PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910709

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910709

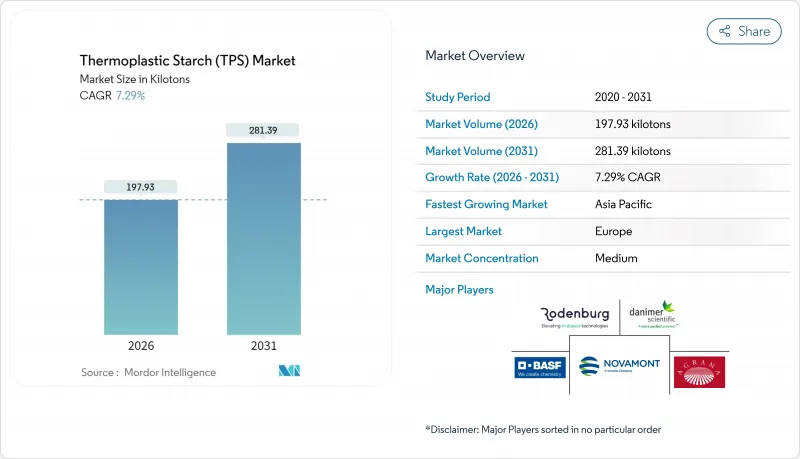

Thermoplastic Starch (TPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Thermoplastic Starch market size in 2026 is estimated at 197.93 kilotons, growing from 2025 value of 184.49 kilotons with 2031 projections showing 281.39 kilotons, growing at 7.29% CAGR over 2026-2031.

Continuous improvements in moisture-barrier performance, coupled with mechanical-strength gains achieved through compatibilizer and nanocomposite technologies, are removing long-standing functional barriers. European legislation that prioritizes compostability, North American e-commerce fulfillment demands, and Asia-Pacific government stimulus for bio-based materials are jointly expanding the thermoplastic starch market's addressable applications. Price volatility in corn and potato starch feedstocks has raised supply-chain risk, yet parallel progress in non-food alternatives such as cassava and agricultural residues is buffering cost exposure. Competition remains intense but fragmented, with established chemical majors leveraging scale while specialists round out product portfolios for niche medical, 3-D printing, and premium packaging uses.

Global Thermoplastic Starch (TPS) Market Trends and Insights

Rising Demand for Biodegradable Packaging

New EU Packaging and Packaging Waste Regulation rules, effective February 2025, legally require recyclability while encouraging industrial and home-compostable substrates, instantly enlarging the thermoplastic starch market. Parallel breakthroughs in epoxidized soybean-oil plasticizers have lowered water sensitivity by 28.6% without losing optical clarity. Multinational brand owners now treat compostable packaging as a premium differentiator, and 73% of consumers in developed economies are willing to pay higher prices for verified sustainable solutions. Converter-starch-processor partnerships that cut intermediaries are cementing long-term contracts, thereby supporting capacity expansions. The combined regulatory and commercial pull is translating into faster specification approvals across food, beverage, and personal-care verticals, further solidifying thermoplastic starch market growth trajectories.

Ban on Single-Use Plastics in Major Economies

More than 67 nations enforced single-use plastic restrictions by 2024, closing the compliance window for incumbent petro-based products. China's bamboo-as-plastic-substitute policy and financial incentives have catalyzed domestic demand for bio-materials. The EU Single-Use Plastics Directive has pushed major quick-service restaurants to require biodegradable utensils, while Australia's state-level bans on starch-polypropylene blends illustrate tightening purity thresholds. Regulatory fragmentation creates a premium niche for pure thermoplastic starch formulations meeting strict biodegradability standards. The accelerated enforcement pace points to an enduring, structural shift away from petroleum plastics, thus feeding the thermoplastic starch market.

Moisture Sensitivity Limiting Shelf-Life

The hydrophilic nature of starch results in water-vapor transmission rates up to 5 times higher than LDPE, curbing adoption in tropical zones. Nanocrystalline-cellulose reinforcement can slash moisture uptake by 40%, yet production costs jump 25-35%, challenging price-sensitive segments. Food products that require 12-month shelf lives typically experience quality degradation in 30-60 days when packaged purely in thermoplastic starch films. Climate-controlled logistics add as much as 15% to distribution costs in humid markets. These technical and logistical penalties temporarily limit the thermoplastic starch market's penetration rate until next-generation barrier chemistries become commercial at scale.

Other drivers and restraints analyzed in the detailed report include:

- Brand-Owner Sustainability Pledges Beyond Regulatory Mandates

- Pharma Blister-Pack Replacement Trials with TPS Composites

- Inferior Mechanical Strength Vs. Petro-Plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Extrusion molding delivered 57.72% of the thermoplastic starch market share in 2025, buoyed by its continuous processing economics and adaptability to high-volume flexible-film lines. The process allows inline plasticizer dosing and rapid order changeovers, keeping per-unit costs low and securing orders from snack-food and produce-bag converters. Injection molding, although smaller, is forecast at a 7.73% CAGR as brand owners pursue precision components such as pharmaceutical caps and cosmetic jars that demand tighter dimensional tolerances. Continuous enhancements in reciprocating-screw designs now reduce residence-time degradation by 20%, lifting mechanical integrity and widening the addressable range of thin-wall items.

Manufacturers diversify across both platforms to hedge demand swings. Extrusion systems remain the backbone for commodity films, but capacity additions tilt toward multi-purpose lines that switch between sheet, blown film, and profile extrusion to maximize asset utilization. Injection equipment suppliers embed servo-electric drives to enhance energy efficiency, narrowing the cost gap with hydraulic machines. As equipment prices fall, small and medium enterprises gain entry, expanding regional competition and deepening the thermoplastic starch market across emerging economies.

The Thermoplastic Starch Report is Segmented by Manufacturing Type (Extrusion Molding and Injection Molding), Application (Bags, Films, 3-D Printing, and Other Applications), End-User Industry (Packaging, Agriculture and Horticulture, Consumer Goods, and More), and Geography ( Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Kilotons).

Geography Analysis

Europe's 39.32% share of the thermoplastic starch market in 2025 is rooted in clear legislative frameworks, mature composting systems, and strong consumer acceptance. Member-state waste-sorting targets incentivize municipal investments in organics collection, ensuring true circularity and validating demand for starch-based materials. Feedstock pressure, however, surfaced when corn prices spiked and AGRANA reported a 26% drop in corn processing volumes in 2024, highlighting supply-chain risk.

Asia-Pacific is forecast to deliver the fastest 8.22% CAGR through 2031, anchored by China's bio-material subsidies and India's widening biopolymer capacity. Regional advantages include abundant agricultural residues and growing domestic demand for sustainable, flexible packaging. Local processors leverage government grants to add reactive-extrusion lines, thereby accelerating market entry and intensifying competition. The thermoplastic starch market thus transitions from export-oriented pockets to a broad regional production base.

North America benefits from e-commerce penetration and rising retailer sustainability benchmarks. Municipal organics programs in California and Washington state create a natural outlet for compostable waste streams, reinforcing demand among direct-to-consumer brands. South America's starch abundance positions the region as a feedstock exporter, yet limited downstream processing capacity delays domestic consumption. Middle East and Africa remain nascent, with uptake tied to future waste-infrastructure modernization and agricultural water-conservation programs that could favor biodegradable mulch films.

- AGRANA

- BASF

- BioLogiQ Inc.

- Biome Bioplastics

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- Danimer Scientific

- Great Wrap

- Grupa Azoty

- Kuraray Co., Ltd

- Novamont S.p.A (Versalis S.p.A.)

- Rodenburg Biopolymers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Biodegradable Packaging

- 4.2.2 Ban on Single-Use Plastics in Major Economies

- 4.2.3 Brand-Owner Sustainability Pledges Beyond Regulatory Mandates

- 4.2.4 Shift Toward Home-Compostable E-Commerce Mailers

- 4.2.5 Pharma Blister-Pack Replacement Trials with TPS Composites

- 4.3 Market Restraints

- 4.3.1 Moisture Sensitivity Limiting Shelf-Life

- 4.3.2 Inferior Mechanical Strength Vs. Petro-Plastics

- 4.3.3 Food-Versus-Materials Debate around Starch Feedstock

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Manufacturing Type

- 5.1.1 Extrusion Molding

- 5.1.2 Injection Molding

- 5.2 By Application

- 5.2.1 Bags

- 5.2.2 Films

- 5.2.3 3-D Printing

- 5.2.4 Other Applications

- 5.3 By End-User Industry

- 5.3.1 Packaging

- 5.3.2 Agriculture and Horticulture

- 5.3.3 Consumer Goods

- 5.3.4 Medical and Pharmaceuticals

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Nordics

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AGRANA

- 6.4.2 BASF

- 6.4.3 BioLogiQ Inc.

- 6.4.4 Biome Bioplastics

- 6.4.5 BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- 6.4.6 Danimer Scientific

- 6.4.7 Great Wrap

- 6.4.8 Grupa Azoty

- 6.4.9 Kuraray Co., Ltd

- 6.4.10 Novamont S.p.A (Versalis S.p.A.)

- 6.4.11 Rodenburg Biopolymers

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment