PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876818

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876818

Recycled Carbon Fiber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

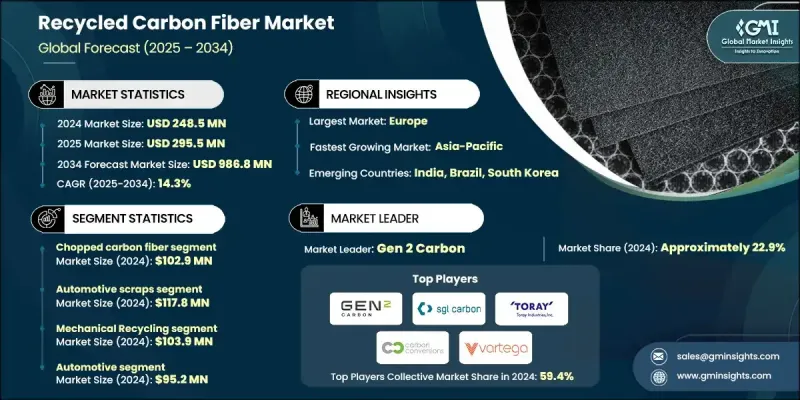

The Global Recycled Carbon Fiber Market was valued at USD 248.5 million in 2024 and is estimated to grow at a CAGR of 14.3% to reach USD 986.8 million by 2034.

Market growth is fueled by the increasing push to reduce the environmental impact of primary carbon fiber production, prompting Original Equipment Manufacturers to integrate rCF in electric vehicle components and lightweight automotive interiors. Companies such as Vartega and ELG Carbon Fibre have expanded their production capacities to meet growing demand. Government-backed research initiatives, particularly in the transportation sector, are promoting rCF for enhanced vehicle efficiency and lower emissions. Advances in pyrolysis and solvolysis are enabling longer fiber strands, making structural applications more feasible. Aerospace and automotive industries are scaling the use of rCF in interiors, plastic reinforcements, and underbody components. China has also intensified efforts, developing recycling hubs to manage wind turbine blades and composite waste. The transition from niche applications to scalable commercial production is supported by circular economy policies and cleaner composite processing technologies. Innovations in fiber recovery, including low-temperature pyrolysis and chemical solvolysis, are enhancing fiber length and strength. Companies such as Vartega and Carbon Conversions are producing rCF with near-virgin quality suitable for thermoplastics and sheet molding compounds, enabling applications in high-performance consumer electronics and sporting goods where finish and performance are critical.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $248.5 Million |

| Forecast Value | $986.8 Million |

| CAGR | 14.3% |

The chopped carbon fiber segment was valued at USD 102.9 million in 2024 and is expected to grow at a CAGR of 13.1% through 2034. Chopped and milled rCF is widely used due to its ease of integration with thermoplastics and resins, particularly in automotive and electronics manufacturing. Injection molding of these fibers has enabled mass production of lightweight components, with consistent fiber sizing being a key focus for OEMs.

The automotive scrap-based rCF was valued at USD 117.8 million in 2024, with a projected CAGR of 17% from 2025 to 2034. Rising volumes of automotive and industrial waste, accelerated by the electric vehicle boom and stricter landfill regulations, are driving this segment. Shredded CFRP waste is increasingly processed into chopped and milled fibers for injection molding applications. Wind turbine blade recycling is also gaining traction in Europe, with advanced methods being piloted to recover materials from mixed sources.

U.S. Recycled Carbon Fiber Market was valued at USD 58.5 million in 2024 and is expected to grow at a CAGR of 14.4% through 2034. Demand is driven by lightweighting initiatives, increased EV adoption, and regulatory pressure on landfill waste. Companies like Carbon Conversions and Vartega have partnered with domestic automakers, while the Department of Energy supports innovation in automotive-focused recycling. U.S.-based industrial recycling hubs offer opportunities to scale production as OEMs increasingly adopt circular manufacturing practices.

Key players in the Global Recycled Carbon Fiber Market include Vartega, Gen 2 Carbon, Toray Industries, Carbon Conversions, and SGL Carbon. To strengthen their foothold, companies in the recycled carbon fiber sector are investing heavily in research and development to improve fiber recovery, maintain structural integrity, and enhance the quality of rCF. Strategic partnerships with automotive and aerospace OEMs allow firms to secure long-term supply contracts and scale production. Firms are also expanding their global production capacity to meet rising demand and adopting circular economy practices to attract environmentally conscious clients. Technological innovation in pyrolysis, solvolysis, and low-temperature processing ensures near-virgin quality fibers, enabling entry into high-value applications like consumer electronics and sports equipment.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Source

- 2.2.4 Recycling Method

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2025 - 2034 (USD Million, Kilo Tons)

- 5.1 Chopped carbon fiber

- 5.2 Milled carbon fiber

- 5.3 Carbon fiber mat

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Source, 2025 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive scrap

- 6.3 Aerospace scrap

- 6.4 Other

Chapter 7 Market Estimates and Forecast, By Recycling Method, 2025 - 2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Mechanical Recycling

- 7.3 Chemical Recycling

- 7.4 Pyrolysis

- 7.5 Solvolysis

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2025 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 Aerospace and Defense

- 8.3 Automotive

- 8.4 Wind Energy

- 8.5 Sports and Leisure

- 8.6 Construction

- 8.7 Electronics

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Million, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Gen 2 Carbon

- 10.2 Carbon Conversions

- 10.3 Vartega

- 10.4 SGL Carbon

- 10.5 Toray Industries

- 10.6 Mitsubishi Chemical

- 10.7 Procotex Corporation

- 10.8 Shocker Composites

- 10.9 Carbon Fiber Recycling

- 10.10 CFK Valley Stade

- 10.11 Zoltek (Toray Group)

- 10.12 Karborek

- 10.13 Alpha Recyclage

- 10.14 Sigmatex

- 10.15 Carbon Clean Tech

- 10.16 Recycled Carbon Fiber Ltd

- 10.17 Composite Recycling Ltd

- 10.18 Adherent Technologies

- 10.19 Carbon Fiber Remanufacturing

- 10.20 Fiberline Composites