PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876793

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876793

Immunotherapy Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

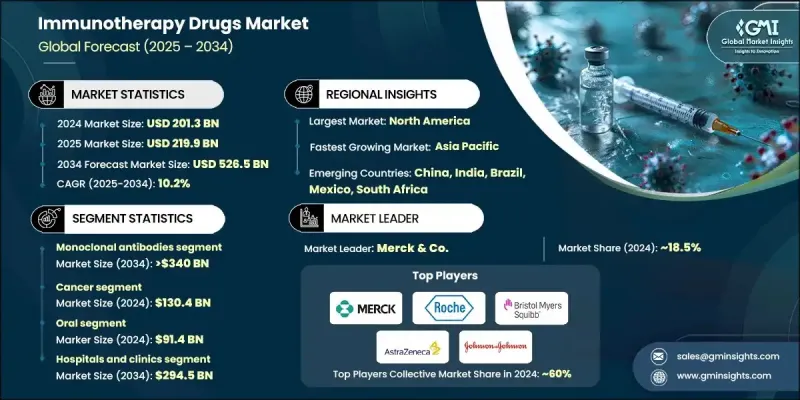

The Global Immunotherapy Drugs Market was valued at USD 201.3 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 526.5 billion by 2034.

The market expansion is influenced by the rising prevalence of chronic illnesses, including cancer, autoimmune, and infectious diseases, coupled with continuous innovation in antibody engineering. Advanced therapeutic technologies such as CAR-T cell therapy, bispecific antibodies, and immune checkpoint inhibitors are transforming treatment paradigms, offering improved efficacy and safety over conventional therapies. Artificial intelligence is accelerating drug discovery, while biomarker-driven clinical development is enhancing patient selection and treatment success rates. The ongoing shift toward precision and personalized medicine continues to strengthen market growth, as therapies designed around genetic and molecular profiles gain global acceptance. Emerging approaches such as neoantigen-based vaccines and biomarker-guided regimens are advancing rapidly, supported by progress in genomics, proteomics, and diagnostic tools that improve monitoring and outcomes. Immunotherapy drugs are designed to modify or regulate immune responses, helping the body combat various diseases through either immune activation or suppression mechanisms using biologically engineered substances such as antibodies or proteins.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $201.3 Billion |

| Forecast Value | $526.5 Billion |

| CAGR | 10.2% |

The monoclonal antibodies segment accounted for 63.3% share in 2024 and is expected to reach USD 340 billion by 2034, growing at a CAGR of 10.4%. The rising incidence of chronic conditions continues to drive strong demand for targeted biologics. Monoclonal antibodies have become a cornerstone of treatment due to their superior selectivity and reduced side effects compared to traditional pharmaceuticals. Their ability to target specific molecular pathways has made them indispensable in modern medical therapies and positioned them as one of the most valuable components of immunotherapy development worldwide.

The cancer segment generated USD 130.4 billion in 2024, maintaining its position as the leading therapeutic area within the global immunotherapy drugs market. The surge in global cancer cases and the ongoing evolution of advanced biological therapies are central to market expansion. Innovative treatments, including immune checkpoint modulators, monoclonal antibodies, and next-generation cell therapies, have redefined oncology care by improving patient survival and response rates. The autoimmune disease segment is also recording rapid growth as the focus shifts from generalized immune suppression to precision-targeted biologic therapies, resulting in better disease management and fewer adverse effects.

U.S. Immunotherapy Drugs Market reached USD 83.1 billion in 2024, reinforcing its global leadership position in research, development, and clinical innovation. The country's ecosystem of biotechnology startups, pharmaceutical giants, and strong federal support enables rapid commercialization of novel immunotherapies. Ongoing investments by companies such as Amgen, Pfizer, and Johnson & Johnson are expanding the pipeline of next-generation biologics and cellular therapies, with numerous investigational new drug approvals highlighting the nation's commitment to accelerating immunotherapy advancements.

Major participants in the Global Immunotherapy Drugs Market include Bristol Myers Squibb, AstraZeneca, Gilead Sciences, F. Hoffmann La Roche, Johnson & Johnson, Novartis, GlaxoSmithKline, Sanofi, Merck & Co., Moderna, Pfizer, Amgen, Kite Pharma, Adaptimmune Therapeutics, and Bluebird Bio. Key companies in the Global Immunotherapy Drugs Market are employing diverse strategies to enhance their global presence and strengthen competitiveness. They are expanding R&D programs targeting novel immune pathways and investing in next-generation biologics such as bispecific antibodies and CAR-T platforms. Strategic alliances, mergers, and acquisitions are enabling them to access cutting-edge technologies and accelerate clinical development timelines. Firms are also focusing on regional expansion, particularly in emerging economies, to increase access to advanced treatments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Application trends

- 2.2.4 Route of administration trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Technological advancement in antibody engineering

- 3.2.1.3 Growing demand for personalized and targeted therapies

- 3.2.1.4 Expansion into non-oncology applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and limited accessibility

- 3.2.2.2 Variable patient response and resistance

- 3.2.3 Market opportunities

- 3.2.3.1 Decentralized manufacturing and regional hubs

- 3.2.3.2 Personalized neoantigen vaccines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Monoclonal antibodies

- 5.3 Vaccines

- 5.4 Interferons alpha & beta

- 5.5 Interleukins

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Cancer

- 6.3 Autoimmune diseases

- 6.4 Infectious diseases

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Intravenous

- 7.3 Subcutaneous

- 7.4 Oral

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Cancer research institutes

- 8.4 Pharmaceutical and biotechnology companies

- 8.5 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adaptimmune Therapeutics

- 10.2 Amgen

- 10.3 AstraZeneca

- 10.4 Bristol Myers Squibb

- 10.5 Bluebird Bio

- 10.6 F. Hoffmann La Roche

- 10.7 GlaxoSmithKline

- 10.8 Gilead Sciences

- 10.9 Johnson & Johnson

- 10.10 Kite Pharma

- 10.11 Merck & Co.

- 10.12 Moderna

- 10.13 Novartis

- 10.14 Pfizer

- 10.15 Sanofi