PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876626

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876626

Resistive Random Access Memory (ReRAM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

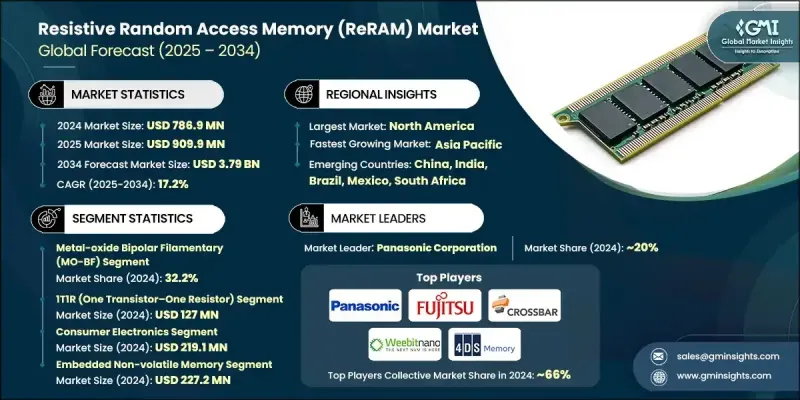

The Global Resistive Random Access Memory (ReRAM) Market was valued at USD 786.9 million in 2024 and is estimated to grow at a CAGR of 17.2% to reach USD 3.79 billion by 2034.

This surge is fueled by the increasing demand for high-performance, energy-efficient memory solutions across industries such as automotive, healthcare, consumer electronics, and industrial automation. ReRAM delivers faster data access, lower power consumption, and superior scalability compared to traditional memory technologies. Its potential in supporting artificial intelligence and neuromorphic computing applications further strengthens its appeal. As companies adopt smarter technologies and edge computing grows, ReRAM is becoming essential in next-generation memory architectures. Its low energy consumption makes it ideal for IoT and battery-powered devices, while its high-speed performance supports real-time processing and learning, critical for modern intelligent systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $786.9 Million |

| Forecast Value | $3.79 Billion |

| CAGR | 17.2% |

In 2024, the Metal-Oxide Bipolar Filamentary (MO-BF) segment held a 32.2% share. MO-BF stands out for its rapid switching speed, exceptional endurance, and scalability. By reliably forming and breaking conductive filaments in metal-oxide layers, it delivers high-density storage with low power consumption. Its compatibility with AI, edge computing, and industrial IoT applications makes it a preferred choice for manufacturers seeking durable, high-performance non-volatile memory.

The 1T1R (One Transistor-One Resistor) segment generated USD 127 million in 2024. This architecture is favored for its scalability, high integration density, and seamless compatibility with CMOS processes. By precisely controlling current flow, it reduces variability and enhances reliability. Its straightforward design supports cost-efficient production and high-speed operation, making it suitable for embedded memory, AI accelerators, and storage-class applications, positioning 1T1R as a preferred architecture for advanced non-volatile memory solutions.

North America Resistive Random Access Memory (ReRAM) Market held a 40.2% share. Growth in the region is driven by strong demand for high-performance computing in sectors like finance, healthcare, and autonomous systems. Advanced cloud infrastructure, robust semiconductor research, and significant investments by leading technology companies further stimulate market growth. Government initiatives supporting AI, edge computing, and next-generation memory development also contribute to the market expansion. Companies in the region are increasingly focusing on designing highly efficient and scalable ReRAM architectures tailored for real-time AI workloads.

Key players in the Global Resistive Random Access Memory (ReRAM) Market include Micron Technology Inc., Panasonic Corporation, Fujitsu Limited, Rambus Inc., Weebit Nano Ltd., SK hynix Inc., Intel Corporation, Crossbar Inc., Sony Corporation, Taiwan Semiconductor Manufacturing Company (TSMC), Adesto Technologies Corporation, Renesas Electronics Corporation, SMIC (Shanghai Microelectronics Corporation), Infineon Technologies AG, Xinyuan Semiconductor (Shanghai) Co., Ltd., TetraMem Inc., 4DS Memory Limited, ReRam Nanotech Ltd., and eMemory Technology Inc. Leading companies in the Global Resistive Random Access Memory (ReRAM) Market adopt strategies such as heavy investment in research and development to improve memory density and energy efficiency, strategic partnerships to expand technology adoption across industries, and mergers or acquisitions to strengthen market presence. Firms focus on diversifying their product portfolios to cater to AI, edge computing, and IoT applications while enhancing production capabilities for cost-effective scaling.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology type trends

- 2.2.2 Integration trends

- 2.2.3 End Use industry trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Low power consumption ideal for IoT and mobile devices

- 3.2.1.2 High-speed data access supporting AI and edge computing

- 3.2.1.3 Non-volatility ensures data retention without power

- 3.2.1.4 Scalability for miniaturized electronics and wearables

- 3.2.1.5 Increasing demand in automotive and industrial automation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and development costs

- 3.2.2.2 Limited commercial availability and adoption

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in neuromorphic and AI computing

- 3.2.3.2 Rising demand for smart and wearable devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Electrochemical metallization bridge (EMB/CBRAM)

- 5.3 Metal-oxide bipolar filamentary (MO-BF)

- 5.4 Metal-oxide unipolar filamentary (MO-UF)

- 5.5 Metal-oxide bipolar non-filamentary (MO-BN)

- 5.6 Phase transition based ReRAM

Chapter 6 Market Estimates and Forecast, By Integration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 1T1R (one transistor-one resistor)

- 6.3 1S1R (one selector-one resistor)

- 6.4 3D cross-point arrays

- 6.5 Mem-on-logic integration

Chapter 7 Market Estimates and Forecast, By End Use Industries, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Internet of things (IOT) & edge computing

- 7.3 Automotive electronics

- 7.4 Data centers & ai accelerators

- 7.5 Consumer electronics

- 7.6 Industrial automation

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Compute-in-memory (CIM)

- 8.3 Embedded non-volatile memory

- 8.4 Storage-class memory

- 8.5 Neuromorphic computing

- 8.6 Reconfigurable logic

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Panasonic Corporation

- 10.2 Fujitsu Limited

- 10.3 Crossbar Inc.

- 10.4 Adesto Technologies Corporation

- 10.5 Weebit Nano Ltd.

- 10.6 4DS Memory Limited

- 10.7 Taiwan Semiconductor Manufacturing Company (TSMC)

- 10.8 Intel Corporation

- 10.9 Micron Technology Inc.

- 10.10 SK hynix Inc.

- 10.11 Samsung Electronics Co., Ltd.

- 10.12 Sony Corporation

- 10.13 Rambus Inc.

- 10.14 Infineon Technologies AG

- 10.15 Renesas Electronics Corporation

- 10.16 SMIC (Shanghai Microelectronics Corporation)

- 10.17 eMemory Technology Inc.

- 10.18 Xinyuan Semiconductor (Shanghai) Co., Ltd.

- 10.19 TetraMem Inc.

- 10.20 ReRam Nanotech Ltd.