electronics segment generated USD 159.4 million in 2024, holding the largest share of the Phase Change Memory (PCM) Market. The segment's growth is fueled by increasing integration of high-performance, non-volatile memory in smart devices, portable gadgets, and connected home technologies. PCM offers quick booting, low energy consumption, and long write endurance, improving user experience through faster response and reliability. Its ability to store essential data locally enhances device independence, reducing reliance on cloud storage and enabling smooth functionality even in limited connectivity environments.

North America Phase Change Memory (PCM) Market held a 40.2% share in 2024. The region's leadership is supported by growing adoption of non-volatile, high-speed memory in data centers, AI systems, and consumer electronics. The presence of advanced semiconductor research hubs, robust production capabilities, and strong investments by major technology firms has accelerated market development. Additionally, government initiatives encouraging AI and memory technology advancements are propelling PCM integration across emerging digital infrastructures and next-generation computing applications.

Leading companies participating in the Global Phase Change Memory (PCM) Market include Micron Technology, Inc., Intel Corporation, Samsung Electronics Co., Ltd., Toshiba Corporation, SK hynix Inc., Western Digital Corporation, Sony Corporation, Infineon Technologies AG, Renesas Electronics Corporation, Texas Instruments Incorporated, NXP Semiconductors N.V., Microchip Technology Inc., Cypress Semiconductor Corporation, STMicroelectronics N.V., Fujitsu Ltd., IBM Corporation, Avalanche Technology Inc., Adesto Technologies Corporation, Crossbar, Inc., and Hewlett Packard Enterprise. Key players in the Phase Change Memory (PCM) Market are focusing on technology innovation, collaborations, and manufacturing advancements to strengthen their market footprint. Companies are heavily investing in research and development to enhance endurance, scalability, and write speed while reducing production costs. Strategic partnerships with semiconductor foundries and system integrators are supporting efficient commercialization and faster deployment across automotive, consumer, and industrial sectors. Many firms are integrating PCM into embedded applications to meet growing demand for high-performance, energy-efficient memory.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Device trends

- 2.2.2 Application trends

- 2.2.3 End Use trends

- 2.2.4 Regional trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Demand for High-Speed, Non-Volatile Memory in AI, Big Data & Edge Systems

- 3.2.1.2 Increasing Adoption in Automotive Electronics, EVs & Autonomous Systems

- 3.2.1.3 Integration with Hybrid Memory Architectures and Storage-Class Memory Solutions

- 3.2.1.4 Advancements in Material Engineering and 3D/Stacked PCM Cell Technologies

- 3.2.1.5 Surging Deployment of IoT Devices and Consumer Electronics Driving Low-Power Memory Needs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Manufacturing Costs and Complex Fabrication Processes

- 3.2.2.2 Limited Endurance and Thermal Stability Concerns in Certain Applications

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into AI, Edge Computing, and High-Performance Data Centers

- 3.2.3.2 Adoption in Automotive, Industrial, and IoT Systems for Persistent and Low-Power Memory

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 1T1R (One Transistor, One Resistor) Devices

- 5.3 Crosspoint Array Devices

- 5.4 3D Stacked Devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Main Memory Replacement

- 6.3 Storage acceleration

- 6.4 Embedded code storage

- 6.5 Neuromorphic computing elements

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.3 Automotive

- 7.4 Enterprise data center

- 7.5 Industrial & aerospace

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Adesto Technologies Corporation

- 9.2 Avalanche Technology Inc.

- 9.3 Crossbar, Inc.

- 9.4 Cypress Semiconductor Corporation

- 9.5 Fujitsu Ltd.

- 9.6 Hewlett Packard Enterprise

- 9.7 IBM Corporation

- 9.8 Infineon Technologies AG

- 9.9 Intel Corporation

- 9.10 Micron Technology, Inc.

- 9.11 Microchip Technology Inc.

- 9.12 NXP Semiconductors N.V.

- 9.13 Renesas Electronics Corporation

- 9.14 Samsung Electronics Co., Ltd.

- 9.15 SK hynix Inc.

- 9.16 Sony Corporation

- 9.17 STMicroelectronics N.V.

- 9.18 Texas Instruments Incorporated

- 9.19 Toshiba Corporation

- 9.20 Western Digital Corporation