PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876656

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876656

800V Electric Vehicle Architecture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

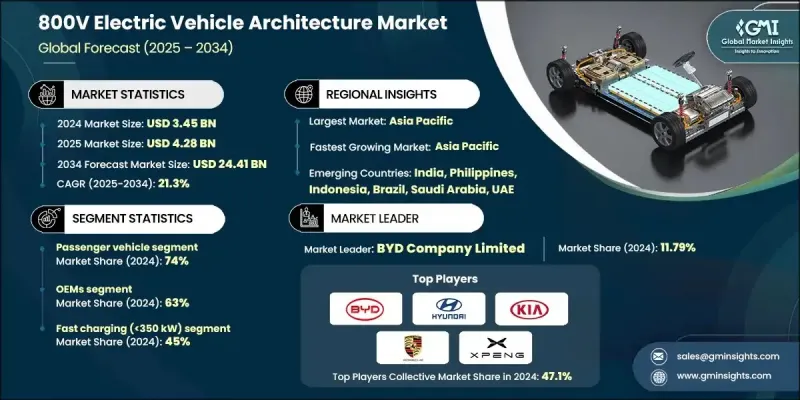

The Global 800V Electric Vehicle Architecture Market was valued at USD 3.45 billion in 2024 and is estimated to grow at a CAGR of 21.3% to reach USD 24.41 billion by 2034.

The adoption of 800V architectures is transforming the global EV industry by enabling faster charging, higher energy efficiency, reduced wiring weight, and superior thermal management. These high-voltage systems integrate batteries, inverters, motors, and onboard electronics to support ultra-fast charging and enhanced power output, making them essential for next-generation EVs. Investments and collaborations among OEMs, semiconductor suppliers, battery manufacturers, and power electronics companies are accelerating their deployment. The COVID-19 pandemic further boosted EV adoption and infrastructure development, as governments and manufacturers prioritized sustainability, low emissions, and contactless technologies. North America and Europe lead adoption due to advanced regulations, strong OEM presence, and charging infrastructure readiness. Ultra-fast charging networks capable of supporting 800V vehicles are expanding worldwide, reducing charging times from hours to minutes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.45 Billion |

| Forecast Value | $24.41 Billion |

| CAGR | 21.3% |

The passenger vehicle segment held a 74% share in 2024 and is forecasted to grow at a 20.8% CAGR through 2034. The growth is driven by consumer demand for high-performance EVs with extended driving ranges, rapid charging, and improved energy efficiency. Leading automakers are increasingly adopting 800V platforms to deliver faster acceleration and superior charging performance, responding to the rising preference for premium and technologically advanced EVs.

The OEM segment accounted for a 63% share in 2024 and is expected to grow at a CAGR of 20.4% from 2025 to 2034. OEMs are rapidly integrating high-voltage architectures into next-generation EVs to improve efficiency, thermal management, and charging speed. Companies are focusing on developing proprietary systems that reduce wiring complexity and optimize energy use, strengthening their competitive edge in the evolving EV market.

China 800V Electric Vehicle Architecture Market held a 40% share, generating USD 534.2 million in 2024. The country's leadership stems from a strong manufacturing ecosystem, government-backed incentives, and widespread adoption of high-voltage platforms by key automakers. Its integrated supply chain, from batteries to semiconductors and charging infrastructure, allows large-scale production and cost efficiency. China is aggressively expanding ultra-fast charging networks and leading innovations in battery technologies, further accelerating the transition to 800V systems.

Major players in the 800V Electric Vehicle Architecture Market include Hyundai Motor Company, Lucid Motors, BYD Company, Kia, Xpeng Motors, BorgWarner, Zeekr Automobile, NIO, Volkswagen, and Porsche. Companies in the 800V Electric Vehicle Architecture Market are adopting multiple strategies to enhance their market position. They are investing heavily in research and development to optimize high-voltage platforms, improve thermal management, and reduce wiring complexity. Strategic partnerships and collaborations with battery manufacturers, semiconductor suppliers, and infrastructure providers are accelerating technology deployment and ecosystem integration. OEMs are also focusing on launching premium, high-performance EV models with ultra-fast charging capabilities to attract tech-savvy and performance-oriented customers. Additionally, geographic expansion, local production, and supply chain optimization are helping companies lower costs, enhance scalability, and strengthen their global footprint in this rapidly growing market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Charging

- 2.2.4 Propulsion

- 2.2.5 Application

- 2.2.6 Architecture

- 2.2.7 Component

- 2.2.8 End Use

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in demand for faster charging and extended driving range

- 3.2.1.2 Surge in production of high-performance electric vehicles

- 3.2.1.3 Increase in government incentives and regulatory support for EVs

- 3.2.1.4 Growth in collaboration between OEMs and semiconductor suppliers

- 3.2.1.5 Rise in consumer preference for energy-efficient and premium EVs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of 800V components and integration

- 3.2.2.2 Limited availability of compatible charging infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Rise in adoption of 800V systems in commercial and fleet EVs

- 3.2.3.2 Surge in investment toward next-generation battery technologies

- 3.2.3.3 Increase in demand for 800V-ready autonomous and connected vehicles

- 3.2.3.4 Expansion of EV manufacturing in emerging economies

- 3.2.3.5 Growth in R&D toward lightweight, efficient power electronics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Future outlook & opportunities

- 3.13.1 Emerging Applications

- 3.13.2 Next-Generation Innovations

- 3.13.3 Investment Opportunities

- 3.14 Consumer Adoption & Market Readiness

- 3.15 Total Cost of Ownership (TCO) Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LAMEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Architecture, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Full 800V System

- 6.3 Hybrid / Boosted System

Chapter 7 Market Estimates & Forecast, By Charging, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Ultra-Fast Charging (>350 kW)

- 7.3 Fast Charging (<350 kW)

- 7.4 Standard Charging

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery electric vehicles (BEVs)

- 8.3 Plug-in hybrid electric vehicles (PHEVs)

- 8.4 Fuel cell electric vehicles (FCEVs)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Battery

- 10.3 Inverter

- 10.4 On-board Charger

- 10.5 Electric Motor

- 10.6 Power Distribution Module

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 Private

- 11.3 Commercial/Fleet

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Philippines

- 12.4.7 Indonesia

- 12.5 LAMEA

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 South Africa

- 12.5.5 Saudi Arabia

- 12.5.6 UAE

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 Audi (Volkswagen)

- 13.1.2 BMW

- 13.1.3 BYD Company

- 13.1.4 General Motors Company

- 13.1.5 Hyundai Motor

- 13.1.6 Kia

- 13.1.7 Lucid Motors

- 13.1.8 Mercedes-Benz

- 13.1.9 NIO

- 13.1.10 Porsche

- 13.1.11 Xpeng

- 13.2 Power Electronics & Semiconductor Suppliers

- 13.2.1 Hitachi

- 13.2.2 Infineon Technologies

- 13.2.3 ON Semiconductor

- 13.2.4 ROHM Semiconductor

- 13.2.5 STMicroelectronics

- 13.2.6 Wolfspeed

- 13.3 Charging Infrastructure Providers

- 13.3.1 ABB

- 13.3.2 ChargePoint

- 13.3.3 EVgo

- 13.3.4 Tritium DCFC

- 13.4 Battery & Energy Storage Suppliers

- 13.4.1 CATL

- 13.4.2 LG Energy Solution

- 13.4.3 Panasonic