PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876785

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876785

Dental Implants and Abutment Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

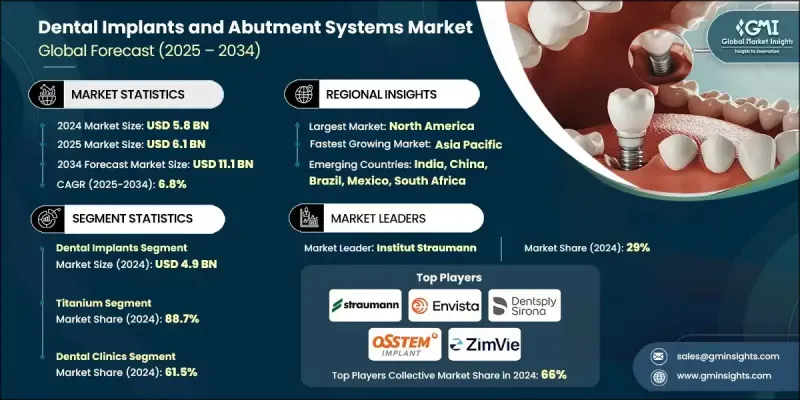

The Global Dental Implants and Abutment Systems Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 11.1 billion by 2034.

The growth is fueled by the rising elderly population worldwide, the increasing prevalence of dental disorders, and the growing demand for cosmetic dentistry. Technological advancements in implant materials and procedures in developed regions are also contributing to market expansion. As individuals age, they face greater risks of tooth loss, gum disease, and bone degradation, creating a strong demand for restorative dental solutions. Dental implants and abutment systems are designed to replace missing teeth, restoring both function and aesthetics. A dental implant serves as an artificial tooth root made from titanium or zirconia, surgically positioned in the jawbone to support crowns, bridges, or dentures. The abutment connects the prosthetic tooth to the implant, providing a durable, stable, and natural-looking replacement for lost teeth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $11.1 Billion |

| CAGR | 6.8% |

The market is divided into dental implants and abutment systems, with dental implants generating USD 4.9 billion in 2024 owing to their excellent biocompatibility and ability to integrate with bone tissue. Dental implants act as stable foundations for dental prosthetics, replicating the function and appearance of natural teeth.

The dental clinics segment held a 61.5% share in 2024. They serve as the primary point for implant procedures and are increasingly integrating digital workflows and customized implant solutions. Rising patient expectations for personalized care and high-quality treatments make dental clinics central to the adoption and success of dental implants and abutment systems.

North America Dental Implants and Abutment Systems Market generated USD 2.3 billion in 2024 and is projected to reach USD 4.2 billion by 2034. Growth in this region is driven by the high prevalence of dental disorders, growing oral health awareness, and the adoption of innovative dental technologies. Advances in digital workflows, minimally invasive techniques, and customized abutments are boosting the uptake of dental implants and abutment systems across North America.

Key players in the Dental Implants and Abutment Systems Market include Cortex, A.B. Dental Devices, Bicon, Envista Holdings Corporation, Biotem, Dentsply Sirona, Osstem Implant, ZimVie, Adin Dental Implant Systems, Dentalpoint, Ziacom, Henry Schein, TAV Dental, Institut Straumann, Glidewell, Keystone Dental Group, Cowellmedi, Dentium USA, Dynamic Abutment Solutions, BioHorizons, Ditron Dental, and BioThread Dental Implant Systems. Companies in the Dental Implants and Abutment Systems Market are pursuing several strategies to strengthen their market position. They focus on continuous research and development to improve implant materials, designs, and surgical techniques, enhancing product performance and patient outcomes. Strategic collaborations with dental clinics, hospitals, and distributors help expand market reach and improve service delivery. Companies are also investing in digital technologies for customized and minimally invasive solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expanding elderly population base across the globe

- 3.2.1.2 Growing prevalence of dental disorders worldwide

- 3.2.1.3 Rising demand for cosmetic dentistry across the world

- 3.2.1.4 Advancements in implant technology in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited reimbursement policies

- 3.2.2.2 High cost of dental implant treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Shift towards minimally invasive procedures

- 3.2.3.2 Expansion of dental tourism in emerging countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dental implants

- 5.2.1 Tapered implants

- 5.2.2 Parallel-walled implants

- 5.3 Abutment systems

- 5.3.1 Stock abutments

- 5.3.2 Custom abutments

- 5.3.3 Abutments fixation screws

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium

- 6.3 Zirconium

- 6.4 Other materials

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Dental clinics

- 7.4 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Dentsply Sirona

- 9.2 A.B. Dental Devices

- 9.3 Adin Dental Implant Systems

- 9.4 Bicon

- 9.5 Cortex

- 9.6 AVINENT Science and Material

- 9.7 Envista Holdings Corporation

- 9.8 Henry Schein

- 9.9 Institut Straumann

- 9.10 Osstem Implant

- 9.11 ZimVie

- 9.12 Biotem

- 9.13 Dentium USA

- 9.14 Ziacom

- 9.15 Dynamic Abutment Solutions

- 9.16 Keystone Dental Group

- 9.17 BHI Implants

- 9.18 Dentalpoint

- 9.19 Ditron Dental

- 9.20 Cowellmedi

- 9.21 TAV Dental

- 9.22 BioHorizons

- 9.23 National Dentex Labs

- 9.24 Glidewell

- 9.25 BioThread Dental Implant Systems