PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885831

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885831

Asia Pacific Heat Recovery Steam Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

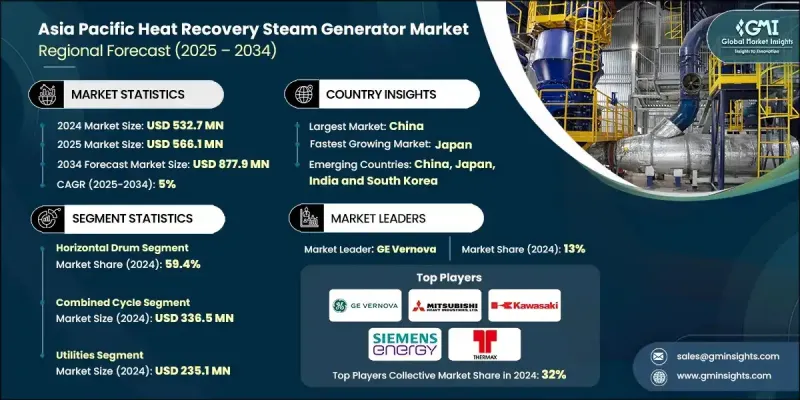

Asia Pacific Heat Recovery Steam Generator Market was valued at USD 532.7 million in 2024 and is estimated to grow at a CAGR of 5% to reach USD 877.9 million by 2034.

The region is experiencing rising demand for energy-efficient technologies as industrial expansion increases the need to convert waste heat into usable power. HRSG systems are being integrated at a faster pace because they significantly enhance plant performance by transforming turbine exhaust into steam for electricity generation and industrial processes. The ongoing move toward cleaner and more efficient power solutions, paired with a gradual shift from coal-fired units to natural gas-driven systems, is driving widespread deployment of HRSGs within combined cycle gas turbine facilities. Industries are also prioritizing cogeneration setups to meet power and steam requirements simultaneously, supporting operational efficiency and lowering energy expenditures. Growing industrialization across countries such as China, India, and Japan, along with rapid population growth and urban expansion, is intensifying electricity consumption across the region. Additionally, rising regulatory pressure to cut greenhouse gas emissions is prompting utilities and independent producers to install energy-optimized equipment across manufacturing hubs, refineries, and power-generation sites, further spurring product installation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $532.7 Million |

| Forecast Value | $877.9 Million |

| CAGR | 5% |

The horizontal drum segment held a 59.4% share in 2024 and is projected to register a CAGR of 4.7% through 2034. This segment is expanding due to demand for systems that boost plant efficiency while harnessing exhaust heat to generate steam. Growing investments in combined cycle facilities and the adoption of advanced thermal systems aimed at improving energy utilization are set to strengthen the overall regional market outlook.

The cogeneration mode of operation is poised to grow at a CAGR of 5.4% by 2034. Cogeneration is becoming more prominent because it provides electricity and thermal energy from a single energy source, significantly improving fuel efficiency and reducing waste. Industries in sectors such as chemical processing and manufacturing are seeking cost-effective and dependable power solutions, while supportive government measures encouraging combined heat and power deployment to reduce emissions and enhance energy reliability are reinforcing market expansion.

China Heat Recovery Steam Generator Market generated USD 224.1 million in 2024. Accelerated industrial growth, widespread energy infrastructure development, and a strong effort to enhance the efficiency of power generation systems are elevating market conditions. The shift toward gas-fired systems and integrated renewable configurations is increasing the adoption of HRSG units. Continuous investments in energy-efficient processes, expansion of industrial operations, and rising installation of combined cycle facilities aimed at capturing and reusing waste heat are shaping the country's market trajectory.

Major companies active in the Asia Pacific Heat Recovery Steam Generator Market include BHI Co., Ltd., CIC Group Inc, Clayton Industries, Clyde Bergemann, Gasco Pty Ltd., GE Vernova, Harris Pye, IHI Power System Malaysia Sdn Bhd, John Cockerill, Kawasaki Heavy Industries Ltd., Larsen & Toubro Limited, Martech JSC, Mitsubishi Heavy Industries, Ltd., NEM Energy, Par Techno-Heat Pvt. Ltd., Rentech Boiler Systems, Inc., Siemens Energy, Thermax Limited, Vogt Power International, and Xizi Clean Energy Equipment Manufacturing Co., Ltd. Companies in the Asia Pacific Heat Recovery Steam Generator Market are strengthening their position by focusing on technology upgrades, large-scale project execution, and regional expansion strategies. Many players are enhancing product portfolios with advanced heat-transfer technologies that boost system efficiency and reduce lifecycle costs. Strategic collaborations with power producers and industrial clients are helping firms secure long-term supply agreements and broaden their customer base. Several manufacturers are investing in localized production capabilities to reduce lead times and address region-specific requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Design trends

- 2.4 Rated power trends

- 2.5 Mode of operation trends

- 2.6 Application trends

- 2.7 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of heat recovery steam generator

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 China

- 4.2.2 Japan

- 4.2.3 South Korea

- 4.2.4 India

- 4.2.5 Australia

- 4.2.6 Indonesia

- 4.2.7 Singapore

- 4.2.8 Malaysia

- 4.2.9 Philippines

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Design, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 Horizontal drum

- 5.3 Vertical drum

Chapter 6 Market Size and Forecast, By Rated Power, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 ≤ 30 MW

- 6.3 ≥ 30 - 50 MW

- 6.4 ≥ 50 - 100 MW

- 6.5 ≥ 100 - 200 MW

- 6.6 ≥ 200 MW

Chapter 7 Market Size and Forecast, By Mode of Operation, 2021 - 2034, (USD Million)

- 7.1 Key trends

- 7.2 Cogeneration

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034, (USD Million)

- 8.1 Key trends

- 8.2 Utilities

- 8.3 Commercial

- 8.4 Chemicals

- 8.5 Refineries

- 8.6 Pulp & paper

- 8.7 Others

Chapter 9 Market Size and Forecast, By Country, 2021 - 2034, (USD Million)

- 9.1 Key trends

- 9.2 China

- 9.3 Japan

- 9.4 South Korea

- 9.5 India

- 9.6 Australia

- 9.7 Indonesia

- 9.8 Singapore

- 9.9 Malaysia

- 9.10 Philippines

Chapter 10 Company Profiles

- 10.1 BHI Co., Ltd.

- 10.2 CIC GROUP INC

- 10.3 Clayton Industries

- 10.4 Clyde Bergemann

- 10.5 Gasco Pty Ltd.

- 10.6 GE Vernova

- 10.7 Harris Pye

- 10.8 IHI POWER SYSTEM MALAYSIA SDN BHD

- 10.9 John Cockerill

- 10.10 Kawasaki Heavy Industries Ltd.

- 10.11 LARSEN & TOUBRO LIMITED

- 10.12 MARTECH JSC

- 10.13 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 10.14 NEM Energy

- 10.15 Par Techno-Heat Pvt. Ltd.

- 10.16 Rentech Boiler Systems, Inc.

- 10.17 Siemens Energy

- 10.18 Thermax Limited

- 10.19 Vogt Power International

- 10.20 Xizi Clean Energy Equipment Manufacturing Co., Ltd.