PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876811

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876811

Europe Smart Lock Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

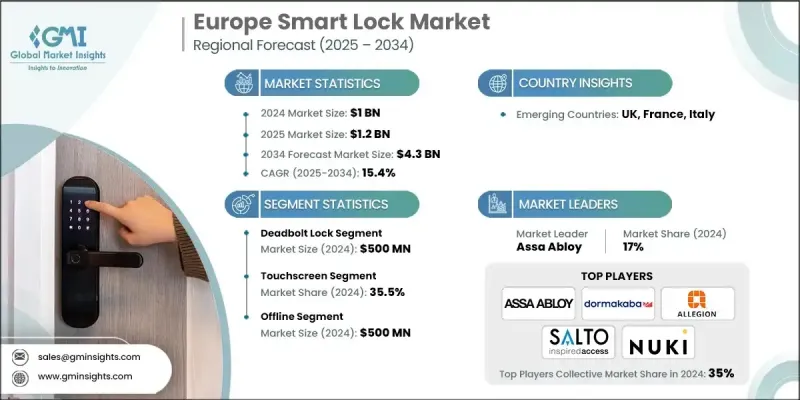

Europe Smart Lock Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 15.4% to reach USD 4.3 billion by 2034.

Rising incidents of burglaries, intrusions, and unauthorized access have heightened the need for advanced home and workplace security systems. Conventional locking mechanisms are increasingly seen as insufficient, particularly in densely populated urban environments where the risk of theft is higher. Smart locks address these modern security concerns by offering real-time alerts, tamper detection, and remote access control that allows users to monitor and manage entry from any location. Additionally, features such as access history tracking and the ability to create temporary digital keys add a new level of flexibility, transparency, and control for property owners. These advantages are particularly beneficial for households with children or elderly family members, shared living spaces, and the expanding short-term rental market. As consumers recognize the benefits of greater accountability, control, and ease of use, smart locking systems are becoming a natural extension of the evolving smart home ecosystem across Europe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 15.4% |

In 2024, the deadbolt lock segment generated USD 500 million. Deadbolt locks are considered a key component in smart locking systems because of their superior resistance to break-ins compared to traditional spring bolt mechanisms. In smart systems, these deadbolts are electronically driven and integrated with digital access management platforms. This combination provides the durability of a strong mechanical lock along with modern electronic functions such as remote locking, tamper notifications, and automatic security engagement. The integration of strong hardware with digital intelligence continues to attract both residential and commercial users seeking higher protection standards.

The touchscreen segment captured 35.5% share in 2024, emerging as the leading interface type in the Europe smart lock industry. Touchscreen systems replace conventional keys with PIN-based digital access, offering both convenience and a sleek, modern aesthetic. These solutions enhance user experience by eliminating the need for physical keys while allowing personalized access through programmable or time-restricted PIN codes. This functionality is particularly valuable for residential and hospitality sectors, where user-specific access and fast, secure entry are priorities. The growing preference for touch-based interfaces aligns with the broader shift toward digitally connected and automated living spaces.

Germany Smart Lock Market held a 29.6% share and generated USD 310 million. The country's strong adoption of connected devices and smart home technologies has been instrumental in shaping regional growth. European consumers are increasingly seeking integrated solutions that combine convenience, energy efficiency, and enhanced home security. Smart locks compatible with home automation systems and voice assistants are especially appealing. However, given Europe's stringent data protection regulations, particularly the General Data Protection Regulation (GDPR), companies operating in the region are prioritizing data privacy and security. Manufacturers are developing encryption-based communication systems and privacy-focused solutions to ensure user data remains protected while maintaining functionality and convenience.

Prominent players operating in the Europe Smart Lock Market include Yale Locks, Salto Systems S.L., Dormakaba, U-tec Group, Schlage, Allegion, Onity, Nuki Home Solutions, Honeywell International, Spectrum Brands, Avent Security, UniKey Technologies, Cansec Systems, August Home, and Assa Abloy. Companies in the Europe Smart Lock Market are focusing on innovation, product diversification, and partnerships to strengthen their market presence. Major manufacturers are investing heavily in research and development to design advanced locking systems with improved cybersecurity, energy efficiency, and seamless integration with smart home platforms. Strategic collaborations with home automation providers and IoT technology firms are helping companies expand connectivity features and enhance product compatibility. Firms are also emphasizing compliance with regional privacy regulations such as GDPR to build consumer trust and ensure data protection.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product type

- 2.2.3 Unlocking mechanism

- 2.2.4 Connectivity type

- 2.2.5 Price range

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising security awareness

- 3.2.1.2 Increase in adoption of smart homes

- 3.2.1.3 Integration of enhanced features with traditional lock systems

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of adoption

- 3.2.2.2 Security concerns

- 3.2.3 Opportunities

- 3.2.3.1 Biometric and AI integration

- 3.2.3.2 Cloud-based access management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By country

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Deadbolt lock

- 5.3 Lever handle

- 5.4 Padlock

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Unlocking Mechanism, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Keyboard

- 6.3 Touchscreen

- 6.4 App Based

- 6.5 Hybrid

- 6.6 Biometric

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Price Range, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (<100$)

- 7.3 Mid (100$-300$)

- 7.4 High (>300$)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.1.1 Commercial

- 8.1.1.1 HoReCa

- 8.1.1.2 Hospitals

- 8.1.1.3 Offices

- 8.1.1.4 Malls

- 8.1.1.5 Others

- 8.1.2 Residential

- 8.1.2.1 Condominium

- 8.1.2.2 Individual Houses

- 8.1.3 Industrial

- 8.1.4 Government

- 8.1.5 Transportation and Logistics

- 8.1.5.1 Trucks

- 8.1.5.2 Airports

- 8.1.5.3 Others

- 8.1.6 Others

- 8.1.1 Commercial

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Europe

- 10.2.1 Germany

- 10.2.2 UK

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

Chapter 11 Company Profiles

- 11.1 Allegion

- 11.2 Assa Abloy

- 11.3 Avent Security

- 11.4 August Home

- 11.5 Cansec Systems

- 11.6 Dormakaba

- 11.7 Honeywell International

- 11.8 Nuki Home Solutions

- 11.9 Onity

- 11.10 Salto Systems S.L.

- 11.11 Schlage

- 11.12 Spectrum Brands

- 11.13 U-tec Group

- 11.14 UniKey Technologies

- 11.15 Yale Locks