PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876631

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876631

Automotive Hydrogen Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

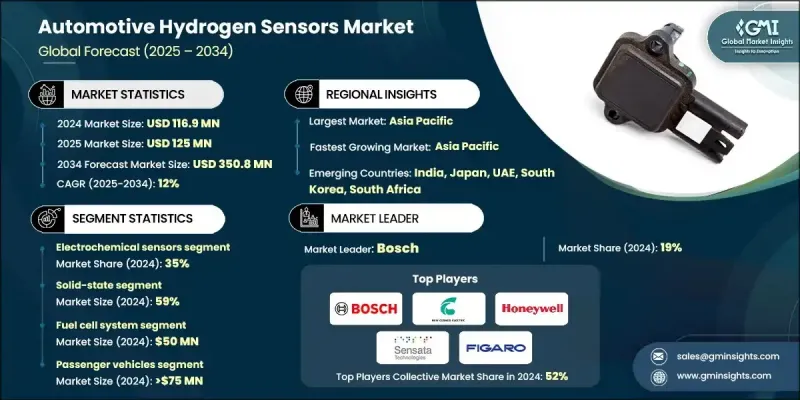

The Global Automotive Hydrogen Sensors Market was valued at USD 116.9 million in 2024 and is estimated to grow at a CAGR of 12% to reach USD 350.8 million by 2034.

The rising demand for hydrogen fuel cell vehicles, along with stringent safety regulations, is accelerating the growth of the automotive hydrogen sensors industry. These sensors are critical components designed to detect hydrogen leaks, monitor fuel cell performance, and ensure the overall safety of vehicles powered by hydrogen technology. The market features multiple sensing technologies such as electrochemical, catalytic combustion, thermal conductivity, and metal oxide semiconductor sensors, each catering to distinct automotive requirements. The ongoing development of hydrogen fueling networks is fueling the adoption of hydrogen sensors not only in vehicles but also across the broader hydrogen supply chain. Increasing investments in hydrogen-powered transport, particularly in commercial vehicles, are further driving market expansion. Although the COVID-19 pandemic initially disrupted production and delayed R&D projects due to supply chain constraints and reduced industrial activity, it ultimately acted as a catalyst for policy initiatives supporting hydrogen energy and safety advancements, leading to renewed momentum in market recovery and technological innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $116.9 Million |

| Forecast Value | $350.8 Million |

| CAGR | 12% |

The electrochemical sensors category captured a 35% share in 2024 and is expected to grow at a CAGR of 10.2% from 2025 to 2034. This segment continues to dominate due to its high precision, sensitivity, and fast response, which are essential in safety-critical automotive systems. Electrochemical sensors operate by using platinum-based electrodes within an electrolyte that produce electrical signals directly proportional to the hydrogen concentration in the environment. They are capable of detecting hydrogen concentrations as low as 1 ppm within seconds, making them ideal for monitoring applications that require accuracy and reliability.

The solid-state sensors segment held a 59% share and is projected to witness a robust CAGR of 14% during 2025-2034. Their dominance is attributed to their durability, compact design, and maintenance-free operation, which align with modern automotive preferences for reliable and long-lasting components. These sensors leverage MEMS and thin-film semiconductor technologies to create micro-scale sensing elements integrated with advanced signal processing and communication features. This approach enhances the robustness and efficiency of hydrogen detection in fuel cell and emission monitoring systems.

Asia-Pacific Automotive Hydrogen Sensors Market held a 51.6% share and is forecasted to grow at a 13% CAGR through 2034. Regional growth is primarily supported by large-scale public investment in hydrogen infrastructure, strong policy backing for zero-emission mobility, and rapid commercialization of hydrogen-powered vehicles. The region's strategic focus on hydrogen fuel adoption is expected to sustain its leadership position throughout the forecast period.

Key Automotive Hydrogen Sensors Market participants include Honeywell, Bosch, Amphenol Sensors, Continental, Infineon Technologies, Sensata Technologies, New Cosmos Electric, Figaro Engineering, Nissha FIS, and Sensirion. Companies active in the Automotive Hydrogen Sensors Market are implementing innovation-driven strategies to strengthen their global presence. They are heavily investing in research and development to create miniaturized, energy-efficient, and cost-effective sensor solutions tailored for hydrogen-powered vehicles. Strategic collaborations between automotive OEMs and sensor manufacturers are accelerating product development cycles and improving technology integration within fuel cell systems. Firms are also expanding their regional distribution networks and manufacturing capacities to meet the growing demand across emerging hydrogen economies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Vehicle

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Specialized gas sensor manufacturers

- 3.1.1.2 Diversified industrial electronics conglomerates

- 3.1.1.3 Automotive-specific sensor suppliers

- 3.1.1.4 Chemical & advanced materials companies

- 3.1.1.5 Dedicated hydrogen & fuel cell technology specialists

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Global push for green hydrogen and fuel cell electric vehicles

- 3.2.1.2 Expansion of hydrogen refueling infrastructure

- 3.2.1.3 Stringent safety standards and government mandates

- 3.2.1.4 Advancements in sensor technology

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced sensor technologies

- 3.2.2.2 Technical and performance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with IoT and predictive maintenance

- 3.2.3.2 Growth of hydrogen-powered commercial vehicles

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Quantum dot sensors

- 3.3.1.2 Wireless sensor networks

- 3.3.1.3 Graphene-based detection

- 3.3.1.4 Predictive maintenance systems

- 3.3.2 Emerging technologies

- 3.3.2.1 Machine learning integration

- 3.3.2.2 Blockchain for data integrity

- 3.3.2.3 Augmented reality interfaces

- 3.3.2.4 AI-powered smart sensors

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Cost breakdown analysis

- 3.9 Patent landscape

- 3.9.1 Patent Portfolio Analysis

- 3.9.2 Key Patent Families

- 3.9.3 Patent Expiration Analysis

- 3.9.4 IP Strategy & Licensing

- 3.10 Price trends

- 3.10.1 Cost-plus pricing models

- 3.10.2 Margin enhancement strategies

- 3.10.3 Manufacturing expenses

- 3.10.4 Volume-price relationships

- 3.11 Product pipeline & R&D roadmap

- 3.11.1 Technology Development Timeline

- 3.11.1.1 Short-Term Developments (2024-2026)

- 3.11.1.2 Medium-Term Innovations (2027-2030)

- 3.11.1.3 Long-Term Breakthroughs (2031-2034)

- 3.11.1.4 Moonshot Technologies(Beyond 2034)

- 3.11.2 Product Development Stages

- 3.11.2.1 Concept & Feasibility Studies

- 3.11.2.2 Prototype Development

- 3.11.2.3 Pilot Testing & Validation

- 3.11.2.4 Commercial Launch Readiness

- 3.11.3 R&D Investment Analysis

- 3.11.3.1 Corporate R&D Spending

- 3.11.3.2 Government Funding Programs

- 3.11.3.3 Academic Research Initiatives

- 3.11.3.4 Public-Private Partnerships

- 3.11.4 Technology Readiness Assessment

- 3.11.4.1 TRL Mapping by Technology

- 3.11.4.2 Commercialization Timelines

- 3.11.4.3 Scalability Challenges

- 3.11.4.4 Market Entry Barriers

- 3.11.1 Technology Development Timeline

- 3.12 Risk assessment & mitigation

- 3.12.1 Technology performance degradation

- 3.12.2 Demand volatility

- 3.12.3 Supply chain disruptions

- 3.12.4 Risk identification processes

- 3.12.5 Mitigation action plans

- 3.13 Supply chain resilience & localization

- 3.13.1 Global supply chain mapping

- 3.13.2 Supply chain risk assessment

- 3.13.3 Localization strategies

- 3.13.4 Government incentives

- 3.14 Market adoption & penetration analysis

- 3.14.1.1 Adoption Curve Analysis

- 3.14.1.2 Early Adopter Characteristics

- 3.14.1.3 Mainstream Market Penetration

- 3.14.1.4 Late Adopter Segments

- 3.14.1.5 Market Saturation Projections

- 3.14.2 Penetration Rate by Segment

- 3.14.2.1 Vehicle Type Penetration

- 3.14.2.2 Geographic Penetration Rates

- 3.14.2.3 Application-Specific Adoption

- 3.14.2.4 Technology Migration Patterns

- 3.14.3 Market Maturity Assessment

- 3.14.3.1 Technology Maturity Indicators

- 3.14.3.2 Market Development Stages

- 3.14.3.3 Competitive Intensity Evolution

- 3.14.3.4 Value Chain Optimization

- 3.15 Consumer behavior & end-user insights

- 3.15.1 Infrastructure operator demands

- 3.15.2 User experience analysis

- 3.15.3 Voice of customer insights

- 3.15.4 Purchase decision factors

- 3.16 Sustainability and environmental aspects

- 3.16.1 Sustainable practices

- 3.16.2 Waste reduction strategies

- 3.16.3 Energy efficiency in production

- 3.16.4 Eco-friendly initiatives

- 3.16.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Catalytic combustion Sensors

- 5.3 Electrochemical sensors

- 5.4 Metal Oxide Semiconductor (MOS) sensors

- 5.5 Thermal conductivity sensors

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Microelectromechanical system

- 6.3 Solid-State sensors

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicle

- 7.2.1 Sedan

- 7.2.2 Hatchback

- 7.2.3 SUV

- 7.3 Commercial Vehicle

- 7.3.1 Light commercial vehicle

- 7.3.2 Medium commercial vehicle

- 7.3.3 Heavy commercial vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Onboard vehicle detection

- 8.3 Fuel cell system monitoring

- 8.4 Hydrogen refueling stations

- 8.5 Exhaust gas analysis

- 8.6 Post-crash detection

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Bosch

- 11.1.2 Continental

- 11.1.3 Figaro Engineering

- 11.1.4 Honeywell

- 11.1.5 Nissha FIS

- 11.1.6 Sensata Technologies

- 11.1.7 Sensirion

- 11.2 Regional players

- 11.2.1 Amphenol Sensors

- 11.2.2 Infineon Technologies

- 11.2.3 New Cosmos Electric

- 11.2.4 TE Connectivity

- 11.2.5 Vitesco Technologies

- 11.3 Emerging players

- 11.3.1 Custom Sensors Solutions

- 11.3.2 NexTech Materials

- 11.3.3 NGK Spark Plug

- 11.3.4 Nuvoton Technology

- 11.3.5 UST Umweltsensortechnik

- 11.3.6 UTC Fuel Cells

- 11.3.7 Winsen Sensor

- 11.3.8 Xensor Integration