PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876828

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876828

Companion Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

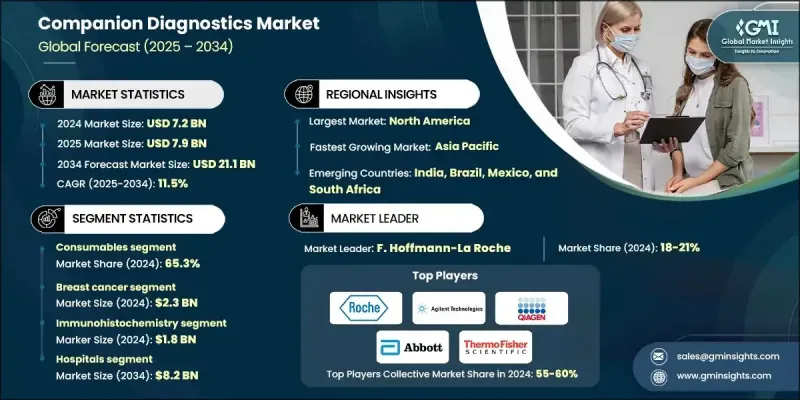

The Global Companion Diagnostics Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 21.1 billion by 2034.

Market growth is driven by the rising prevalence of cancer, the growing incidence of adverse drug reactions, and the rapid adoption of precision medicine. Companion diagnostics are specialized medical tests that help identify patients who are most likely to respond positively to a particular therapy. By detecting specific biomarkers or genetic variations that influence drug response, these diagnostics enable more accurate, personalized treatment decisions. The use of companion diagnostics reduces the risk of side effects, enhances therapeutic efficacy, and aligns with the global shift toward individualized healthcare. Their increasing integration into clinical protocols, especially in oncology, immunology, and chronic disease management, reflects their growing role in optimizing treatment outcomes. As adverse drug reactions continue to pose major challenges in modern healthcare, both regulatory agencies and healthcare providers are emphasizing the adoption of diagnostics that minimize patient risk and improve drug safety. This growing awareness, combined with technological progress and the expansion of biomarker research, continues to strengthen the companion diagnostics market worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 11.5% |

The consumables segment accounted for a 65.3% share in 2024. This category includes single-use products such as cartridges, assay reagents, test kits, and sample preparation materials that are vital for conducting diagnostic assays. The continuous demand for consumables in clinical laboratories drives consistent revenue streams, as they are required for every test performed. Unlike diagnostic instruments, which represent a one-time capital expense, consumables ensure ongoing product demand, making them a crucial growth driver for suppliers and manufacturers across the sector.

The breast cancer segment was valued at USD 2.3 billion in 2024. The widespread incidence of breast cancer has created a strong need for diagnostic tools capable of identifying specific molecular markers that guide therapy selection. The move toward personalized treatment approaches for subtypes such as HER2-positive and hormone receptor-positive breast cancers has resulted in increasing testing volumes. Additionally, collaborations between pharmaceutical and diagnostic companies are advancing biomarker-driven solutions, boosting market expansion and innovation in oncology diagnostics.

U.S. Companion Diagnostics Market reached USD 2.7 billion in 2024, supported by the rising cancer burden and increasing focus on targeted medicine. With cancer rates continuing to rise across the nation, the demand for accurate and efficient diagnostic platforms is intensifying. Companion diagnostics are being rapidly integrated into precision oncology, helping physicians customize treatment strategies based on tumor genetics and individual patient profiles. This approach enhances therapy success rates and minimizes adverse effects, making diagnostic-guided treatment a central part of modern cancer care in the United States.

Leading companies operating within the Global Companion Diagnostics Market include Pfizer, Merck, AstraZeneca, Thermo Fisher Scientific, F. Hoffmann-La Roche, Abbott Laboratories, Amgen, Johnson & Johnson, Bristol Myers Squibb, Eli Lilly and Company, Myriad Genetics, Guardant Health, Foundation Medicine, Biogen, and Becton, Dickinson and Company. Key players in the Companion Diagnostics Market are employing a range of strategies to strengthen their competitive positions. Many are forming long-term collaborations with pharmaceutical firms to co-develop targeted therapies and companion tests that align with new drug launches. Companies are also investing heavily in biomarker discovery and next-generation sequencing technologies to enhance the accuracy and predictive power of diagnostic assays. Strategic mergers and acquisitions are expanding their global reach and diversifying product portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Products trends

- 2.2.3 Disease indication trends

- 2.2.4 Technology trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Upward trend in disease prevalence among developing countries

- 3.2.1.2 Surging number of pathology labs and services equipped with advanced diagnostic equipment in North America

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing R&D investment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of product development

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand in remote and rural areas

- 3.2.3.2 Integration with digital health platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Disease Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Breast cancer

- 6.3 Lung cancer

- 6.4 Colorectal cancer

- 6.5 Skin cancer

- 6.6 Other diseases indications

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Immunohistochemistry

- 7.3 In situ hybridization

- 7.4 Polymerase chain reaction

- 7.5 Genetic sequencing

- 7.6 Other technologies

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic laboratories

- 8.4 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Amgen

- 10.3 AstraZeneca

- 10.4 Becton, Dickinson and Company

- 10.5 Biogen

- 10.6 Bristol Myers Squibb

- 10.7 Eli Lilly and Company

- 10.8 F. Hoffmann-La Roche

- 10.9 Foundation Medicine

- 10.10 Guardant Health

- 10.11 Johnson & Johnson

- 10.12 Merck

- 10.13 Myriad Genetics

- 10.14 Pfizer

- 10.15 Thermo Fisher Scientific