PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885792

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885792

US Data Center Renovation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

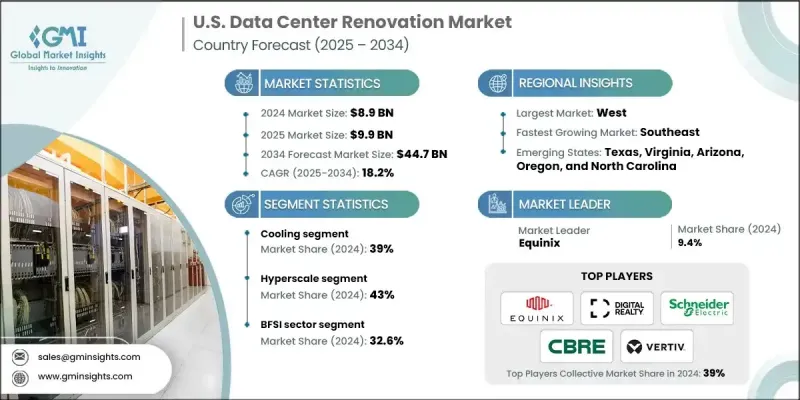

U.S. Data Center Renovation Market was valued at USD 8.9 billion in 2024 and is estimated to grow at a CAGR of 18.2% to reach USD 44.7 billion by 2034.

Market growth is driven by the nation's rapidly expanding digital infrastructure, increasing data traffic, and the need to modernize aging data center facilities to meet high-density computing demands. The transition toward AI workloads, hyperscale cloud adoption, and edge computing requires enhanced power distribution, cooling efficiency, and space optimization. Enterprises are increasingly prioritizing renovation over new construction to reduce costs, accelerate deployment, and comply with emerging energy-efficiency and sustainability regulations. As cyber threats intensify, modernization also includes robust upgrades to security, monitoring, and automation systems to maintain operational continuity in mission-critical environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $44.7 Billion |

| CAGR | 3.4% |

The cooling segment held a 39% share in 2024, driven by the explosive growth of AI and high-density computing workloads. Traditional air-cooling systems are rapidly becoming insufficient as GPU-accelerated servers generate far greater heat loads than conventional IT equipment, with accelerated servers expected to drive nearly 30% annual growth in server electricity consumption, contributing to 70% of server-driven electricity growth between 2025 and 2030

The hyperscale segment will grow at a CAGR of 19.4% through 2034, driven by surging AI workloads, large-scale cloud expansion, and the increasing intensity of compute demands among major cloud and tech service providers. Hyperscale facilities require continuous upgrades to power distribution, cooling systems, and rack infrastructure to sustain unprecedented power densities and operational complexity.

The Southeast Data Center Renovation Market reached USD 2.35 billion in 2024, supported by its large concentration of enterprise data centers, rising colocation expansions, and strong adoption of cloud and edge infrastructure. States such as Texas, Virginia, Georgia, and Florida are leading renovation activities due to growing power demands, grid modernization efforts, and attractive tax incentives supporting infrastructure upgrades. The region's expanding technology sector, combined with a surge in AI, financial services, and hyperscale operations, continues to drive investment in data center modernization. Additionally, increasing sustainability commitments in the South are fueling the adoption of energy-efficient cooling and electrical systems, positioning the region as a key driver of long-term market growth.

Major companies in the U.S. Data Center Renovation Market include ABB Ltd., AECOM, Caterpillar Inc., Cummins Inc., DPR Construction, Eaton Corporation, Legrand, Schneider Electric, Siemens AG, and Vertiv Group Corp. Companies in the U.S. Data Center Renovation Market are implementing multifaceted strategies to reinforce their presence and meet rising modernization needs. A primary focus is on expanding specialized renovation services, including advanced cooling retrofits, modular power upgrades, and resiliency enhancements that address high-density computing challenges. Firms are integrating AI-enabled monitoring, automation tools, and digital twin modeling to optimize renovation accuracy and reduce downtime. Strategic partnerships with cloud providers, hyperscalers, and construction firms help companies broaden their project pipelines and accelerate deployment capabilities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Data Center

- 2.2.4 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 AI/ML workload density requirements

- 3.2.1.2 Energy efficiency mandates & sustainability pressures

- 3.2.1.3 Aging infrastructure & equipment lifecycle replacement

- 3.2.1.4 Power grid constraints & transmission bottlenecks

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment requirements

- 3.2.2.2 Technical complexity & downtime risk management

- 3.2.3 Market opportunities

- 3.2.3.1 Liquid cooling retrofit market expansion

- 3.2.3.2 Waste heat recovery & energy as-a-service-models

- 3.2.3.3 Tier upgrade certification services

- 3.2.3.4 Federal & state incentive program utilization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Federal regulatory environment

- 3.4.2 State-level regulatory analysis

- 3.4.3 Industry standards & certifications

- 3.4.4 Regulatory compliance cost analysis

- 3.5 Future policy & regulatory trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.1.1 Power and electrical infrastructure solutions

- 3.8.1.2 Cooling technology solutions

- 3.8.1.3 IT infrastructure & rack systems

- 3.8.1.4 Monitoring and management systems

- 3.8.2 Emerging technologies

- 3.8.2.1 AI driven infrastructure transformation

- 3.8.2.2 Advanced cooling technology evolution

- 3.8.2.3 Modular and prefabricated solutions

- 3.8.2.4 Automation and AI enabled operations

- 3.8.3 Technology adoption lifecycle & market readiness

- 3.8.3.1 Mainstream technology maturity assessment

- 3.8.3.2 Emerging technology adoption patterns

- 3.8.3.3 Innovation pipeline and future readiness

- 3.8.1 Current technological trends

- 3.9 Cost breakdown analysis

- 3.9.1 Capital expenditure analysis

- 3.9.2 Operational expenditure impact

- 3.9.3 Total cost of ownership (TCO) analysis

- 3.10 Patent analysis

- 3.10.1 Patent innovation trends & technology hotspots

- 3.10.2 Key patent assignees & competitive landscape

- 3.10.3 Technology maturity, gaps and trends

- 3.11 Sustainability and environmental aspects

- 3.11.1 Environmental impact assessment

- 3.11.2 ESG investment drivers

- 3.11.3 Green building certifications & standards

- 3.11.4 Renewable energy integration

- 3.11.5 Circular economy & material reuse

- 3.12 Workforce & skill gap analysis

- 3.12.1 Current workforce assessment

- 3.12.2 Skill gap identification

- 3.12.3 Training & development programs

- 3.12.4 Workforce development strategies

- 3.12.5 Labor cost impact analysis

- 3.13 Use cases

- 3.13.1 Hyperscale AI data center retrofit

- 3.13.2 Colocation ESG modernization

- 3.13.3 Edge data center for smart city

- 3.13.4 Enterprise ESG & compliance renovation

- 3.13.5 Modular data center for disaster resilience

- 3.14 Best case scenario

- 3.14.1 AI-ready, net-zero data center cluster

- 3.14.2 Circular economy innovation hub

- 3.14.3 Edge-enabled smart city

- 3.14.4 Regulatory first-mover advantage

- 3.14.5 Workforce-led digital transformation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Northeast

- 4.2.2 Southeast

- 4.2.3 Midwest

- 4.2.4 West

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Cooling

- 5.3 Power

- 5.4 IT Racks & enclosures

- 5.5 Networking equipment

- 5.6 LV/MV distribution

- 5.7 DCIM

Chapter 6 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Hyperscale

- 6.3 Colocation

- 6.4 Enterprise

- 6.5 Edge

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Government

- 7.4 Healthcare

- 7.5 IT & telecom

- 7.6 Automotive

- 7.7 Media & entertainment

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Northeast

- 8.2.1 Connecticut

- 8.2.2 Maine

- 8.2.3 Massachusetts

- 8.2.4 New Hampshire

- 8.2.5 Rhode Island

- 8.2.6 Vermont

- 8.2.7 New Jersey

- 8.2.8 New York

- 8.2.9 Pennsylvania

- 8.3 Southeast

- 8.3.1 Alabama

- 8.3.2 Arkansas

- 8.3.3 Delaware

- 8.3.4 Florida

- 8.3.5 Georgia

- 8.3.6 Kentucky

- 8.3.7 Louisiana

- 8.3.8 Maryland

- 8.3.9 Mississippi

- 8.3.10 North Carolina

- 8.3.11 Oklahoma

- 8.3.12 South Carolina

- 8.3.13 Tennessee

- 8.3.14 Texas

- 8.3.15 Virginia

- 8.3.16 West Virginia

- 8.4 Midwest

- 8.4.1 Illinois

- 8.4.2 Indiana

- 8.4.3 Iowa

- 8.4.4 Kansas

- 8.4.5 Michigan

- 8.4.6 Minnesota

- 8.4.7 Missouri

- 8.4.8 Nebraska

- 8.4.9 North Dakota

- 8.4.10 Ohio

- 8.4.11 South Dakota

- 8.4.12 Wisconsin

- 8.5 West

- 8.5.1 Alaska

- 8.5.2 Arizona

- 8.5.3 California

- 8.5.4 Colorado

- 8.5.5 Hawaii

- 8.5.6 Idaho

- 8.5.7 Montana

- 8.5.8 Nevada

- 8.5.9 New Mexico

- 8.5.10 Oregon

- 8.5.11 Utah

- 8.5.12 Washington

- 8.5.13 Wyoming

Chapter 9 Company Profiles

- 9.1 Global companies

- 9.1.1.1 American Tower

- 9.1.1.2 Brookfield Infrastructure

- 9.1.1.3 Carrier Global

- 9.1.1.4 CBRE

- 9.1.1.5 Cushman & Wakefield

- 9.1.1.6 Digital Realty Trust

- 9.1.1.7 Equinix

- 9.1.1.8 Iron Mountain

- 9.1.1.9 JLL (Jones Lang LaSalle)

- 9.1.1.10 Trane Technologies

- 9.1.2 Regional champions

- 9.1.2.1 ABB

- 9.1.2.2 Digital Realty Trust

- 9.1.2.3 Eaton

- 9.1.2.4 Honeywell International

- 9.1.2.5 Johnson Controls International

- 9.1.2.6 Schneider Electric

- 9.1.2.7 Siemens

- 9.1.2.8 STULZ Air Technology Systems

- 9.1.2.9 Vertiv Holdings

- 9.1.2.10 Legrand

- 9.1.3 Top emerging players & specialists

- 9.1.3.1 Rittal

- 9.1.3.2 CyrusOne

- 9.1.3.3 CoreSite Realty

- 9.1.3.4 Chemours Company (Opteon Solutions)

- 9.1.3.5 Asetek

- 9.1.3.6 LiquidStack Holdings