PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876806

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876806

Recycled Thermoplastic Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

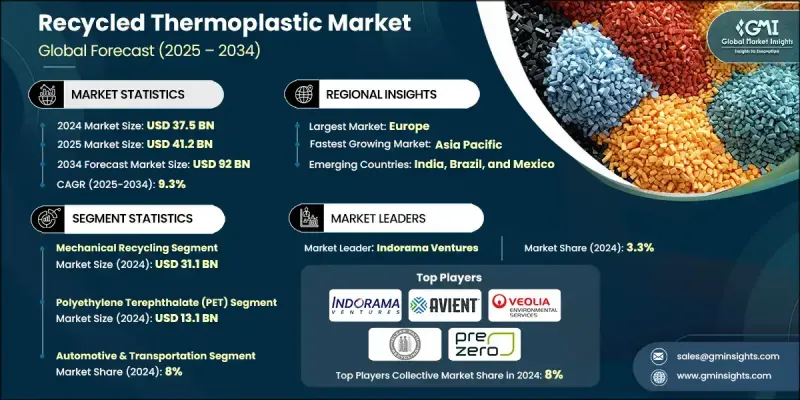

The Global Recycled Thermoplastic Market was valued at USD 37.5 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 92 billion by 2034.

The market is witnessing rapid adoption of advanced recycling technologies such as chemical depolymerization, enzymatic recycling, plasma processing, and microwave-assisted methods. These techniques enable the transformation of mixed, contaminated, and multilayer plastics into high-quality recycled polymers that meet the standards of virgin materials. Rising adoption of circular economy principles, growing consumer awareness, and strong government policies mandating minimum recycled content and restricting single-use plastics are fueling demand. Closed-loop systems and increased investments in recycling infrastructure are further enhancing the availability of recycled thermoplastics. The automotive, packaging, and electronics industries are among the primary end-users, leveraging these materials for sustainable manufacturing. Rising emphasis on eco-efficient production and high-value applications is expected to sustain consistent growth in the market over the coming decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.5 Billion |

| Forecast Value | $92 Billion |

| CAGR | 9.3% |

The advanced and hybrid recycling technologies segment is projected to grow at a CAGR The Global Recycled Thermoplastic Market was valued at USD 37.5 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 92 billion by 2034.

The market is witnessing rapid adoption of advanced recycling technologies such as chemical depolymerization, enzymatic recycling, plasma processing, and microwave-assisted methods. These techniques enable the transformation of mixed, contaminated, and multilayer plastics into high-quality recycled polymers that meet the standards of virgin materials. Rising adoption of circular economy principles, growing consumer awareness, and strong government policies mandating minimum recycled content and restricting single-use plastics are fueling demand. Closed-loop systems and increased investments in recycling infrastructure are further enhancing the availability of recycled thermoplastics. The automotive, packaging, and electronics industries are among the primary end-users, leveraging these materials for sustainable manufacturing. Rising emphasis on eco-efficient production and high-value applications is expected to sustain consistent growth in the market over the coming decade.

The advanced and hybrid recycling technologies segment is projected to grow at a CAGR of 9.8% through 2034. These methods can recycle complex and hard-to-process plastic waste streams while minimizing carbon footprint, producing high-performance polymers suitable for premium applications.

In 2024, the polyethylene Terephthalate (PET) accounted for USD 13.1 billion, driven by its use in beverage bottles, packaging, and recycled PET (rPET) fibers. PET recycling continues to expand, particularly for food-grade and textile applications, due to its high recyclability and versatility.

U.S. Recycled Thermoplastic Market reached USD 9.4 billion in 2024, supported by advanced recycling infrastructure and improved sorting and collection processes. Both the U.S. and Canada are investing heavily in mechanical and chemical recycling to enhance feedstock recovery and material quality. Key demand stems from the packaging, automotive, and electronics sectors, with increasing focus on closed-loop systems and circular economy initiatives.

Leading players in the Global Recycled Thermoplastic Market include PreZero Polymers AG, Veolia Environmental Services, Eastman Chemical Company, KW Plastics Manufacturing, Loop Industries Inc., Republic Services Inc., Carbios SA, Lyondell Basell, Biffa plc, Remondis Recycling GmbH, Plastipak Holdings Inc., SUEZ Recycling & Recovery, Avient Corporation, Clear Path Recycling, and Indorama Ventures Public Company Limited. Companies in the Recycled Thermoplastic Market are employing multiple strategies to enhance their market position and expand their reach. These include investing in advanced chemical and mechanical recycling technologies to improve polymer quality, expanding processing capacity, and establishing partnerships with feedstock suppliers to secure consistent input. Many players are focusing on developing closed-loop systems and high-performance recycled polymers to cater to premium end-use applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Processing method

- 2.2.3 Product type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa (MEA)

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By processing method

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Mechanical recycling

- 5.2.1 Collection & sorting systems

- 5.2.2 Washing & cleaning processes

- 5.2.3 Shredding & size reduction

- 5.2.4 Melting & pelletizing

- 5.3 Chemical recycling

- 5.3.1 Pyrolysis technologies

- 5.3.2 Depolymerization processes

- 5.3.3 Gasification methods

- 5.3.4 Solvolysis techniques

- 5.3.5 Catalytic cracking

- 5.3.6 Enzymatic depolymerization

- 5.4 Advanced technologies

- 5.4.1 Bio based recycling methods

- 5.4.2 Plasma based technologies

- 5.4.3 Microwave enhanced processing

- 5.4.4 Other emerging technologies

Chapter 6 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 PET

- 6.3 HDPE

- 6.4 LDPE

- 6.5 PP

- 6.6 PS

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Packaging

- 7.2.1 Food & beverage containers

- 7.2.2 Non-food packaging

- 7.2.3 Flexible packaging & films

- 7.2.4 Caps & closures

- 7.3 Automotive & transportation

- 7.3.1 Interior components

- 7.3.2 Under-hood applications

- 7.3.3 Exterior panels & trim

- 7.3.4 Battery housing & EV components

- 7.4 Building & construction

- 7.4.1 Pipes & fittings

- 7.4.2 Insulation materials

- 7.4.3 Roofing & decking

- 7.4.4 Window profiles

- 7.5 Electronics & electrical

- 7.5.1 Device housings

- 7.5.2 Connectors & components

- 7.5.3 Cable insulation

- 7.6 Consumer goods & furniture

- 7.6.1 Household items

- 7.6.2 Outdoor furniture

- 7.6.3 Toys & sporting goods

- 7.7 Agriculture & horticulture

- 7.7.1 Greenhouse films

- 7.7.2 Irrigation systems

- 7.7.3 Plant pots & containers

- 7.8 Textiles & apparel

- 7.8.1 Synthetic fibers

- 7.8.2 Carpeting & flooring

- 7.8.3 Non-woven fabrics

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Avient Corporation

- 9.2 Biffa plc

- 9.3 Carbios SA

- 9.4 Clear Path Recycling

- 9.5 Eastman Chemical Company

- 9.6 Indorama Ventures Public Company Limited

- 9.7 KW Plastics Manufacturing

- 9.8 Loop Industries Inc.

- 9.9 Lyondell Basell

- 9.10 Plastipak Holdings Inc.

- 9.11 PreZero Polymers AG

- 9.12 Remondis Recycling GmbH

- 9.13 Republic Services Inc.

- 9.14 SUEZ Recycling & Recovery

- 9.15 Veolia Environmental Services