PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716494

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716494

Data Center Renovation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

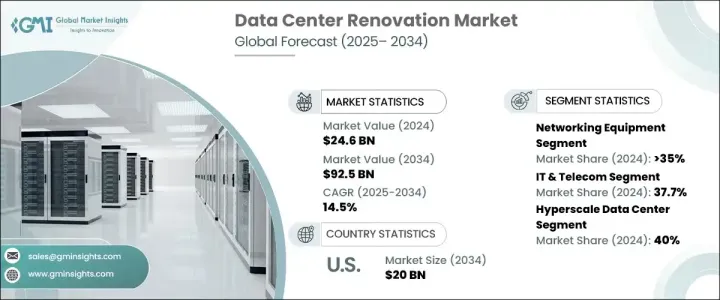

The Global Data Center Renovation Market was valued at USD 24.6 billion in 2024 and is projected to register a CAGR of 14.5% between 2025 and 2034. The exponential rise of cloud computing, streaming platforms, social media, and e-commerce has triggered a massive increase in global data traffic, prompting organizations to modernize their data centers to meet growing demands. As businesses continue to embrace remote work, online collaboration, and digital transactions, the need for high-performance, low-latency data processing has become essential.

The increasing adoption of artificial intelligence (AI), big data analytics, and 5G-enabled applications is further fueling the need for infrastructure upgrades to ensure seamless data flow, enhanced security, and operational efficiency. Data center operators are investing in advanced solutions to improve power management, cooling efficiency, and network performance. Additionally, the growing emphasis on environmental sustainability is driving the adoption of renewable energy sources, liquid cooling systems, and AI-powered energy management solutions to minimize operational costs and reduce carbon footprints. As organizations focus on scaling hyperscale and edge data centers to support high-speed connectivity and low-latency communication, the demand for upgraded infrastructure continues to surge.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.6 Billion |

| Forecast Value | $92.5 Billion |

| CAGR | 14.5% |

The market is segmented based on product into cooling, power, IT racks and enclosures, networking equipment, LV/MV distribution, and data center infrastructure management (DCIM). Networking equipment dominated the data center renovation market with a 35% share in 2024, driven by the need for high-speed connectivity and seamless data flow. As digital transformation accelerates across industries, data centers are upgrading their routers, switches, fiber-optic infrastructure, and load balancers to support increasing workloads from cloud computing, AI, and 5G technologies. The adoption of software-defined networking (SDN) and network function virtualization (NFV) is enhancing operational flexibility and reducing latency, making it a critical segment of the market.

On the basis of end use, the market is divided into BFSI, healthcare, IT and telecom, government, and others. The IT and telecom sector led the market with a 37.7% share in 2024 due to the growing need for advanced digital infrastructure to accommodate the expanding footprint of cloud services, AI applications, and 5G networks. As data volumes soar, telecom operators and cloud service providers are investing in hyperscale and edge data centers to ensure faster data processing, improved network efficiency, and reduced latency. This trend has resulted in a significant boost to the demand for data center modernization and renovation initiatives globally.

North America data center renovation market accounted for a 35% share in 2024, with the United States dominating the region. The rapid growth of cloud computing, increased adoption of AI, and evolving regulatory requirements have prompted hyperscale and enterprise data centers to invest heavily in modernization efforts. These investments are focused on enhancing cooling efficiency, optimizing power usage, and strengthening cybersecurity protocols. Sustainability initiatives play a critical role in shaping these renovation strategies, with companies integrating renewable energy solutions, liquid cooling technologies, and AI-driven energy management systems to improve efficiency and reduce their carbon footprints. As data center operators in the U.S. continue to prioritize innovation and compliance, the market is poised for sustained growth over the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Manufacturers

- 3.1.2 System integrators

- 3.1.3 Installation and maintenance providers

- 3.1.4 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Case studies

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing use of online services across the globe

- 3.9.1.2 Growing demand for data center modernization

- 3.9.1.3 Government initiatives to reduce the energy consumption of data centers

- 3.9.1.4 Expansion of the IT & telecom sector

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Disruptions in the daily operational activities of facilities

- 3.9.2.2 Rising cost of raw materials and skilled labor

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Cooling

- 5.3 Power

- 5.4 IT Racks & enclosures

- 5.5 Networking equipment

- 5.6 LV/MV distribution

- 5.7 DCIM

Chapter 6 Market Estimates & Forecast, By Data Center, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Hyperscale

- 6.3 Colocation

- 6.4 Enterprise

- 6.5 Edge

Chapter 7 Market Estimates & Forecast, By Application, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Government

- 7.4 Healthcare

- 7.5 IT & telecom

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Acer

- 9.3 Ascenty

- 9.4 Cisco

- 9.5 Dell

- 9.6 Equinix

- 9.7 Fujitsu

- 9.8 Gensler

- 9.9 Hewlett Packard Enterprise (HPE)

- 9.10 Hitachi

- 9.11 HostDime

- 9.12 Huawei

- 9.13 IBM

- 9.14 Inspur

- 9.15 IPXON Networks

- 9.16 KIO Networks

- 9.17 Lenovo

- 9.18 Oracle

- 9.19 Schneider Electric

- 9.20 Vertiv